Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

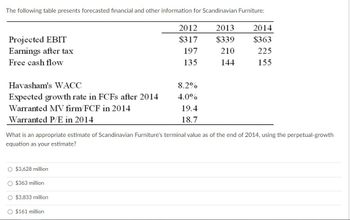

Transcribed Image Text:The following table presents forecasted financial and other information for Scandinavian Furniture:

Projected EBIT

Earnings after tax

Free cash flow

Havasham's WACC

Expected growth rate in FCFs after 2014

Warranted MV firm/FCF in 2014

Warranted P/E in 2014

O $3,628 million

O $363 million

O $3,833 million

2012

$317

197

135

O $161 million

8.2%

4.0%

What is an appropriate estimate of Scandinavian Furniture's terminal value as of the end of 2014, using the perpetual-growth

equation as your estimate?

19.4

18.7

2013

$339

210

144

2014

$363

225

155

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The table lists future concentrations of CFC 12 in parts per billion (ppb), if current trends continue. Year 2000 2005 2010 2015 2020 CFC 12 (ppb) 0.72 1.01 1.42 1.99 2.79 a. Let x=0 correspond to 2000 and x = 20 correspond to 2020. Find values for C and a so that f(x) = Cax models the data. b. Estimate the CFC 12 concentration in 2013. a. C= a≈ (Simplify your answer. Round to the nearest hundredth as needed)arrow_forwardGiven the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS 2016 $ 84.90 2.70 CFPS 7.92 2017 $ 90.80 3.41 8.76 2018 $ 89.50 4.21 2019 2020 2021 $87.00 $ 108.50 $ 123.90 4.91 7.65 8.65 9.10 10.77 12.19 13.36 SPS 66.50 71.50 70.90 74.40 85.60 93.60 Using PE ratio Using P/CF ratio Using P/S ratio Share Pricearrow_forwardUse the table for the question(s) below. FCF Forecast (S million) Year Sales 1 270 12.5% 27.00 (5.40) Less Increase in NWC (12% of Change in Sales) 3.60 Free Cash Flow 18.00 Growth versus Prior Year EBIT (10% of Sales) Less: Income Tax (20%) 0 240 OA. $46.15 B. $25.64 OC. $12.82 D. $23.07 2 290 7.4% 29.00 5.80 2.40 20.80 • 3 310 6.9% 31.00 6.20 2.40 22.40 4 325.5 5.0% 32.55 6.51 1.86 2418 Banco Industries expect sales to grow at a rapid rate over the next three years, but settle to an industry growth rate of 7% in year 4. The spreadsheet above shows a simplified pro forma for Banco Industries. If Banco industries has a weighted average cost of capital of 11%, $30 million in cash, $60 million in debt, and 18 million shares outstanding, which of the following is the best estimate of Banco's stock price at the start of year 1?arrow_forward

- How is Coca Cola's financial health based on the statistics from 2023, 2022, and 2021 pasted below? How do they preform against their competitors? 2023 Global Unit Case Volume Grew 2%Net Revenues Grew 8%;Organic Revenues (Non-GAAP) Grew 11%Operating Income Grew 6%;Comparable Currency Neutral Operating Income (Non-GAAP) Grew 13%Operating Margin Was 27.4% Versus 27.9% in the Prior Year;Comparable Operating Margin (Non-GAAP) Was 29.7% Versus 29.5% in the Prior YearEPS Grew 9% to $0.71; Comparable EPS (Non-GAAP) Grew 7% to $0.74 2022 Global Unit Case Volume Declined 1% for the Quarter and Grew 5% for the Full YearNet Revenues Grew 7% for the Quarter and 11% for the Full Year;Organic Revenues (Non-GAAP) Grew 15% for the Quarter and 16% for the Full YearOperating Income Grew 24% for the Quarter and 6% for the Full Year;Comparable Currency Neutral Operating Income (Non-GAAP) Grew 21% for the Quarter and19% for the Full YearFourth Quarter EPS Declined 16% to $0.47, and Comparable…arrow_forwardBased on the above information, calculate the sustainable growth rate for Kayla's Heavy Equipment.arrow_forwardGiven the information below for HooYah! Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Exclude negative annual P/E and P/CFPS ratios from the average PE and average P/CFPS ratio calculations. When computing annual growth rates, use a positive sign on the annual rate of change if the per share value increased in value and use a negative sign on the annual rate of change if the per share value deceased in value. Year Price EPS CFPS SPS 2016 $ 21.00 -5.00 Using PE ratio Using P/CF ratio Using P/S ratio -12.00 18.00 2017 $ 57.50 -4.29 -9.50 26.50 S Answer is not complete. Share Price 110.41 2018 $ 129.00 -1.70 -2.70 24.60 $ 132.55 2019 $ 206.00 -0.45 -0.10 28.10 2020 $ 96.00 0.05 0.33 31.60 2021 $26.50 0.06 0.08 34.95arrow_forward

- YearEPSDividendChange 20130.75 20140.78 20150.81 20160.82 20170.85 20180.90 Payout Ratio:30% Required Rate of Return: 10% Current Stock Price P0:$5.00 1) Dividend amount in 2013: 2) Dividend CAGR: 3) 2019 Dividend: 4) Intrinsic value: 5) Compared to P0: 6) Required rate of return (solver or goal seek): The following table contains the six-year EPS history for Corporation X. The dividend payout ratio is 30%. 1) What is the dividend amount paid in 2013? 2) What is the compound growth rate (CAGR) of the dividend based on the dividend paid from 2013 - 2018? 3) Assume dividend is growing at the the compound growth rate of the dividend in 2019, what is the dividend per share paid in 2019? 4) Use dividend constant growth model, calculate the intrinsic value of the stock using a 10% required rate of return. 5) How does the calculated intrinsic value compare to the current stock price of $5? Use IF statement. 6) Use the Goal Seek or Solver option to find the required rate…arrow_forwardsach.2arrow_forwardYou inverted $10,000 in a large U.S. stocks at the beginning of 2016 and earned 6% in 2016, 2.0% in 2017, 4.5% in 2018, and 1.6% in 2019. What average return did you earn during the 2016-2019 period?arrow_forward

- Question is in the screen shotarrow_forwardUse the information below to calculate WACC given the Market Capitalization of the company: Market Cap = 193.2 Million EBIT = 17.2 Million Depreciation = 4.2 Million Capital Expenditures = - 3.8 Million Change in W/C = 2.1 Million growth = 7% FCF = ? WACC = ?arrow_forwardRaghubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education