Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What is the project expected free cash flow for the year?

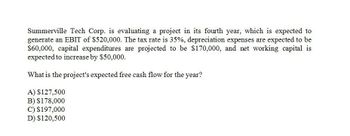

Transcribed Image Text:Summerville Tech Corp. is evaluating a project in its fourth year, which is expected to

generate an EBIT of $520,000. The tax rate is 35%, depreciation expenses are expected to be

$60,000, capital expenditures are projected to be $170,000, and net working capital is

expected to increase by $50,000.

What is the project's expected free cash flow for the year?

A) $127,500

B) $178,000

C) $197,000

D) $120,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Your company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forwardJPGR Inc is considering a project with a $2,000,000 initial investment, that is expected to create incremental after-tax cash flows of $450,000 per year for 7 years, starting 1 year from today. Given this information, what is the IRR of the project, stated as an APR compounded annually? A) 12.84% B) 13.57% C) 14.38% D) 15.43%arrow_forwardProvide solution for this accounting questionarrow_forward

- Suppose that a project has an immediate cost of $10 million and running costs of $1 million per year beginning at the end of a one-year construction period. At the end of this year, annual gross revenue from the project of $1.5 million per year is generated in perpetuity. (You may assume that the running costs and revenues accrue at the end of each year.) (a) Is the project profitable in a net present-value sense if the interest rate is 8%? (b) For what range of interest rates (nonnegative) is the present value of net revenues (including the immediate cost of $10 million) positive?arrow_forwardA.) ABC inc. is considering investing in a new project with an initial cost of $500,000. The project is expected to generate cash flows of $100,000 per year for hte next fire years. After five years, the project will have a residual value of $50,000. Calculate the accounting rate of retrn (ARR) for this investment. B.) Given that the calculated ARR for this investment is 18% provide a critical analysis of whether ABC Inc. Should proceed with this project. Consider the strengths and weaknesses of using ARR as an investment appraisal method and discuss any other financial and non financial factors that ABC Inc. should take into account when making this investment decision.arrow_forwardA project requires an immediate investment of $10,000 for the purchase and installation of equipment. The project is expected to generate after-tax cashflows in the amount of $3,000 at the end of each of the next five years. What is the IRR? [Select the best answer, please.] 11 % 13 % 15 % 18 % 20 %arrow_forward

- EABL is considering an investment that will cost $80,000 and have a useful life of 4 years. During the first 2 years, the net incremental after-tax cash flows are $25,000 per year and for the last two years they are $20,000 per year. What is the payback period for this investment?arrow_forwardYou are evaluating a real estate development project that requires an initial investment of $ 4,000,000. The project is expected to generate a net operating income of $550,000 per year with annual increases of 2% for the next 5 years. After 5 years, you expect to sell the developed property for $4,200,000. If your required rate of return is 14 %, what is the present value or investment value of the cash flows from the project? $4,136, 484 $3,768,350 $4,073,281 $ 4,225595arrow_forwardNo1. You are considering a project that will require an initial outlay of $54,200. This project has an expect life of 5 years and will generate after-tax cash flows to the company as a whole of $20,608 at the end of each year over its 5-year life. In addition to the $20,608 cash flow from operations during the fifth and final year, there will be an additional cash inflow of $13,200 at the end of the fifth year associated with the salvage value of a machine, making the cash flow in year 5 equal to $33,808. Thus the cash flows associated with this project look this: Year 1 2 3 Cash Flow -$54,200 20,608 20,608 Year 4 5 6 Given a required rate of return of 15 percent, calculate the following: a. Payback period b. Net present value c. Profitability index d. Internal rate of return Should this project be accepted? Cash Flow 20,608 20,608 20,608arrow_forward

- A project is expected to cost $4 million today and generate a net after-tax cash flow of $600,000 at the end of year 1 and $500,000 at the end of year 2. The net cash flows from year 2 onwards are expected to grow at 6% per annum forever. If the project’s discount rate is 12%, calculate the net present value of the project. Show all calculations.arrow_forwardFoster Manufacturing is analyzing a capital investment project that is forecast to produce the following cash flows and net income:arrow_forwardBhaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning