Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

sub. general account

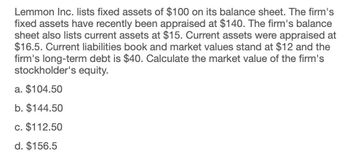

Transcribed Image Text:Lemmon Inc. lists fixed assets of $100 on its balance sheet. The firm's

fixed assets have recently been appraised at $140. The firm's balance

sheet also lists current assets at $15. Current assets were appraised at

$16.5. Current liabilities book and market values stand at $12 and the

firm's long-term debt is $40. Calculate the market value of the firm's

stockholder's equity.

a. $104.50

b. $144.50

c. $112.50

d. $156.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- General Accountingarrow_forwardAva’s SpinBall Corp. lists fixed assets of $31 million on its balance sheet. The firm’s fixed assets have recently been appraised at $54 million. Ava’s SpinBall Corp.’s balance sheet also lists current assets at $24 million. Current assets were appraised at $44 million. Current liabilities’ book and market values stand at $6 million, and the firm’s book and market values of long-term debt are $26 million. Calculate the book and market values of the firm’s stockholders’ equity. Construct the book value and market value balance sheets for Ava’s SpinBall Corp. (Enter your answers in millions of dollars.) BOOK VALUE MARKET VALUE (in millions of dollars) Assets Current assets Fixed assets Total $0 $0 Liabilities and Equity Current liabilities Long-term debt Stockholders' equity Total $0 $0arrow_forwardAva’s SpinBall Corp. lists fixed assets of $12 million on its balance sheet. The firm’s fixed assets have recently been appraised at $16 million. Ava’s SpinBall Corp.’s balance sheet also lists current assets at $5 million. Current assets were appraised at $6 million. Current liabilities’ book and market values stand at $3 million and the firm’s book and market values of long-term debt are $7 million. Calculate the book and market values of the firm’s stockholders’ equity. Construct the book value and market value balance sheets for Ava’s SpinBall Corp.arrow_forward

- Donner United has total owners' equity of $17,600. The firm has current assets of $20, 150, current liabilities of $10,300, and total assets of $26,300. What is the value of the long-term debt?arrow_forwardAndyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.8. Assuming the market value of debt equals its book value, what weights should it use for its WACC calculation? Assets $1,090 Liabilities & Equity Debt $460 Equity $630 The equity weight for the WACC calculation is __ % ? (Round to two decimal places.)arrow_forwardAva's SpinBall Corp. lists fixed assets of $21 million on its balance sheet. The firm's fixed assets have recently been appraised at $34 million. Ava's SpinBall Corp.'s balance sheet also lists current assets at $14 million. Current assets were appraised at $24 million. Current liabilities' book and market values stand at $4 million and the firm's book and market values of long-term debt are $23 million. Calculate the book and market values of the firm's stockholders' equity. Construct the book value and market value balance sheets for Ava's SpinBall Corp. (Enter your answers in millions of dollars.) Assets Current assets Fixed assets Total Liabilities and Equity BOOK VALUE $ SA MARKET VALUE (in millions of dollars) 0 $ 0 Current liabilities Long-term debt Stockholders' equity Total $ 0 $ 0arrow_forward

- The Mikado Company has a long-term debt ratio (i.e., the ratio of long-term debt to long-term debt plus equity) of 47 and a current ratio of 1.36. Current liabilities are $2,440, sales are $10,600, profit margin is 12 percent, and ROE is 17 percent. What is the amount of the firm's net fixed assets? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Net fixed assetsarrow_forwardAndyco, Inc., has the following balance sheet and an equity market-to-book ratio of 1.6. Assuming the market value of debt equals its book value, what weights should it use for its WACC calculation? Assets Liabilities & Equity $1,040 Debt $400 Equity $640 The debt weight for the WACC calculation is 28.09 %. (Round to two decimal places.) The equity weight for the WACC calculation is 71.91 %. (Round to two decimal places.)arrow_forwardThe Rossdale Company has a ratio of long-term debt to long-term debt plus equity of .34 and a current ratio of 1.29. Current liabilities are $1,450, sales are $7,380, profit margin is 8.1 percent, and ROE is 14.3 percent. What is the amount of the firm’s net fixed assets? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- Sunny firm has the following balance sheet statement items: total current liabilities of RM805,000; total assets of RM2,655,000; fixed and other assets of RM1,770,000; and long-term debt of RM200,000. What is the amount of the firm's total current assets?arrow_forwardThe Lawrence Company has a ratio of long-term debt to long-term debt plus equity of .34 and a current ratio of 1.6. Current liabilities are $900, sales are $6,320, profit margin is 9.1 percent, and ROE is 19.5 percent. What is the amount of the firm's net fixed assets? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Net fixed assetsarrow_forwardSuppose that for 2010 Aquarius company's current assets totaled $60,000; total assets totaled 470,000; current liabilities totaled 72,000; and total liabilities totaled $430,000. Calculate the debt-to-equity ratio for Aquarius for 2010. Calculate the debt-to-equity ratio for Aquarius for 2010. (round your answer to three decimal places.) Prepare the Stockholder's Equity section of the Balance sheet given the following information: Preferred Stock $500,000Paid In Capital in Excess of Par P/S $10,000 Common Stock $700,000 Paid in Capital in Excess of Par C/S $200,000 Retained Earnings $40 0,000 Treasury Stock $40,000 Paid in Capital from Sale of Treasury Stock $5,000 What is the total stockholders' equity based on the following account balances? Common Stock $450,000 Paid-in Capital in Excess of Par $90,000 Retained Earnings Treasury Stock a. $740,000 b. $730,000 c. $720,000 d. $640,000 $190,000 $10,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning