Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

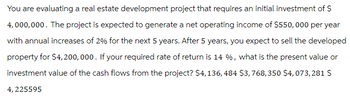

Transcribed Image Text:You are evaluating a real estate development project that requires an initial investment of $

4,000,000. The project is expected to generate a net operating income of $550,000 per year

with annual increases of 2% for the next 5 years. After 5 years, you expect to sell the developed

property for $4,200,000. If your required rate of return is 14 %, what is the present value or

investment value of the cash flows from the project? $4,136, 484 $3,768,350 $4,073,281 $

4,225595

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A project requires a $100,000 investment and is expected to generate the following cash flows in the years after the investment is made. Year 1 $20,000 - Year 2 - $40,000 Year 3 $60,000 - Year 4 $30,000 - Year 5 - $10,000 Assuming the project's cost of capital is 10%, what is the profitability index?arrow_forwardGarfield Inc is considering a new project that requires an initial investment of $37,700 and will generate a net income of $5,331 per year, if the project’s profitability index is 1.8, What is the present value of the project’s future cash flows. Round to the nearest dollar.arrow_forward. calculate the net present value of the following: Project A requires an initial investment of $1,000 and is expected to generate cash flows of $400 per year for 3 yearsarrow_forward

- Grayson Company is considering a purchase of equipment that costs $62,000 and is expected to offer annual cash inflows of $17,000. Grayson’s minimum required rate of return is 10%. How many years must the cash flows last for the investment to be acceptable ?arrow_forwardConsider a project with an initial investment (today, t = 0) of $225,000. This project will generate cash flows of $68,750 per year for the next 6 years. The company will pay $50,000 to another for clean-up and disposal in Year 6. What is the Profitability Index (PI) of the project if shareholders demand 8.25% return? Answer in whole numbers, rounded to three decimal places.arrow_forwardI need solutionarrow_forward

- Let's say you have the opportunity to invest in a project that will require you to invest $133,292.00 today. You will receive positive after tax cash flows of $37,000 at the end of each of the next six years. At the end of that sixth year, you will also receive a terminal value payment of $22,000 after tax. Your cost of capital is 11.0%. What is the NPV of the project? Round to the nearest $ and use the $ symbol..and use a comma in your number if applicable. No decimals.arrow_forwardTed is considering a project that will produce cash inflows of $2,900 per year for 3 years. The required rate of return is 15.5 percent, and the initial cost is $6,700. What is the discounted payback period?arrow_forwardUse the NPV method to determine whether Kyler Products should invest in the following projects: Project A: Costs $280,000 and offers seven annual net cash inflows of $52,000. Kyler Products requires an annual return of 12% on investments of this nature. Project B: Costs $385,000 and offers 9 annual net cash inflows of $75,000. Kyler Products demands an annual return of 10% on investments of this nature. (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Years 1-7 0 Present value of annuity Investment Net present value of Project A Calculate…arrow_forward

- You have an opportunity to purchase a piece of vacant land for $30,000 cash. If you plan to hold it for 15 years and then sell it at a profit. During this period, you would have to pay annual property taxes of $600 and have no income from the property. Assuming that you would want a 10% rate of return from the investment, a) Draw a cashflow diagram. b) What net price would you have to sell it in the next 15 years?arrow_forwardYou are considering opening a new plant. The plant will cost $103.4 million up front and will take one year to build. After that it is expected to produce profits of $29.6 million at the end of every year of production (starting two years from now). The cash flows are expected to last forever Calculate the NPV of this investment opportunity if your cost of capital is 8.3%. Should you make the investment? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. Darrow_forwardCapstone Investments is considering a project that will produce cash inflows of $11,000 in 1 year, $22,000 in 2 years, and $33,000 in 3 years. The company assigns the project a discount rate of 6%? What is the present value of these cash inflows?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education