FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Answer? ? Financial accounting question

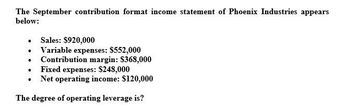

Transcribed Image Text:The September contribution format income statement of Phoenix Industries appears

below:

•

Sales: $920,000

• Variable expenses: $552,000

•

.

Contribution margin: $368,000

Fixed expenses: $248,000

⚫ Net operating income: $120,000

The degree of operating leverage is?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If the contribution margin ratio for France Company is 32%, sales are $488,000, and fixed costs are $110,000, the operating income is Oa. S110,000 Ob. $46,160 Oc. $36,928 Od. S156,160 Previous Submit Te Reflector-3.2.1.dmgarrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Sales (7,600 unita) Variable expenses Total $ 243,200 136, 800 Per Unit $32.00 18.00 Contribution nargin 106,400 $ 14.00 ried expenses 55,000 5 51,400 et operating Lncone Required: (Consider each case independently): 1 What would be the revised net operating income per month if the sales volume increases by 50 units? 2 What would be the revised net operating income per month if the sales volume decreases by 50 units? 3. What would be the revised net operating income per month if the sales volume is 6,600 units? 1. Revined net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forwardA company’s contribution approach income statement showed net operating incomeof $4,000, and fixed expenses of $10,000. How much contribution margin did thecompany earn?a. $29,000b. $15,000c. $19,000d. $14,000arrow_forward

- Selling price per unit -$17; Selling & administrative (fixed expense)- $130 000; Interest expense (fixed expense)- $10 000; COGS (variable expense) - $4; Selling or administrative (variable expense)- $3; What is the company's contribution margin?arrow_forwardProvide correct option general accountingarrow_forwardA segment reported sales of $225,000; variable costs of $175,000; direct fixed expenses $20,000 and indirect fixed expenses of $22,000. Calculate the contribution to indirect expenses for this segment. O $8,000 O $50,000 O$30,000arrow_forward

- CVP Analysis, *What IT?" AnalysisKevin Co. projected contribution-format income statement for the upcoming month is shownBelow Sales (500 units) $10000Variable expenses. 4000Contributions margin. 6000Fixed expenses. 1000Net operating income. 5000Required:a.) Compute the breakeven point in units.b) Compute the breakeven paint in dollars.c.) If the company wishes to earn a monthly target profit of $10,000, how many units must be sold each month?d.) Compute the company's margin of safety. State your answer in both dollar and percentage terms,e.) The company's manager thinks that adding a salaried sales staff member at a cost of 52,000 per month will increase sales by $4,000 per month. If he is correct, what will be the net dollar advantage or disadvantage of making this change?t.) Refer to the original data, the company's manager believes that a new production process will improve profitability. He plans to add new machinery that will cut variable expenses…arrow_forwardSubject: acountingarrow_forwardHow much is Alibaba Auto’s residual income?arrow_forward

- Whirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $31.00 18.00 $ 13.00 Sales (8,600 units) Variable expenses Contribution, margin Fixed expenses Net operating income Total $ 266,600 154,800 111,800 Required: (Consider each case independently): 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 56,000 $ 55,800 1. What would be the revised net operating income per month if the sales volume increases by 90 units? 2. What would be the revised net operating income per month if the sales volume decreases by 90 units? 3. What would be the revised net operating income per month if the sales volume is.7,600 units?arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 30.00 20.00 $10.00 Sales (8,200 units) Variable expenses Contribution margin Fixed expenses. Net operating income. Required: (Consider each case independently): Total $ 246,000 164,000 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 82,000 55,500 $ 26,500 1. What would be the revised net operating income per month if the sales volume increases by 50 units? 2. What would be the revised net operating income per month if the sales volume decreases by 50 units? 3. What would be the revised net operating income per month if the sales volume is 7,200 units?arrow_forwardThe contribution format income statement for Huerra Company for last year is given below: “雅 Total Unit Sales $ 992,000 $ 49.60 Variable expenses 595,200 396,800 312,800 84,000 33,600 29.76 Contribution margin Fixed expenses 19.84 15.64 Net operating income Income taxes @ 40% 4.20 1.68 Net income $ 50,400 $ 2.52 The company had average operating assets of $502,000 during the year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education