Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

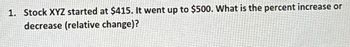

Transcribed Image Text:1. Stock XYZ started at $415. It went up to $500. What is the percent increase or

decrease (relative change)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A stock has a sustainable growth rate of 4.2% and a return on equity of 23.8%. What is the plowback ratio? Enter your answer as a percentage. Do not include the percentage sign in your answer. Enter your response below rounded to 2 DECIMAL PLACES. Numberarrow_forwardA stock has had returns of -19.1 percent, 29.1 percent, 25.2 percent, -10.2 percent, 34.9 percent, and 27.1 percent over the last six years. What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Arithmetic average return Geometric average return % %arrow_forwardSuppose a stock had an initial price of $93 per share, paid a dividend of $2.40 per share during the year, and had an ending share price of $76.00. a. Compute the percentage total return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What was the capital gains yield? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. b. Dividend yield Percentage total return C. Capital gains yield % % %arrow_forward

- A stock has had the following year-end prices and dividends: Year 1234 in 10 5 6 Price $64.68 71.55 77.35 63.62 73.81 83.25 Dividend Arithmetic average return. Geometric average return $.67 .72 .78 .87 .94 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g.. 32.16. % %arrow_forward(a) Compute the expected book value per share at time 1. (b) Compute the expected earnings per share of DTI at time 2. (c) Compute the expected value of the ex-dividend stock price at time 2. (d) Compute the expected value of the ex-dividend stock price at time 0. (e) Compute the expected return (over a single-period) on the stock of DTI at time 0 (in %).arrow_forwardplease help me out here !!!!arrow_forward

- Please help!arrow_forwardYou are building out your 1 x 3 point and figure chart that is currently in a column of X's with the last X at $17. When you look at the high, low, close data for today you see that the high was $17.99 and the low was $14.01. The stock closed at $15.01. What do you add to the chart for today? O a. A new trend line b. You add noting to the chart c. A new column of O's to the $15 level d. A new X at $18arrow_forwardConsider three stocks, X, Y, and Z, in the following table. P0, P1, and P2 represent prices at time 0, 1, and 2. Q0, Q1, and Q2 represent shares outstanding. Stock Z splits two for one in the last period. Stocks PO Q0 P1 Q1 P2 Q2 ? X 90 100 95 100 95 100 Y 50 200 60 200 45 200 Z 100 200 110 200 55 400 Using the above information to compute an equally weighted average returns in the three stocks from periods 1 to 2 0% O-1.85% -8.33% -25.00%arrow_forward

- A stock has had the following year-end prices and dividends: Year Price Dividend 1 $43.33 2 48.31 $0.54 3 57.23 0.57 4 45.31 0.80 5 52.23 0.85 6 61.31 0.93 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Arithmetic return Geometric return % %arrow_forwardA stock has had the following year-end prices and dividends: Year Price Dividend 1 $ 65.13 — 2 72.00 $ .76 3 77.80 .81 4 64.07 .87 5 74.71 .96 6 87.75 1.03 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardConsider a stock whose value increases across an 8-year period as shown in the table. Instructions: Round your answers to two decimal places. a. Calculate the percentage change in the value of the stock from year to year. Percent Change Year 1 2 3 4 5 6 7 8 Stock Value $80.00 92.00 107.00 128.00 145.00 250.00 400.00 670.00 % V b. Calculate the percentage change in the value of the stock across the entire 8-year period. c. Do you think this qualifies as a bubble? & % 4 V N % O Yes, because the percentage change in the stock value is positive every year. O No, because the percentage change in the stock value has not increased. O Yes, because the percentage change in the stock value has increased greatly. O No, because the percentage change in the stock value fluctuates up and down across the 8 years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education