Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

(a) Compute the expected book value per share at time 1.

(b) Compute the expected earnings per share of DTI at time 2.

(c) Compute the expected value of the ex-dividend stock price at time 2.

(d) Compute the expected value of the ex-dividend stock price at time 0.

(e) Compute the expected return (over a single-period) on the stock of DTI at time 0 (in %).

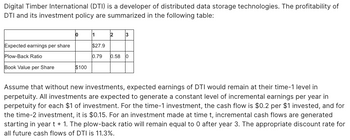

Transcribed Image Text:Digital Timber International (DTI) is a developer of distributed data storage technologies. The profitability of

DTI and its investment policy are summarized in the following table:

Expected earnings per share

Plow-Back Ratio

Book Value per Share

0

$100

1

$27.9

0.79 0.58 0

2 3

Assume that without new investments, expected earnings of DTI would remain at their time-1 level in

perpetuity. All investments are expected to generate a constant level of incremental earnings per year in

perpetuity for each $1 of investment. For the time-1 investment, the cash flow is $0.2 per $1 invested, and for

the time-2 investment, it is $0.15. For an investment made at time t, incremental cash flows are generated

starting in year t + 1. The plow-back ratio will remain equal to 0 after year 3. The appropriate discount rate for

all future cash flows of DTI is 11.3%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume a stock has earnings per share (EPS0) of £ 34.10 and a dividend pay-out ratio of53.3%. The required rate of return (discount rate) is 16% p.a. a) Calculate the price of the share using Dividend Discount Model assuming constant growth of dividends of 10% p.a. b) Calculate the price of the share using Dividend Discount Model assuming that earnings grow 30% p.a. during the first three years, followed by the constant growth of 10% p.a. starting from the beginning of the fourth year. c) Compare the calculated prices in part a) and b) and explain why they differ?arrow_forwardCalculate the correlation between the expected return and market capitalization for the following stocks, all of which will pay a liquidating dividend in one year and no interim dividends: Market cap (SMM) Expected dividend (SMM) Stock A 500 1000 Stock B 800 1000 Stock C 600 1000 Stock D 900 1000arrow_forwardA Moving to another question will save this response. Question 14 The market compensates investors for accepting which type(s) of risk? O None of the listed selections are correct O market and firm-specific risk O market risk only O firm-specific risk only O diversifiable risk A Moving to another question will save this response. MacBoc esc F1 F2 F3 F4 F5 # $ 2 4 W E T 60arrow_forward

- Please show steps in excel.arrow_forwardUse the information to solve the current share price. Scheduled dividends: $6.90, $17.90, $22.90, and $4.70. After that, they will pay a constant dividend growth rate of: 6%. The required return on the stock: 10% What is the current price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 12.34.) Share pricearrow_forwardCalculate the missing information for the following stock. Show your work. Company Earnings per Share Annual Dividend Current Price per Share Current Yield Price-Earnings Ratio Sampson, Inc. ? $0.39 $26.50 ? 22arrow_forward

- The annual dividend yield is compounded by dividing annual dividend by the current stock price.arrow_forwardThe Price-Earning ratio (P/E) of stock A, B, C are 5, 3, 7 respectively. Which one you should buy?arrow_forwardADC 1) Based on End-of-Chapter Problem 6 in Chapter 5 The stock of Business Adventures sells for $40 a share. Its likely dividend payout and end- of-year price depend on the state of the economy by the end of the year as follows: Stock Price Dividend. $2.00 $50 1.00 43 0.50 34 a. Calculate the expected holding-period return and standard deviation of the holding- period return. All three scenarios are equally likely. Boom Normal economy Recession b. Calculate the expected return and standard deviation of a portfolio invested half in Business Adventures and half in Treasury bills. The return on bills is 4%.arrow_forward

- Answer question in the imagearrow_forwardThe sum of the expected dividend and the expected capital gains yield is called a. Required rate of return b. expected total return c. expected rate of return d. value of the stock e. realized rate of returnarrow_forwardA stock has had the following year-end prices and dividends: Year Price 1 $65.08 71.95 77.75 64.02 74.61 87.25 23456 Dividend $.75 .80 .86 .95 1.02 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Arithmetic average return Geometric average return % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education