Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

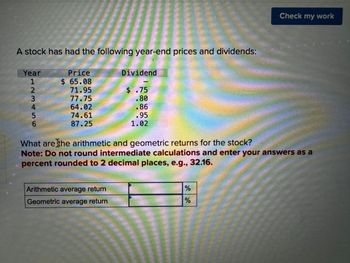

Transcribed Image Text:A stock has had the following year-end prices and dividends:

Year

123456

Price

$ 65.08

Dividend

71.95

$ .75

77.75

.80

64.02

.86

74.61

.95

87.25

1.02

Check my work

What are the arithmetic and geometric returns for the stock?

Note: Do not round intermediate calculations and enter your answers as a

percent rounded to 2 decimal places, e.g., 32.16.

Arithmetic average return

Geometric average return

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A stock has had the following year-end prices and dividends: Year Price Dividend 1 $ 43.45 - 2 48.43 $ .72 3 57.35 .75 4 45.43 .80 5 52.35 .85 6 61.43 .93 What are the arithmetic and geometric average returns for the stock? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Arithmetic average return % Geometric average return %arrow_forwardS Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA = 3.6% + 1.20RM + eA RB = -1.6% + 1.5RM + eB OM = 16%; R-squareд = 0.25; R-squareg = 0.15 What is the standard deviation of each stock? Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Stock A Stock B Standard Deviation % %arrow_forwardA stock has had the following year-end prices and dividends: Year 0 1 ~ 34 2 5 Arithmetic returns Geometric Price $ 32.5 returns 34.68 35.68 34.18 36.52 39.63 What are the arithmetic and geometric returns for the stock? (Round your answer to 2 decimal places. Omit the "%" sign in your response.) Dividend $ 0.15 0.31 1.63 0.22 % 0.41arrow_forward

- Nonearrow_forwardWhat is the expected return of Stock A given the information below about its returns across future states of nature? Enter return in decimal form, rounded to 4th digit, as in "0.1234arrow_forwardHow do you calcuate the bechmark and historical return for the stock ARKK when the last price listed is $123.40 and the current value is $26,531.00.arrow_forward

- A stock has had the following year-end prices and dividends: Year 1 Price Dividend $ 43.41 2 48.39 $0.66 3 57.31 0.69 4 45.39 0.80 5 52.31 0.85 6 61.39 0.93 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Round the final answers to 2 decimal places.)arrow_forwardA stock has had the following year-end prices and dividends: TIT Year Price Dividend $16.25 1 18.43 $ .15 2 19.43 .30 3 17.93 .33 4 20.27 .34 23.38 .40 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Arithmetic return |% Geometric returnarrow_forwardThe following table displays hypothetical stock quotations. Use the information in the table to answer the questions that follow. Listed Stock Quotes Company Ticker High Low Last Price* Net Change** YTD %*** Div. Yield P/E Ratio MarkMin MM 93.06 67.68 84.60 4.56 1.66 0 46 MarlRedBiro MRB 14.00 9.15 10.77 2.01 7.19 6.0 10 TStar TS 341.06 221.69 284.22 2.70 5.02 2.4 26 *Last price for the day **Net change in price from previous day ***Year-to-date percentage change in stock price Of the three stocks listed, a retiree who lives partially off of investment income would be best off holding because of its . You can calculate that MarkMin had per-share earnings for the most recent 12-month period of . If you had purchased 100 shares of TStar stock yesterday at the last price of the day, you would have of if you sold all 100 shares at the last price today.arrow_forward

- Consider a market value-weighted index consisting of 3 stocks: A, B, and C. The stocks' prices at time 0 (p0) and time 1 (p1) are given below, along with the number of shares outstanding. Calculate the index levels at time 0. Round your answer to 4 decimal places. For example, if your answer is 3.205%, then please write down 0.0321. stock p0 p1 outstanding shares 43 45 200 69 50 500 11 12 600 A B Carrow_forwardUse the information in the following stock quote to answer the question: As of February 1, 2XX1 Name Symbol Open High Low Close Net Chg Div Yield PE Target TGT 87.01 87.32 86.75 87.05 -0.32 2.56 2.93 16.76 What was Target’s earnings per share over the last year? (Round your answer to 2 decimal places. (e.g., 32.16))arrow_forwardWhat is the required rate of return on a preferred stock with a $50 par value, a stated annual dividend of 9% of par, and a current market price of (a) $31, (b) $40, (c) $52, and (d) $74 (assume the market is in equilibrium with the required return equal to the expected return)? Do not round intermediate calculations. Round the answers to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education