Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

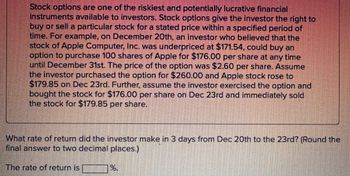

Transcribed Image Text:Stock options are one of the riskiest and potentially lucrative financial

instruments available to investors. Stock options give the investor the right to

buy or sell a particular stock for a stated price within a specified period of

time. For example, on December 20th, an investor who believed that the

stock of Apple Computer, Inc. was underpriced at $171.54, could buy an

option to purchase 100 shares of Apple for $176.00 per share at any time

until December 31st. The price of the option was $2.60 per share. Assume

the investor purchased the option for $260.00 and Apple stock rose to

$179.85 on Dec 23rd. Further, assume the investor exercised the option and

bought the stock for $176.00 per share on Dec 23rd and immediately sold

the stock for $179.85 per share.

What rate of return did the investor make in 3 days from Dec 20th to the 23rd? (Round the

final answer to two decimal places.)

The rate of return is _________%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The current market price for common shares of Funny Company is $15. Put options on these shares currently trade at 0.50 and come with a $10 strike price. If the stock’s market price falls to $8 what would be the percentage rate of return earned on these put options? your answer should look like this 200 that is not the right answerarrow_forwardA put option on Iowa stock specifies an exercise price of $71. Today the stock’s price is $68. The premium on the put option is $8. Assume the option will not be exercised until maturity, if at all. Complete the following table for a speculator who purchases the put option (and currently does not own the stock)arrow_forwardOn July 1, an investor holds 50000 shares of a certain stock. The market price is $50 per share. The investor is interested in hedging against movements in the market over the next month and decides to use the September Mini S&P 500 futures contract. The index is currently 1500 and one contract is for delivery of $50 times the index. The beta of the stock is 1.5. What strategy should the investor follow? Under what circumstances will it be profitable?arrow_forward

- Learn Corp. (Ticker: LC), an education technology company, is considered to be one of the least risky companies in the education sector. Investors trade call options for Learn Corp., whose stock is currently trading at $18.00. Suppose you are interested in buying a call option with a strike price of $25.20 that expires in 6 months. (Assume that you get the option for free!) Based on speculations and probability analysis, you compute and collect the following information for your price analysis of the option: • For LC’s options, time until expiration (t) is taken as 0.50 year (6 months/12 months). • LC’s stock could go up by a factor of 1.50 (u). • LC’s stock could decline by a factor of 0.60 (d). At this time, LC’s stock price is , and if you exercised the option, your payoff would be . Therefore, if the option is out-of-the-money, you exercise the option. Calculate the ending stock price of Learn Corp. for both possible outcomes and the payoff in both…arrow_forwardConsider a U.S. exchange-traded call option contract to buy 100 shares with a strike price of $37 and maturity in six months. Explain how the terms of the option contract would be revised if the specified change involving the underlying stock were to occur. What would be the revised strike price contract if there were a 5-for 1 stock split? Report your answer rounded to dollars and cents. Answer:arrow_forwardSuppose you have an option to buy a share of ABC Corp stock for $100. The option expires tomorrow, and the current price of ABC Corp is $95. How much is your option worth?arrow_forward

- En Zahir, the CFO of Cahaya Berhad believes that all corporate securities have implicit or explicit option features and as a result, understanding securities that possess option features requires knowledge of the factors that determine an option's value. En Zahir is also aware that the most familiar options are stock options. On 13th June 2024, En Zahir buys call options on 50,000 units of Jelantas Berhad shares with an exercise price of RM40 per unit. The value of the options is RM2 per unit and the termination date is on 30th June 2024. On 30th June 2024, the share price of Jelantas Berhad share is RM42. From the above information you are required to compute En Zahir's gain or losses. Based on your computation, explain to En Zahir about this situation.arrow_forward(c) A risk-neutral competitive market maker clears the market for trading in a stock after observing the incoming orders from a noise trader and an informed trader (who perfectly knows the true value of the stock). The noise trader buys and sells 1 share of the stock with equal probability, whereas the informed trader buys the stock if the value is $14 (high) and sells the stock if the value is $5 (low). The market maker believes initially that there is a 45% probability of high value and a 55% probability of low value. What profits can the informed trader expect to make in this market?arrow_forwardOn January 1 2021 you buy shares of an s&p index ETF at $370 each. You are concerned about the possible drop in value of the large cap equities before year end. The S&P 500 currently is at $4,669. You decide to buy an at-the – money put option on the s&p 500 index to insulate your portfolio from a decline in equity prices. Each put ( assume one put per ETF share)is prived at $56 and expires on 31 december. If the s&p is at $4680 on 31 december an dyour ETF position is priced at $468, what is the annualized percent return on entire investment in the ETF, including the putarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education