Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:### Understanding Put Options in Finance

A put option in finance allows you to sell a share of stock at a given price in the future. There are different types of put options. A European put option allows you to sell a share of stock at a given price, known as the exercise price, at a specific point in time after purchasing the option.

#### Example Scenario:

- Suppose you buy a six-month European put option for a stock with an exercise price of $26.

- If after six months the stock price per share is $26 or more, the option has no value.

- If the stock price is lower than $26, you can purchase the stock and sell it at $26 using the put option.

#### Profit Calculation:

- If the price per share in six months is $22.50, you buy the stock at $22.50 and sell it immediately for $26 using the option.

- Profit: $26 - $22.50 = $3.50 per share, minus the cost of the option.

- If you paid $1.00 per option, profit = $3.50 - $1.00 = $2.50 per share.

#### Risk Management:

- Purchasing a European put option limits the risk of a decrease in the stock’s per-share price.

- Example: You purchased 200 shares at $28 each and 85 six-month put options with an exercise price of $26, each costing $1.

#### Data Table Analysis:

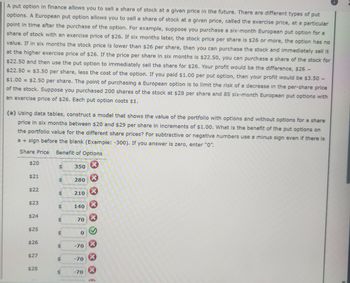

(a) Construct a model using data tables to show the portfolio value with and without options for six-month six-month future share prices between $20 and $29 in $1 increments.

- **Share Price vs. Benefit of Options:**

- $20: $350

- $21: $280

- $22: $210

- $23: $140

- $24: $70

- $25: $0

- $26: -$70

- $27: -$70

- $28: -$70

Negative numbers indicate a loss, and zero indicates no gain or loss. The analysis helps in strategizing the implementation of put options to mitigate risks effectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You think that there is an arbitrage opportunity on the market. The current stock price of Wesley corp. is $20 per share. A one- year put option on Wesley corp. with a strike price of $18 sells for $3.33, while the identical call sells for $7. The one-year risk- free interest rate is 8%. Assuming that the put option is fairly priced, compute the fair price of the call option and explain what you must do to exploit this arbitrage opportunity and what will be your gain.arrow_forward1. Put and Call options a) On the 10th of December 2020, an investor buys a call option (European) with a strike price of £30 for £3 with a maturity of three months. When will the trader exercise the option? Describe when they would lose money? b) The same investor sells a put option with a strike price of £40 for £5. What is the investor's maximum loss and maximum gain?arrow_forwardAn investor buys a 6-month European call option with an exercise price of $35 for $6, and sells a 6-month European call option with an exercise price of $40 for $4. a) What kind of a spread does this strategy create? Answer in terms of “Bull Spread” versus “Bear Spread”. b) Calculate both the total payoff and profit on this strategy at the expiration of the options. Please use a Table (as in the class notes) to identify the payoff and profit.arrow_forward

- Suppose there is also a 1-year European put option on the same stock as in Question 3 with exercise price $30. The current stock price is also $25 and the stock price, in 1 year, will be either $35 (up by 40%) or $20 (down by 20%). The interest rate is 8%. This stock does not pay dividend. What is the value of the put option? Please use risk neutral probability method and assume discrete discounting. (2) What is put-call parity in option pricing? What needs to be true in order for put-call parity to hold?arrow_forwardCalculate the European call and put option on the basis of the following data: Consider the following facts regarding Bank Windhoek, which is publicly traded on the Namibian Stock Exchange (NSX): The current stock price is N $18, the exercise price is N $16, the duration of the option is 180 days, the volatility is 35%, and the risk-free rate is 8%. Show all your calculations. 1. What is the value of the European call option? 2. What is the value of the European put option? 3. Comment on the Value for both the European call & put options. 4. Why is a Black Scholes Merton model used to price optionsarrow_forwardThe price of a European call option on a stock with a strike price of $50.9 is $5.6. The stock price is $40.1, the continuously compounded risk-free rate (all maturities) is 5.2% and the time to maturity is one year. A dividend of $0.6 is expected in six months. What is the price of a one-year European put option on the stock with a strike price equal to the call's strike price? Please state the formula and steps, thanksarrow_forward

- Previously, you purchased a European put option on Parlicoot Inc shares. The option has just matured. The strike price on the option is 98.17, while the current stock price is 89.19. What is your payoff?arrow_forwardMelbourne Capital Ltd considers selling European call options on ANZ Bank Ltd for $1.50 per option. The current market price is $17.70 on 28th September 2020, the exercise price is $20, and the maturity of each call option is 6 months. (i) Under what circumstances does the investor make a profit? (ii) Under what circumstances will the option be exercised? (iii) How many call options should the investor sell to raise a total capital of $1,260,000?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education