FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

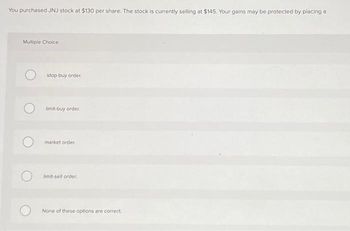

Transcribed Image Text:You purchased JNJ stock at $130 per share. The stock is currently selling at $145. Your gains may be protected by placing a

Multiple Choice

Ostop-buy order.

O

limit-buy order.

market order

limit-sell order.

None of these options are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- You would like to be holding a protective put position on the stock of XYZ Company to lock in a guaranteed minimum value of $240 at year-end. XYZ currently sells for $240. Over the next year, the stock price will either increase by 7% or decrease by 7%. The T-bill rate is 3%. Unfortunately, no put options are traded on XYZ Company. Required: a. How much would it cost to purchase if the desired put option were traded? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What would be the cost of the protective put portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardSuppose you own a put option on Apple stock with a strike price of $150. Suppose it is the expiration date of the option and the current stock price of Apple is $75. What payoff will you receive from making an optimal exercise decision on your option? 1. -$75 2. $0 3. $75arrow_forwardPlease explain with details also explain wrong optionsarrow_forward

- Covered Calls Please help me.arrow_forwardYou purchase 20 call option contracts with a strike price of $110 and a premium of $1.85. Assume the stock price at expiration is $119.12. a. What is your dollar profit? (Do not round intermediate calculations.) Dollar profit S 14,540 b. What is your dollar profit if the stock price is $105.07? (A negative value should be indicated by a minus sign. Do not round intermediate calculations.) If the stock price is $105.07, the call is worthless so the dollar profit is $arrow_forwardYou bought a $50 strike call option on a stock XYZ for $8.20 and then sold/wrote a $65 call option for $4.35. What price would the stock have to be at expiration for you to start losing profit?arrow_forward

- he initial margin requirement on a stock purchase is 50% and the maintenance margin is 30%. You fully use the margin allowed to purchase 100 shares of XYZ at $25. If the price drop to the margin-call point, your broker will sell just enough of your shares to restore the initial margin requirement. How many shares will your broker sell Ignore interest on the loan.) Multiple Choice 334 400 462 667arrow_forwardYou purchased a call option on TSLA with an exercise price of $180 for a premium of $5.0 and held it until the expiration date. What is your profit (per share) if the stock sells for $192 on the expiration date? Enter your answer without the dollar sign. Your Answer: Answerarrow_forwardThe database is mentioned in the attachment:Ques) Draw a profit diagram for an investor in a call option with an exercise price of 64 that expires in March and explain the diagram. Undertake the same analysis for the writer of the call. Comment on the contention that options are a zero sum game for the writer and investor in options.arrow_forward

- Ningbo Industrial Concepts Incorporated Initial stock price $115.00 Exercise price $115.00 Call price $4.75 Put Price $4.50 Required: Using the information in the table above, please calculate dollar value of the following option strategies. Use this calculated dollar value to determine the profit of each strategy at various stock prices. (Use cells A3 to B6 from the given information to complete this question. Negative answer should be input and displayed as a negative value. All other answers should be input and displayed as positive values.) Ningbo Industrial Concepts Incorporated Dollar Value of Strategy as a Function of Current Stock Price Strategy $95.00 $105.00 $115.00 $125.00 $135.00 Straddle Strip Strap Ningbo Industrial Concepts Incorporated Rate of Return…arrow_forwardThe current market price for common shares of Getgo Company is $15. Put options on these shares currently trade at 0.75 and come with a $10 strike price. If the stock’s market price falls to $8.45 what would be the dollar return earned on these put options? Your answer should look like this 1.2 that is not the right answerarrow_forwardOnly typing. .... . A strip is a variation of a straddle involving two puts and one call. Construct a short strip using the August 170 options. The price of the call option is $8.10 and the price of the put option is $6.75. Hold the position until the options expire. Determine the profits and graph the results. Identify the breakeven stock prices at expiration and the minimum profit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education