Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

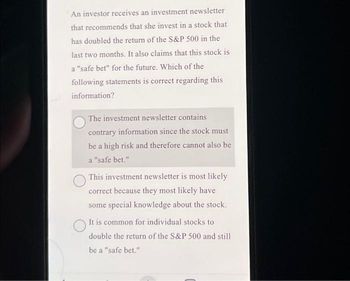

Transcribed Image Text:An investor receives an investment newsletter

that recommends that she invest in a stock that

has doubled the return of the S&P 500 in the

last two months. It also claims that this stock is

a "safe bet" for the future. Which of the

following statements is correct regarding this

information?

The investment newsletter contains

contrary information since the stock must

be a high risk and therefore cannot also be

a "safe bet."

This investment newsletter is most likely

correct because they most likely have

some special knowledge about the stock.

It is common for individual stocks to

double the return of the S&P 500 and still

be a "safe bet."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- In 2021, the Gamestop stock witnessed a sudden rally when a group of Subredditors on r/wallstreetbets decided to attack the hedge fund managers who were short on the stock, and thus aimed to shake the very foundation of Wall Street. The Subreddit influenced many ordinary people to buy the Gamestop stock via the Robinhood App leading to enormous losses for the hedge fund managers who had bet on the price to fall, as the price went up by whopping 1700% in a single week. Your friend exclaims: "I would never buy these trending stocks; their price is too volatile, as a single tweet or a comment thread may lead to the soaring or the plummeting of the prices in a jiffy; in other words, these stocks are too risky and useless for rational investors, they’re just good for regular social media followers and for those people who don’t know anything about finance but are just in to gamble!". How would you reply to such a line of reasoning?arrow_forwardlist K mediums: a stock fund, a bond fund, and his own Sports and Casino Investment Plan (SCIP). The stock fund is a mutual fund investing in op traded stocks. The bond fund focuses on the bond market, which has a Table of Returns, Variances, and Covariances Average return Variance Covariance with stock Covariance with bond Stock Bond 0.148 0.06 0.014697 0.000155 0.000468 SCIP 0.152 0.160791 -0.002222 -0.000227 D - Xarrow_forwardWhich of the following is a reason why an investor would place a stop buy order on a stock? To ensure a short position is closed out for profit To ensure that the broker executes immediately at the current market price To ensure the stock is sold before its price falls to a specified level To ensure the stock is purchased when its price is risingarrow_forward

- As the economy goes through highs and lows, investors with stock in various companies can face significant risk, and significant benefits. How do you see the stock market affecting your own investing plans in the future? What types of risks do investors take? Do you have any companies you follow thru their stock prices?arrow_forwardMicrosoft is the only stock in your portfolio. To reduce the risk you decide to add another stock in your portfolio. In fact you pick another stock that has a correlation coefficient of 1 with Microsoft. Which risk do you reduce by adding the second stock to your portfolio? O A. Systematic risk O B. Company specific risk O C. Risk free rase risk O D. Technology risk OE. None of the abovearrow_forwardPlease answer in 10 minute just need final answer not explanationarrow_forward

- Hedge Funds have become an increasingly popular investment options over the past 15 years, with managers making bold statements about the benefits of investingwith hedge funds. List the three main benefits that are claimed to arise when investing in a hedge fund. Do you believe that these benefits exist?arrow_forwardA long-term investor has recently become concerned that the shares of a large stock holding will decline significantly in the short term. What type of order might the investor most likely consider placing to try to protect against such a decline? Fill or kill stop-loss buy order. Good-till-canceled limit buy order. Good-till-canceled limit sell order. Good-till-canceled stop-loss sell order. Good-till-canceled stop-loss buy order.arrow_forwardAbswer with detailed steps. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education