Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

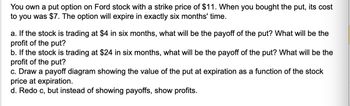

Transcribed Image Text:You own a put option on Ford stock with a strike price of $11. When you bought the put, its cost

to you was $7. The option will expire in exactly six months' time.

a. If the stock is trading at $4 in six months, what will be the payoff of the put? What will be the

profit of the put?

b. If the stock is trading at $24 in six months, what will be the payoff of the put? What will be the

profit of the put?

c. Draw a payoff diagram showing the value of the put at expiration as a function of the stock

price at expiration.

d. Redo c, but instead of showing payoffs, show profits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that the current stock price is $50 per share, that call options can be purchased with an exercise price of $60 per share, that bank loans can be obtained for a 10 percent nominal rate, and that at expiration of the option in three months, the stock will either be valued at $30 or $70. Show that it is possible to replicate the stock payoff by borrowing and buying a call option.arrow_forwardYou sell a call option on Tesla stock with an exercise price of $150.00. The option expires after one month period as soon as the option premium is $12.00. what is the profit on this option is the stock price $180 at expiration?arrow_forwardSuppose you have $28,000 to invest. You're considering Miller-Moore Equine Enterprises (MMEE), which is currently selling for $40 per share. You notice that a put option with a $40 strike is available with a premium of $2.80. Calculate your percentage return on the put option for the six-month holding period if the stock price declines to $36 per share. (Do not round intermediate calculations. Enter your 6-month return as a percent rounded to 2 decimal places. Omit the "%" sign in your response.) Percentage return %arrow_forward

- 5. Gvalt stock is currently selling for $40 and a 4 month call on Gvalt with an exercise price of $35 is selling $9. a) If you write the call, what is your maximum potential profit? b) Under what condition would this profit be obtained? c) What will be your loss if you wrote the option and the stock was selling for $62 on the date of expiration?arrow_forwardConsider a call option on one share of BP with a strike price of $70 and exercise time 1 quarter (3 months). Suppose the current stock price for BP is S(0) = $65 per share. Suppose further that A(0) = $100, A(1) = $102 and two possible prices for S(1) are S $74 with probability 0.5, S(1) = $66 with probability 0.5. Evaluate the expected returns E(Ks) and E(Kc) for the stock and the option.arrow_forwardThe common stock of Triangular File Company is selling at $91. A 13-week call option written on Triangular File's stock is selling for $9. The call's exercise price is $101. The risk-free interest rate is 8% per year. a. Suppose that puts on Triangular stock are not traded, but you want to buy one. Which combination will produce the same results? Buy call, invest PV(EX), sell stock short Sell call, invest PV(EX), sell stock short Buy call, lend PV(EX), buy stock Sell call, lend PV(EX), buy stock b. Suppose that puts are traded. What should a 13-week put with an exercise price of $101 sell for? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Put option pricearrow_forward

- A stock trades for $46 per share. A call option on that stock has a strike price of $53 and an expiration date six months in the future. The volatility of the stock's returns is 45%, and the risk-free rate is 3%. What is the Black and Scholes value of this option? The Black and Scholes value of this call option is (Round to the nearest cent.)arrow_forwardround to nearest dollararrow_forwardThe stock price of Heavy Metal (HM) changes only once a month: either it goes up by 24% or it falls by 20.7%. Its price now is $48. The interest rate is 1.2% per month. What is the value of a one-month call option with an exercise price of $48? What is the option delta? The payoffs of the call option can be replicated by buying shares of stock and borrowing. What amount should be invested in stock and what amount must be borrowed? What is the value of a two-month call option with an exercise price of $49? What is the option delta of the two-month call over the first one-month period?arrow_forward

- The call has a premium of $10 and a strike price of $60. You decide to go on margin, meaning that you put down $8 of your own money and borrow the other $2. On the day of expiration, the underlying asset is worth $75. What is your percentage return on equity for this position?arrow_forwardA stock is currently selling for $39. In one period, the stock will move up by a factor of 1.29 or down by a factor of .53. A call option with a strike price of $50 is available. If the risk-free rate of interest is 2.5 percent for this period, what is the value of the call option?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education