FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:rected net

$137,750

Depro

2. Determine the balances of

an adjusted trial balance.

OBJ. 2,3

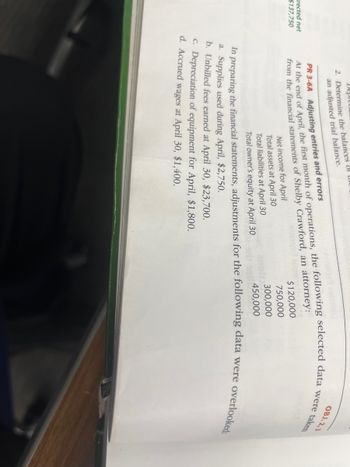

At the end of April, the first month of operations, the following selected data were taken

PR 3-6A Adjusting entries and errors

an attorney:

auoerist

from the financial statements of Shelby Crawford,

$120,000

750,000

300,000

450,000

Net income for April

Total assets at April 30

Total liabilities at April 30

Total owner's equity at April 30

In preparing the financial statements, adjustments for the following data were overlooked:

a. Supplies used during April, $2,750.

b. Unbilled fees earned at April 30, $23,700.

c. Depreciation of equipment for April, $1,800.

d. Accrued wages at April 30, $1,400.

Transcribed Image Text:-) bus (d)

to bas

ns: Series B

Instructions

hany

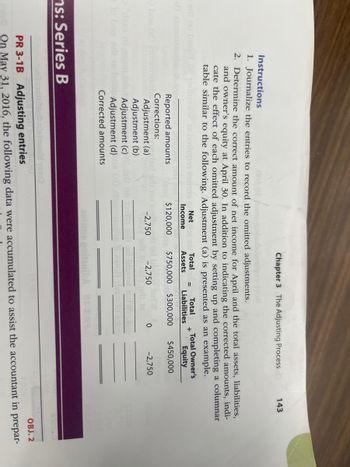

1. Journalize the entries to record the omitted adjustments.

2. Determine the correct amount of net income for April and the total assets, liabilities,

and owner's equity at April 30. In addition to indicating the corrected amounts, indi-

cate the effect of each omitted adjustment by setting up and completing a columnar

table similar to the following. Adjustment (a) is presented as an example.

Total Owner's

Equity

$450,000

Reported amounts

Corrections:

Adjustment (a)

Adjustment (b)

Adjustment (c)

Adjustment (d)

Corrected amounts

Net b

Chapter 3 The Adjusting Process

Total

Income

Liabilities

$120,000 $750,000 $300,000

di od ble

W

-2,750

Total

Assets

-2,750

+

0

sila sdi od bluowasdWobe

Insmaulbs li awoll dasp to 6.920

zsinine pnitauibA 88-2-8400

143

-2,750

17.000

banu

PR 3-1B Adjusting entries

OBJ. 2

On May 31, 2016, the following data were accumulated to assist the accountant in prepar-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comprehensive Problem 2 Part 4 and 6: Note: You must complete parts 1, 2 and 3 before attempting to complete part 4 and part 6. Part 5 is an optional work sheet. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete Part 6. a. Merchandise inventory on May 31 $585,200 b. Insurance expired during the year 12,000 c. Store supplies on hand on May 31 4,000 d. Depreciation for the current year 14,000 e. Accrued salaries on May 31: Sales salaries $7,000 Office salaries 6,600 13,600 f. The adjustment for customer refunds and allowances is $60,000. 6. Journalize the adjusting entries. If an amount box does not require an entry, leave it blank. Post the adjusting entries to the attached spreadsheet you used in parts 1 and 2. Page 22 Post. Date Description Debit Credit Ref. Adjusting Entries |20Υ7 May 31 Cost of Merchandise Sold 585,200 585,200 Incu 12.000arrow_forwardProblem 13 The following Trial Balance of Shri Om, as on 31 st March 20X2. You are requested to prepare the Trading and Profit and Loss Account for the year cnded 31st March 20X2 and a Balance Sheet as on that date after making the necessary adjustment: Particulars Dr. (As) Cr. (Rs) Sundry Debtors/Creditors... Outstanding liability for Expenses. Wages.... Carriage Outwards... Carriage Inwards.. General Expenses... 5,00,000 2,00,000 55,000 1,00,000 1,10,000 50,000 70,000 920,000 Cash Discounts. Bad Debts..... 10,000 Motor Car.... 2,40,000 00 15,000 Printing and Stationery. Furniture and Fittings.. 1,10,000 Advertisement. 85,000 45,000 Insurance... Salesman's commission... 87,500 Postage and Telephone... Salaries... Rates and Taxes... Capital Account/Drawings. Purchases/Sales. 57,500 1,60,000 25,000 14,43,000 020,000 15,50,000 2,50,000 60,000 19,87,500 Stock on 1.4.20x1. Cash at Bank.. Cash in hand.. 10,500 36,30,500 36,30,500 The following adjustments arc to bc made: Stock on 31st March…arrow_forward16:58 PPP A N 15% Required Class Rep Prepare the trading and profit ahd loss accounts for the year ended 3ch 20X9 er with a balance sToday, 09:56 20.11 This question also relates to extended trial balances (see Exhibit 28.2) From the following trial balance of John Brown, store owner, prepare a trading account and profit and loss account for the year ended 31 December 20X7, and a balance sheet as at that date, taking into consideration the adjustments shown below: Trial Balance as at 31 December 20X7 Dr Sales Purchases Sales returns 400,000 350,000 5,000 Purchases returns Opening stock at 1 January 20X7 Provision for doubtful debts 6,200 100,000 800 Weges and salaries 30,000 Rates Telephone Shop fittings at cost Van at cost 6,000 1,000 40,000 30,000 9,800 200 Debtors and creditors Bad debts 7,000 Capital Bank balance Drawings 179,000 3,000 18,000 593,000 593,000 ) Closing stock at 31 December 20X7 £120,000. (i) Accrued wages £5,000. (U) Rates prepaid £500. (iv) The provision for…arrow_forward

- Problem 7-6 Weekly Wage Payment Entries and the Month-End Wages Payable Adjusting Entry Baker Construction, Inc. pays its employees each Friday for the work they performed that week. Baker's employees only work Sunday. Baker produces monthly financial statements; thus they prepare adjusting entries at the Monday through Friday. They do not work on Saturday or end of each month. For the month of June, the last payday was on Friday June 25th. The last day of June was on Wednesday June 30th. The first payday of July was on Friday July 2nd. The following partial calendar shows these days and dates: -6 age Payı Sunday Monday Tuesday Wednesday Thursday Friday ent 1 -- W Saturday Accou June 20 June 21 June 22 June 23 June 24 Juņe 25 June 26 June 27 June 28 June 29 June 30 July 1 July 2 July 3 The following table shows the amount the employees were paid on Friday June 25th and on Friday July 2nd. The table also shows the data required to calculate the amount the employees earned for the last…arrow_forwardHelp pleasearrow_forwardQuestion Content Area Given the following data: Dec. 31, Year 2 Dec. 31, Year 1 Total liabilities $128,250 $120,000 Total owner's equity 95,000 80,000 Compute the ratio of liabilities to owner's equity for each year. Round to two decimal places.arrow_forward

- 11:09 PM Sun Aug 13 Assignment Chapter 6 Question 3 of 4 (a) Accounts receivable (net) Short-term investments Inventory Prepaid insurance Property, plant, and equipment (net) Accounts payable. Wages payable Income tax payable Sales tax payable Notes payable (due within one year). Bank loan payable (due in three years) Current ratio Quick ratio eTextbook and Media education wiley.com Save for Later 130,000 28,000 390,000 46,800 960,000 Calculate the current ratio and quick ratio for Liquid Company. (Round answers to 2 decimal places, e.g. 15.25.) 93,000 37,000 50,000 10,000 83,000 50,000 24% -/1 E 1 Attempts: 0 of 3 used Submit Answerarrow_forwardA ezto.mheducation.com M Question 18 - Midterm 1- Connect b Accounting Question | bartleby Bb Announcements - 2021 Spring Term (1) Principles of .. Midterm 1 Saved Help Save & Exit Submit 18 Torrid Romance Publishers has total receivables of $2,800, which represents 20 days' sales. Total assets are $73,000. The firm's operating profit margin is 5.9%. Find the firm's ROA and asset turnover ratio. (Use 365 days in a year. Do not round intermediate calculations. Round your final answers to 2 decimal places.) X 01:45:00 Asset turnover ratio ROA % Mc Graw Hill Educationarrow_forwardP 15-10A End-of-Period Spreadsheet, Adjusting, Closing, and Reversing Entries Vicki’s Fabric Store shows the trial balance below as of December 31, 20-1. At the end of the year, the following adjustments need to be made: a., b. Merchandise inventory as of December 31, $31,600. c., d., e. Vicki estimates that customers will be granted $2,500 in refunds of this year’s sales next year and the merchandise expected to be returned will have a cost of $1,800. f. Unused supplies on hand, $350. g. Insurance expired, $2,400. h. Depreciation expense for the year on building, $20,000. i. Depreciation expense for the year on equipment, $4,000. j. Wages earned but not paid (Wages Payable), $520. k. Unearned revenue on December 31, 20-1, $1,200. Required Prepare an end-of-period spreadsheet. Prepare adjusting entries and post adjusting entries to an Income Summary T account. Prepare closing entries and post to a Capital T account. There were no additional investments this year. Prepare a…arrow_forward

- Exercise 7-4A Effect of recognizing uncollectible accounts expense on financial statements: percent of revenue allowance method Rosie Dry Cleaning was started on January 1, Year 1. It experienced the following events during its first two years of operation. Events Affecting Year 1 1. Provided $45,000 of cleaning services on account. 2. Collected $39,000 cash from accounts receivable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Events Affecting Year 2 1. Wrote off a $300 account receivable that was determined to be uncollectible. 2. Provided $62,000 of cleaning services on account. 3. Collected $61,000 cash from accounts receivable. 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Required a. Record the events for Year 1 in T-accounts. b. Determine the following amounts:arrow_forwardProduce a solution for the following questionsarrow_forward5arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education