FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

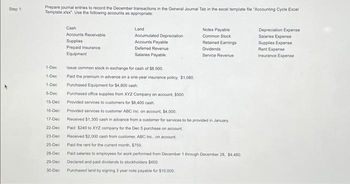

Transcribed Image Text:Step 1:

Prepare journal entries to record the December transactions in the General Journal Tab in the excel template file "Accounting Cycle Excel

Template xisx". Use the following accounts as appropriate:

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Land

Accumulated Depreciation

Accounts Payable

Deferred Revenue

Salaries Payable

Notes Payable

Common Stock

Retained Earnings

Dividends

Service Revenue

1-Dec

Issue common stock in exchange for cash of $8.500

1-Dec

Paid the premium in advance on a one-year insurance policy, $1,080.

1-Dec

Purchased Equipment for $4,800 cash.

5-Dec

Purchased office supplies from XYZ Company on account, $500.

15-Dec

Provided services to customers for $6,400 cash

16-Dec

Provided services to customer ABC Inc on account, $4,000.

17-Dec

Received $1,300 cash in advance from a customer for services to be provided in January

22-Dec

Paid $240 to XYZ company for the Dec 5 purchase on account.

23-Dec

Received $2,000 cash from customer, ABC Inc., on account

25-Dec

Paid the rent for the current month, $750,

28-Dec

Paid salaries to employees for work performed from December 1 through December 28, $4,480

29-Dec

Declared and paid dividends to stockholders $450.

30-Dec Purchased land by signing 3 year note payable for $10,000

Depreciation Expense

Salaries Expense

Supplies Expense

Rent Expense

Insurance Expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Received $3,000 cash from Gomez Co. on its receivable. Note: Enter debits before credits. Date December 28 Record entry General Journal Clear entry Q Search Darrow_forwardFill in the income summary.arrow_forward23. Prepare closing entries rom the following end-of period spreadsheet. Austin Entergrises Fadof Peried Spreadsheet For the Year Eaded December JI Adnted Trial Balance Credit Income Statement Debt Balance Sheet Deb 26.500 7000 Account Titie Crede Debit Crede 26,500 7,000 1,000 18300 Cash Accounts Receivable Supplies Equipment Accumalated Depr 18.500 5.000 5.000 Accoures Payabie Wages Payable Common Stock Retained arnings Dividends Eees Earmed Wages Eapense Rest Esgeme Depreciation Eapense Toals Net omeLo) 11,000 100 6.000 2.000 1000 1,000 6.000 2.000 2.000 2,000 59.500 59.500 19,000 7.000 3.00 19000 7000 3.300 .500 .500 29,500 20.0 59.500 5.000 25,000 20.000arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Claire Corporation is planning to issue bonds with a face value of $160,000 and a coupon rate of 8 percent. The bonds mature in two years and pay interest quarterly every March 31, June 30, September 30, and December 31. All of the bonds were sold on January 1 of this year. Claire uses the effective-interest amortization method and also uses a discount account. Assume an annual market rate of interest of 12 percent.(FV of $1. PV of $1, FVA of $1, and PVA of $1) Note: Use appropriate factor(s) from the tables provided. Show Transcribed Text < Journal entry worksheet Note: Enter debits before credits. Record the issuance of the bonds on January 1. Date January 01 Record entry J General Journal Clear entry c Debit Credit View general journalarrow_forwardA. March 1, paid interest due on note, $2,900 B. December 31, interest accrued on note payable, $4,350 Prepare journal entries to record the above transactions. If an amount box does not require an entry, leave it blank. Mar.1 Dec. 31 Create a T-account for Interest Payable, post any entries that affect the account, and tally the ending balance for the account (assume Interest Payable beginning balance of $2,900). Interest Payable Beginning Balance Balancearrow_forwardRecord the following transactions for the Scott Company: Transactions: Nov. 4 Received a $6,500, 90-day, 6% note from Tim’s Co. in payment of the account. Dec. 31 Accrued interest on the Tim’s Co. note. Feb. 2 Received the amount due from Tim’s Co. on the note. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Round your answers to two decimal places. Assume a 360-day year when calculating interest. CHART OF ACCOUNTS Scott Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Tim’s Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable-Tim’s Co. 141…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education