Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need answer the question

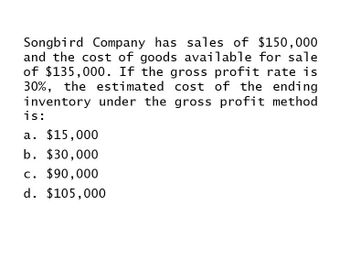

Transcribed Image Text:Songbird Company has sales of $150,000

and the cost of goods available for sale

of $135,000. If the gross profit rate is

30%, the estimated cost of the ending

inventory under the gross profit method

is:

a. $15,000

b. $30,000

c. $90,000

d. $105,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Johnson Corporation had beginning inventory of 20,000 at cost and 35,000 at retail. During the year, it made net purchases of 180,000 at cost and 322,000 at retail. Johnson nude sales of 300,000. Assuming a price index of 100 at the beginning of the year and 110 at the end of the year, compute Johnsons ending inventory at cost using the dollar-value LIFO retail method.arrow_forwardProvide correct answer general accountingarrow_forwardBoston Company sells ten items for $1,100 per unit and has a cost of goods sold per unit of $660. The gross profit to be reported for sellling 10 items is? A. $4,400. B. $11,000. C. $440. D. $6,600.arrow_forward

- If cost of goods sold is $520,000 and the gross profit rate is 20%, what is the gross profit? Select one: a. $2,600,000. b. $130,000. c. $ 520,000. d. $416,000.arrow_forwardA company has sales of $695,000 and cost of goods sold of $278,000. Its gross profit equals: Multiple Choice $(417,000). $695,000. $278,000. $417,000. $973,000.arrow_forwardCan you please answer the questionarrow_forward

- Cushman Company had $814,000 in sales, sales discounts of $12,210, sales returns and allowances of $18,315, cost of goods sold of $386,650, and $280,015 in operating expenses. Gross profit equals: O Multiple Choice $396,825. O $415,140. $409,035. $783,475. $116,810.arrow_forwardKelvin enterprises has the following reported amountsarrow_forwardGross Profit would be____.arrow_forward

- Given the information above, gross margin is? Given the information above, and assuming that Lindsey's total operating expenses (exclusive of the cost of goods sold) are $40,000, pretax income is?arrow_forwardA retailer has net annual sales of $3,000,000. Retail expenses are $260,000. Net profit is $400,000. Calculate the maintained markup at retail. The retail selling price is $10.00. What are the merchandise costs? a. $3.33 b. $6.67 c. $12.00 d. $14.92 The answer must be 6.67$arrow_forwardCompany XYZ has the following information: Beginning Inventory: $20,000 Purchases: $50,000 Ending Inventory: $15,000 Sales Revenue: $100,000 Cost of Goods Sold: $60,000 Calculate the Gross Profit for Company XYZarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning