Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

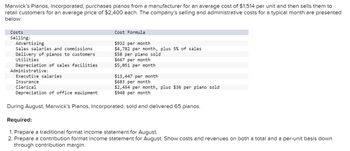

Transcribed Image Text:Marwick's Pianos, Incorporated, purchases pianos from a manufacturer for an average cost of $1,514 per unit and then sells them to

retail customers for an average price of $2,400 each. The company's selling and administrative costs for a typical month are presented

below:

Costs

Selling:

Advertising

Sales salaries and commissions

Delivery of pianos to customers

Utilities

Depreciation of sales facilities

Administrative:

Executive salaries

Insurance

Clerical

Depreciation of office equipment

Cost Formula

$932 per month

$4,782 per month, plus 5% of sales

$58 per piano sold

$667 per month

$5,051 per month

$13,447 per month

$683 per month

$2,454 per month, plus $36 per piano sold

$948 per month

During August, Marwick's Pianos, Incorporated, sold and delivered 65 pianos.

Required:

1. Prepare a traditional format income statement for August.

2. Prepare a contribution format income statement for August. Show costs and revenues on both a total and a per-unit basis down

through contribution margin.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help mearrow_forwardMarwick’s Pianos, Inc., purchases pianos from a large manufacturer and sells them at the retail level. Thepianos cost, on the average, $2,450 each from the manufacturer. Marwick’s Pianos, Inc., sells the pianosto its customers at an average price of $3,125 each. The selling and administrative costs that the companyincurs in a typical month are presented below:Costs Cost FormulaSelling:Advertising ................................................ $700 per monthSales salaries and commissions .............. $950 per month, plus 8% of salesDelivery of pianos to customers ............... $30 per piano soldUtilities ...................................................... $350 per monthDepreciation of sales facilities .................. $800 per monthAdministrative:Executive salaries .................................... $2,500 per monthInsurance .................................................. $400 per monthClerical ..................................................... $1,000 per month, plus…arrow_forwardMarwick's Planos, Incorporated, purchases pianos from a large manufacturer for an average cost of $1,508 per unit and then sells them to retail customers for an average price of $3,400 each. The company's selling and administrative costs for a typical month are presented below: Costs Selling: Advertising Sales salaries and commissions Delivery of pianos to customers Utilities Depreciation of sales facilities Administrative: Cost Formula $958 per month $4,822 per month, plus 3% of sales $58 per piano sold $643 per month $4,959 per month Executive salaries. Insurance Clerical Depreciation of office equipment During August, Marwick's Pianos, Incorporated, sold and delivered 65 pianos. $13,582 per month $715 per month $2,526 per month, plus $42 per piano sold $892 per month Required: 1. Prepare a traditional format income statement for August 2. Prepare a contribution format income statement for August. Show costs and revenues on both a total and a per unit basis down through contribution…arrow_forward

- Marwick's Pianos, Inc., purchases pianos from a large manufacturer and sells them at the retail level. The pianos cost, on the average, $2,450 each from the manufacturer. Marwick's Pianos Inc, sells pianos to its customer at an average price of $3,125 each. The selling and administrative costs that the company incurs in a typical month are presented below:Costs Cost FormulaSelling:Advertising $700 per monthSales salaries asnd commissions $950 per month, plus 8% of salesDelivery of pianos to customers $30 per piano soldUtilities $350 per monthDepreciation of sales facilities $800 per monthAdministrative:Executive salaries $2,500 per monthInsurance $400 per monthClerical $1,000 per month, plus $20 per piano soldDepreciation of office equipment $300 per monthDuring August, Marwick's Pianos, Inc., sold and delivered 40 pianos.Required:1. Prepare an income statement for Marwick's Pianos, Inc. for August. Use the traditional format, with costs organized by function.2. Redo (1) above, this…arrow_forwardMarwick's Pianos, Incorporated, purchases pianos from a manufacturer for an average cost of $1,491 per unit and then sells them to retail customers for an average price of $3,200 each. The company's selling and administrative costs for a typical month are presented below: Costs Selling: Advertising Sales salaries and commissions Delivery of pianos to customers Utilities Cost Formula $960 per month $4,813 per month, plus 4% of sales $57 per piano sold $632 per month $4,934 per month Depreciation of sales facilities Administrative: Executive salaries Insurance Clerical Depreciation of office equipment During August, Marwick's Pianos, Incorporated, sold and delivered 62 pianos. $13,486 per month $712 per month $2,487 per month, plus $37 per piano sold $857 per month Required: 1. Prepare a traditional format income statement for August. 2. Prepare a contribution format income statement for August. Show costs and revenues on both a total and a per-unit basis down through contribution…arrow_forwardMarwick's Pianos, Incorporated, purchases pianos from a large manufacturer for an average cost of $1,503 per unit and then sells them to retail customers for an average price of $2,500 each. The company's selling and administrative costs for a typical month are presented below: Costs Selling: Advertising Sales salaries and commissions Delivery of pianos to customers Utilities Cost Formula $943 per month $4,780 per month, plus 5% of sales $62 per piano sold $638 per month $5,012 per month Depreciation of sales facilities Administrative: Executive salaries $13,474 per month Insurance $688 per month Clerical $2,464 per month, plus $37 per $927 per month Depreciation of office equipment During August, Marwick's Pianos, Incorporated, sold and delivered 61 pianos. Lano sold Required: 1. Prepare a traditional format income statement for August. 2. Prepare a contribution format income statement for August. Show costs and revenues on both a total and a per unit basis down through contribution…arrow_forward

- Marwik Pianos. Inc purchases pianos from a large manufacturer for an average cost of $1,482 per unit and then sells them to retail Customers for an average price or S2,100 each. The company's selling and administrative costs for a typical month are presented below Costs Cost Formuala Selling $965 per month Advertising $4,793 per month plus 5% of Sales Sales Salaries and commissions $57 per piano sold Delivery of Pianos to customers $670 per month Utilities $4,903 per month Depreciaiton of Sales Facilities Administrative Executive Salaries $13,506 per month Insurance $701 per month Clerical $2,480 per month,plus $ 37 per piano sold Depreciation of Office Equipment $916 per month During August, Marvik Pianos sold and delivered 63 pianos. Prepare Traditional Income Statement and also prepare contribution format income statement for cost(Show costs and revenues on both a total and a per unit basis down through contribution margin)arrow_forwardMarwick's Pianos, Incorporated, purchases pianos from a manufacturer for an average cost of S 1,507 per unit and then sells them to retail customers for an average price of $2,600 each. The company's selling and administrative costs for a typical month are presented below: Costs Cost Formula Selling: Advertising $937 per month Sales salaries and commissions $4,790 per month, plus 5% of sales Delivery of pianos to customers $61 per piano sold Utilities $645 per month Depreciation of sales facilities $5,027 per month Administrative: Executive salaries $13,534 per month Insurance $710 per month Clerical $2,535 per month, plus $41 per piano sold Depreciation of office equipment $928 per month During August, Marwick's Pianos, Incorporated, sold and delivered 63 pianos. Required: Prepare a traditional format income statement for August. Prepare a contribution format income statement for August. Show costs and revenues on both a total and a per - unit basis down through contribution margin.arrow_forwardMarwick’s Pianos, Incorporated, purchases pianos from a large manufacturer for an average cost of $1,508 per unit and then sells them to retail customers for an average price of $2,800 each. The company’s selling and administrative costs for a typical month are presented below: Costs Cost Formula Selling: Advertising $ 961 per month Sales salaries and commissions $ 4,802 per month, plus 5% of sales Delivery of pianos to customers $ 59 per piano sold Utilities $ 667 per month Depreciation of sales facilities $ 5,049 per month Administrative: Executive salaries $ 13,433 per month Insurance $ 696 per month Clerical $ 2,513 per month, plus $37 per piano sold Depreciation of office equipment $ 877 per month During August, Marwick’s Pianos, Incorporated, sold and delivered 55 pianos. Required: 1. Prepare a traditional format income statement for August.2. Prepare a contribution format income statement for August. Show costs and revenues on both a…arrow_forward

- Marwick's Pianos, Incorporated, purchases pianos from a large manufacturer for an average cost of $2,450 per unit and then sells them to retail customers for an average price of $3,125 each. The company's selling and administrative costs for a typical month are presented below: Costs Selling: Advertising Sales salaries and commissions Delivery of pianos to customers Utilities Cost Formula $700 per month $950 per month, plus 8% of sales. $30 per piano sold $350 per month $800 per month Depreciation of sales facilities Administrative: Executive salaries Insurance Clerical Depreciation of office equipment During August, Marwick's Pianos, Incorporated, sold and delivered 40 pianos. $2,500 per month $400 per month $1,000 per month, plus $ 20 per piano sold $300 per month Required: 1. Prepare a traditional format income statement for August.arrow_forwardRogers company is operating accounting questionsarrow_forwardHouse of Organs, Inc., purchases organs from a well-known manufacturer and sells them at the retail level. The organs sell, on the average, for $2,500 each. The average cost of an organ from the manufacturer is $1,500. The costs that the company incurs in a typical month are presented below: Costs Cost Formula Selling: Advertising . . . . . . . . . . . . . . . . . . . . . . . $950 per monthDelivery of organs . . . . . . . . . . . . . . . $60 per organ soldSales salaries and commissions . . . . . . $4,800 per month, plus 4% of salesUtilities . . . . . . . . . . . . . . . . . . . . . . . . . . $650 per monthDepreciation of sales facilities . . . . . . . . $5,000 per month Administrative: Executive salaries . . . . . . . . . . . . . . . $13,500 per monthDepreciation of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning