Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Can you please answer the question

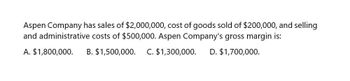

Transcribed Image Text:Aspen Company has sales of $2,000,000, cost of goods sold of $200,000, and selling

and administrative costs of $500,000. Aspen Company's gross margin is:

A. $1,800,000.

B. $1,500,000.

C. $1,300,000.

D. $1,700,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If cost of goods sold is $520,000 and the gross profit rate is 20%, what is the gross profit? Select one: a. $2,600,000. b. $130,000. c. $ 520,000. d. $416,000.arrow_forwardBrad Gravel Pitt Company has sales of $495,000 and cost of goods sold of $302,000. Selling and administrative costs are $100,000. Taxes are $40,000. a. What is the Choose.. gross profit?arrow_forwardStarwise Company had the following amounts from its income statement: $100,000 Sales revenue 32,000 Cost of goods sold -fixed 25,000 Cost of goods sold -variable 9,000 Selling expenses - fixed Selling expenses - variable 11,000 Administrative expenses - fixed 12,000 Administrative expenses - variable 8,000 How much is Starwise's contribution margin? $56,000. O$3,000. O $75,000. $43,000.arrow_forward

- The following information is available for Wade Corp.: Sales $550,000 Total fixed expenses $150,000 Cost of goods sold 390,000 Total variable expenses 360,000 A CVP income statement would report gross profit of $160,000. contribution margin of $400,000. gross profit of $190,000. contribution margin of $190,000.arrow_forwardA recent income statement of Company A reported the following data: Units sold 8,000Sales revenue ₱7,200,000Variable costs ₱4,000,000Fixed costs ₱1,600,000 If the company desired to earn a target net profit of ₱480,000, it would have to sell:A. 1,200 units. B. 2,800 units. C. 4,000 units. D. 5,200 units.arrow_forwardSales for Strength Corp are $725,000, cost of goods sold are $543,000, and interest expenses are $23,000. What is the gross profit margin? A. 25.1% B. 24.3% C. 25.8% D. 21.9% E. 23.2%arrow_forward

- A company has $550,000 in net sales and $193,000 in gross profit. This means its cost of goods sold equals a. $743,000. c. $357,000. e. $(193,000). b. $550,000. d. $193,000.arrow_forwardIf the net operating income is $10,000, the gross margin is $40,000, and the cost of goods sold is $49,500, then the sales must be: Multiple Choice $99,500. $129,000. $89,500. $139,000.arrow_forwardKingsbury Manufacturing has net sales revenue of $940,000, cost of goods sold of $346,400, and all other expenses of $329,200. The net profit margin is: Multiple Choice 0.76 0.72 0.63 0.28arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning