FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

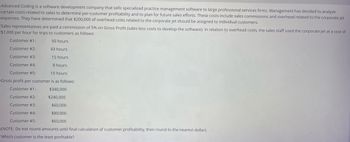

Transcribed Image Text:Advanced Coding is a software development company that sells specialized practice management software to large professional services firms. Management has decided to analyze

certain costs related to sales to determine per-customer profitability and to plan for future sales efforts. These costs include sales commissions and overhead related to the corporate jet

expenses. They have determined that $200,000 of overhead costs related to the corporate jet should be assigned to individual customers.

Sales representatives are paid a commission of 5% on Gross Profit (sales less costs to develop the software). In relation to overhead costs, the sales staff used the corporate jet at a cost of

$1,000 per hour for trips to customers as follows:

Customer #1:

50 hours

Customer #2:

43 hours

Customer #3:

15 hours

Customer #4:

8 hours

Customer #5:

10 hours

Gross profit per customer is as follows:

Customer #1:

$340,000

Customer #2:

$240,000

Customer #3:

$60,000

Customer #4:

$80,000

Customer #5:

$60,000

(NOTE: Do not round amounts until final calculation of customer profitability, then round to the nearest dollar).

Which customer is the least profitable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with coat accounting. thanks.arrow_forwardDetermine the total costs that each operating segment would be accountable for if the step method is used to allocate support costs; assume support departments are ranked according to their original cost. (Round intermediate calculations to 4 decimal places, e.g. 15.2516 and final answers to 2 decimal places, e.g. 15.25.) Total costs $ Operating Segments Institutional Taythank and Media. 776887.5 Retail 468712.5arrow_forwardBaldwin Enterprises has two service departments, Personnel and Legal, and two operating divisions, Eastern and Western. Personnel costs are allocated on the basis of employees and Legal costs are allocated on the basis of hours. A summary of Baldwin operations follows: Employees Hours Department direct costs Costs Personnel Legal Complete this question by entering your answers in the tabs below. Total Personnel $ Personnel $ 10,800 $ 320,000 Required: a. Allocate the cost of the service departments to the operating divisions using the direct method. b. Allocate the cost of the service departments to the operating divisions using the step method. Start with Legal. c. Allocate the cost of the service departments to the operating divisions using the reciprocal method. 320,000 $ 320,000 $ Required A Required B Required C Allocate the cost of the service departments to the operating divisions using the reciprocal method. Note: Do not round intermediate calculations. Round your final answers…arrow_forward

- Founder Consulting Corporation has its headquarters in Memphis and operates from three branch offices in Nashville, Atlanta, and Louisville. Two of the company's activity cost pools are Administrative Service and Development Service. These costs are allocated to the three branch offices using an activity-based costing system. Information for next year follows: Activity Cost Pool Activity Measure Estimated Cost Administrative service % of time devoted to branch $ 1,680,000 Development service Computer time $ 630,000 Estimated branch data for next year is as follows: Time to branch Computer time Nashville 70 % 1,600,000 minutes Atlanta 20 % 1,200,000 minutes Louisville 10 % 400,000 minutes Total 100 % 3,200,000 minutes How much of the headquarters cost allocation should Nashville expect to receive next year?arrow_forward! Required information The Personnel Department at Hernandez Bros. is centralized and provides services to the two operating units: Miami and New York. The Miami unit is the original unit of the company and is well established. The New York unit is new, much like a start-up company. The costs of the Personnel Department are allocated to each unit based on the number of employees in order to determine unit profitability. The current rate is $560 per employee. Data for the fiscal year just ended show the following. Number of employees Number of new hires Number of employees departing Miami New York 1,260 16 14 360 26 24 Required: a. Compute the cost allocated to each unit using the current allocation system. b. Livan, the manager of the Miami unit, is unhappy with the allocation from Personnel. He believes that he gets little benefit other than the occasional hire and termination help. He asks the controller's office to estimate the amount of Personnel Department cost associated with…arrow_forwardYou are working as a manager accountant for a retail company which markets and sells two products product 1 and product 2. The following information is available for last year. The actual fixed product overheads for the same period were 95000 and fixed administration overheads were 25000. a) Please develop both marginal costing and absorption costing income statements. b) elaborate the findings, key advantages and limitations. Please donot provide solution in image format provide solution in step by step format and fast solutionarrow_forward

- The controller of New Wave Sounds Inc. prepared the following product profitability report for management, using activity-based costing methods for allocating both the factory overhead and the marketing expenses. As such, the controller has confidence in the accuracy of this report. Home Theater Wireless Wireless Speakers Speakers Headphones Total $ 1,500,000 (1,050,000) $ 450,000 (600,000) $ (150,000) $ 900,000 (810,000) $ 90,000 (72,000) $ 18,000 $ 3,600,000 (2,580,000) $ 1,020,000 (792,000) $ 228,000 Sales $1,200,000 Cost of goods sold Gross profit (720,000) $ 480,000 (120,000) $ 360,000 Marketing expenses Operating income In addition, the controller interviewed the vice president of marketing, who provided the following insight into the company's three products: The home theater speakers are an older product that is highly recognized in the marketplace. - The wireless speakers are a new product that was just recently launched. - The wireless headphones are a new technology that has…arrow_forwardThornton Corporation's computer services department assists two operating departments in using the company's information system effectively. The annual cost of computer services is $626,200. The production department employs 37 employees, and the sales department employs 25 employees. Thornton uses the number of employees as the cost driver for allocating the cost of computer services to operating departments. Required Allocate the cost of computer services to operating departments. Department Allocated Cost Production Salesarrow_forwardAllocation of common costs. Jim Dandy Auto Sales uses all types of media to advertise its products (television, radio, newspaper, Internet, and so on). At the end of 2016, the company president, Jim McKinnley, decided that all advertising costs would be incurred by corporate headquarters and allocated to each of the company’s four sales locations based on number of vehicles sold. Jim was condent that his corporate purchasing manager could negotiate better advertising contracts on a corporate-wide basis than each of the sales managers could on their own. McKinnley budgeted total advertising cost for 2017 to be $1.6 million. He introduced the new plan to his sales managers just before the New Year. The managers had already drawn up their advertising plans for 2017 and the corporate plan would do the same advertising for them as they had planned. Total advertising costs for 2017 were $1,600,000. If the managers had done thissame advertising on their own, their advertising costs would be…arrow_forward

- Hi-Tek Manufacturing, Inc., makes two types of industrial component parts-the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Inc. Income Statement $ 1,714,000 1,237,202 476,798 Sales Cost of goods sold Gross margin Selling and administrative expenses 610,000 Net operating loss $ (133,202) Hi-Tek produced and sold 60,300 units of B300 at a price of $20 per unit and 12,700 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: B300 T500 Total $ 400,800 $ 120,100 Direct materials $ 162,500 $ 563,300 162,600 511,302 Direct labor $ 42,500 Manufacturing overhead Cost of goods sold $ 1,237,202arrow_forwardSuppose the Reidland CEO decides to use direct costs as the allocation base. Should the Brothers division be closed? Why or why not?arrow_forwardOffice Products Inc. manufactures and sells various high-tech office automation products. Two divisions of Office products Inc. are the Computer Chip Division and the Computer Division. The Computer Chip Division manufactures one product, a "super chip," that can be used by both the Computer Division and other external customers. The following information is available on this month's operations in the Computer Chip Division: Selling price per chip Variable cost per chip Fixed production cost Fixed SG & A costs Monthly capacity External sales Internal sales $50 $20 $60,000 $90,000 $50 $45 $20 10,000 chips 6,000 chips 0 chips Presently the Computer Division purchases no chips from the Computer Chip Division, but instead pays $45 to an external supplier for the 4,000 chips it needs each month. Assume that next month's costs and levels of operation in the Computer and the Computer Chip Divisions are similar to this month. What is the minimum of the transfer price range for a possible…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education