FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

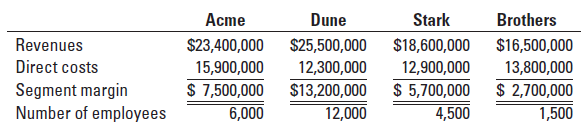

Cost allocation and decision making. Reidland Manufacturing has four divisions: Acme, Dune, Stark, and Brothers. Corporate headquarters is in Minnesota. Reidland corporate headquarters incurs costs of $16,800,000 per period, which is an indirect cost of the divisions. Corporate headquarters currently allocates this cost to the divisions based on the revenues of each division. The CEO has asked each division manager to suggest an allocation base for the indirect headquarters costs from among revenues, segment margin, direct costs, and number of employees. The following is relevant information about each division:

Transcribed Image Text:Stark

Brothers

Acme

Dune

$25,500,000

12,300,000

$13,200,000

12,000

Revenues

$23,400,000

15,900,000

$18,600,000

12,900,000

$16,500,000

13,800,000

Direct costs

$ 7,500,000

$ 5,700,000

4,500

$ 2,700,000

1,500

Segment margin

Number of employees

6,000

Transcribed Image Text:Required

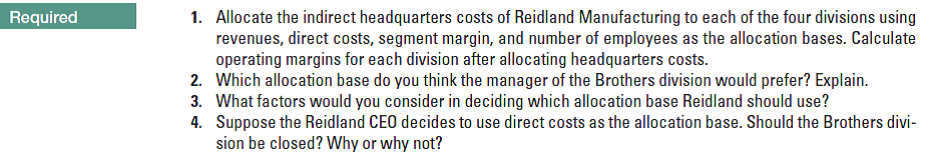

1. Allocate the indirect headquarters costs of Reidland Manufacturing to each of the four divisions using

revenues, direct costs, segment margin, and number of employees as the allocation bases. Calculate

operating margins for each division after allocating headquarters costs.

2. Which allocation base do you think the manager of the Brothers division would prefer? Explain.

3. What factors would you consider in deciding which allocation base Reidland should use?

4. Suppose the Reidland CEO decides to use direct costs as the allocation base. Should the Brothers divi-

sion be closed? Why or why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mackenzie Mining has two operating divisions, Northern and Southern, that share the common costs of the company's human resources (HR) department. The annual costs of the HR department total $14,000,000 a year. You have the following selected information about the two divisions: Northern Southern Required: a. What is the HR cost that is charged to each division if the number of employees is used as the allocation basis? b. What is the HR cost that is charged to each division if the wage and salary expense total is used as the allocation basis? Required A Number of Wage and Salary Expense ($000) $ 173,600 106,400 Complete this question by entering your answers in the tabs below. Employees 2,310 1,890 Division Northern Southern What is the HR cost that is charged to each division if the number of employees is used as the allocation basis? Note: Do not round intermediate calculations. Enter your answers in dollars, not in millions or thousands. Required B HR Cost Required A Required B >…arrow_forwardBalding, Ltd. is composed of 5 divisions. Each division is allocated a share of the overhead of Balding to make divisional managers aware of the cost of running the corporate headquarters. The following information relates to the Metro Division: Sales $6,100,000 Variable Operating Costs $3,640,000 Traceable Fixed Operating Costs $1,560,000 Allocated Corporate Overhead $200,000 If the Metro Division is closed, 100% of the traceable fixed operating costs can be eliminated. What will be the impact on the overall profitability of Balding if the Metro Division is closed? Select one: A. Decrease by $900,000 B. Decrease by $5,900,000 C. Decrease by $4,340,000 D. Decrease by $2,460,000 E. Decrease by $700,000arrow_forwardJasmine Company manufactures both pesticide and liquid fertilizer, with each product manufactured in separate departments. Three support departments support the production departments: Power, General Factory, and Purchasing.Budgeted data on the five departments are as attached: The company does not break overhead into fixed and variable components. The bases for allocation are power-machine hours; general factory-square feet; and purchasing-purchase orders. Required: 1. Allocate the overhead costs to the producing departments using the direct method. (Take allocation ratios out to four significant digits. Round allocated costs to the nearest dollar.)2. Using machine hours, compute departmental overhead rates. (Round theoverhead rates to the nearest cent.)arrow_forward

- The Fly Company provides advertising services for clients across the nation. The Fly Company is presently working on four projects, each for a different client. The Fly Company accumulates costs for each account (client) on the basis of both direct costs and allocated indirect costs. The direct costs include the charged time of professional personnel and media purchases (air time and ad space). Overhead is allocated to each project as a percentage of media purchases. The predetermined overhead rate is 68% of media purchases. On August 1, the four advertising projects had the following accumulated costs: August 1 Balances Vault Bank $261,000 Take Off Airlines 85,000 Sleepy Tired Hotels 208,300 Tastee Beverages 122,300 Total $676,600 During August, The Fly Company incurred the following direct labor and media purchase costs related to preparing advertising for each of the four accounts: Direct Labor Media Purchases Vault Bank $187,000 $717,100 Take Off…arrow_forwardMello Manufacturing Company is a diversified manufacturer that manufactures three products (Alpha, Beta, and Omega) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: Activity Activity Cost Pool Production $259,200 Setup 55,000 Materials handling 9,750 Inspection 60,000 Product engineering 123,200 Total $507,150 The activity bases identified for each activity are as follows: Activity Activity Base Production Machine hours Setup Number of setups Materials handling Number of parts Inspection Number of inspection hours Product engineering Number of engineering hours The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Machine Hours Number of…arrow_forwardanswer in text form please (without image)arrow_forward

- The centralized computer technology department of Lee Company has expenses of$264,000. The department has provided a total of 2,500 hours of service for the period. TheRetail Division has used 1,125 hours of computer technology service during the period, andthe Commercial Division has used 1,375 hours of computer technology service. How mucheach division should be charged for computer technology department services?arrow_forwardABC Corporation has three support departments with the following costs and cost drivers: Support Department Cost Cost Driver Graphics Production $200,000 Number of copies made Accounting 500,000 Number of invoices processed Personnel 400,000 Number of employees ABC has three operating divisions, Micro, Macro, and Super. Their revenue, cost, and activity information is as follows: Revenues Direct operating expenses Number of copies made Number of invoices processed Number of employees Micro Macro Super $700,000 $850,000 $650,000 50,000 70,000 100,000 20,000 30,000 50,000 Et 700 130 800 145 500 125 The support department allocation rate for the Personnel Department is O a. $3,200 O b. $2,758 O c. $1,000 O d. $3,077arrow_forwardSupport Department Cost Allocation-Reciprocal Services Method Blue Africa Inc. produces laptops and desktop computers. The company's production activities mainly occur in what the company calls its Laser and Forming departments. The Cafeteria and Security departments support the company's production activities and allocate costs based on the number of employees and square feet, respectively. The total cost of the Security Department is $242,000. The total cost of the Cafeteria Department is $878,000. The number of employees and the square footage in each department are as follows: Employees Square Feet 10 18 2,400 ETT 40 2,400 50 Security Department Cafeteria Department Laser Department Forming Department Using the reciprocal services method of support department cost allocation, determine the total costs from the Security Department that should be allocated to the Cafeteria Department and to each of the production departments. Security Department cost allocation 540 3,200 Cafeteria…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education