FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

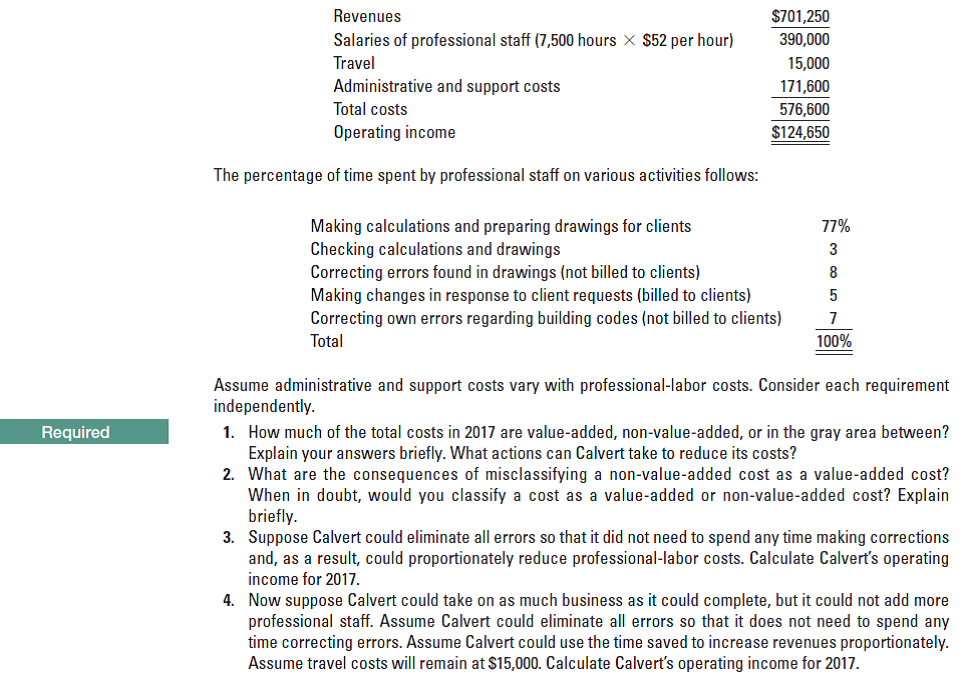

Target operating income, value-added costs, service company. Calvert Associates prepares architectural drawings to conform to local structural-safety codes. Its income statement for 2017 is as follows:

Transcribed Image Text:Revenues

$701,250

390,000

Salaries of professional staff (7,500 hours × $52 per hour)

Travel

15,000

Administrative and support costs

171,600

Total costs

576,600

Operating income

$124,650

The percentage of time spent by professional staff on various activities follows:

Making calculations and preparing drawings for clients

Checking calculations and drawings

Correcting errors found in drawings (not billed to clients)

Making changes in response to client requests (billed to clients)

Correcting own errors regarding building codes (not billed to clients)

77%

3

8

5

Total

100%

Assume administrative and support costs vary with professional-labor costs. Consider each requirement

independently.

Required

1. How much of the total costs in 2017 are value-added, non-value-added, or in the gray area between?

Explain your answers briefly. What actions can Calvert take to reduce its costs?

2. What are the consequences of misclassifying a non-value-added cost as a value-added cost?

When in doubt, would you classify a cost as a value-added or non-value-added cost? Explain

briefly.

3. Suppose Calvert could eliminate all errors so that it did not need to spend any time making corrections

and, as a result, could proportionately reduce professional-labor costs. Calculate Calverť's operating

income for 2017.

4. Now suppose Calvert could take on as much business as it could complete, but it could not add more

professional staff. Assume Calvert could eliminate all errors so that it does not need to spend any

time correcting errors. Assume Calvert could use the time saved to increase revenues proportionately.

Assume travel costs will remain at $15,000. Calculate Calvert's operating income for 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardBriefly explain two (2) potential pitfalls encountered in the design of performance indicators and measurement systems.arrow_forwardWhich of the following would probably properly classified as a step cost with respect to the volume of production ? Depreciation computed on an annual basis Total salaries paid to quality -control inspectors Real estate taxes President of the company's salaryarrow_forward

- An example of a staff management function would be A. determining that new equipment is required. B. managing production. C. preparing operating cost estimates for proposed new equipment. D. ensuring that environmental standards are met. E. being responsible for attaining a set level of plant income.arrow_forwardFor each cost, indicate whether it would most likely be classified as direct materials, direct labor, manufacturing overhead, or selling and administrative. (a) Amortization of patents on factory machine (b) Components used to make product A (Select one) (Select one) (Select one) (c) Direct materials used (d) Factory utilities (e) Property taxes - factory. (f) The cost of a hard-drive installed in a computer for a computer assembling company (g) The wages of employees who assemble computers from components (h) The wages of the company's accountant (i) Wages of the product tester () Wages to assembly line A workers (Select one) (Select one) (Select one) (Select one) (Select one) (Select one) (Select one)arrow_forwardWhich one of the following options can be used when allocating cafeteria costs? Select one: a. Number of square feet b. Appraised value of square footage c. Number of direct labor hours d. Number of employeesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education