FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

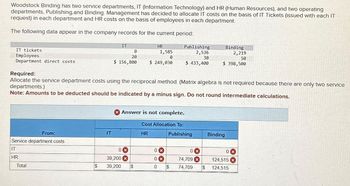

Transcribed Image Text:Woodstock Binding has two service departments, IT (Information Technology) and HR (Human Resources), and two operating

departments, Publishing.and Binding. Management has decided to allocate IT costs on the basis of IT Tickets (issued with each IT

request) in each department and HR costs on the basis of employees in each department.

The following data appear in the company records for the current period:

IT tickets

Employees

Department direct costs

From:

Service department costs

IT

HR

Total

$

IT

IT

0

20

$ 156,800

Required:

Allocate the service department costs using the reciprocal method. (Matrix algebra is not required because there are only two service

departments.)

Note: Amounts to be deducted should be indicated by a minus sign. Do not round intermediate calculations.

39,200

39,200

0x

HR

1,585

0

$ 249,030

Answer is not complete.

$

Cost Allocation To:

HR

Publishing

2,536

30

$ 433,400

0

0X

0

Publishing

$

0x

74,709 x

74,709

Binding

2,219

50

$ 398,500

$

Binding

0 x

124,515

124,515

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Snowflake Company has two service departments (S1 and S2) and two producing departments (P1 and P2). Department S1 costs are allocated on the basis of number of employees, and Department S2 costs are allocated on the basis of space occupied expressed in square feet. Data on direct department costs, number of employees, and space occupied are as follows: Direct dept. costs Number of employees Space occupied P1 P2 0 S1 S2 P1 $15,000 $22,000 $55,000 0 10 2,000 If Snowflake uses the direct method, what is the ratio representing the portion of Department S2 allocated to P2? 25 5 1,000 3,000 P2 $60,000 30 7,000arrow_forwardExpress Delivery Company (EDC) is considering outsourcing its Payroll Department to a payroll processing company for an annual fee of $223,800. An internally prepared report summarizes the Payroll Department's annual operating costs as follows: Supplies Payroll clerks' salaries Payroll supervisor's salary Payroll employee training expenses Depreciation of equipment Allocated share of common building operating costs Allocated share of common administrative overhead Total annual operating cost $ 33,800 123,800 61,800 13,800 23,800 18,800 31,800 $ 307,600 EDC currently rents overflow office space for $39,800 per year. If the company closes its Payroll Department, the employees occupying the rented office space could be brought in-house and the lease agreement on the rented space could be terminated with no penalty. If the Payroll Department is outsourced the payroll clerks will not be retained; however, the supervisor would be transferred to the company's Human Resource Management…arrow_forwardPlease answer complete question otherwise skip it, answer in text form please (without image)arrow_forward

- Marks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office expenses are allocated to the two departments using different allocation bases. The following information is available for the curfent period: office Expenses Salaries Depreciation Advertising Item Number of employees Net sales Cost of goods sold Multiple Choice O The amount of the advertising cost that should be allocated to Grinding for the current period is: O O $24,400 $68.000 $36.600 $360.000 Total $46,000 27,000 61,000 $81,000. Allocation Basis Number of employees Cost of goods sold Net sales Drilling Grinding Total 1,200 1,800 3,000 $360,000 $540,000 $900,000 $114,000 $186,000 $300,000arrow_forwardUse the following information to compute each department's contribution to overhead. Which department contributes the largest amount toward total overhead? Sales Cost of goods sold Gross profit Total direct expenses Contribution to overhead Department A $ 58,000 36,540 Department B $ 196,000 Department C $ 75,000 101,920 39,750 21,460 94,080 35,250 4,380 43,360 8,266 $ $ $ Complete this question by entering your answers in the tabs below. Contribution to Departmental Overhead Overhead Compute each department's contribution to overhead. Department A Department B Department C Contribution to overhead Contribution to Overhead Departmental Overhead >arrow_forwardThe following information relates to Myer, Inc.: Advertising Costs Sales Salary Sales Revenue President's Salary Office Rent Manufacturing Equipment Depreciation Indirect Materials Used Indirect Labor Factory Repair and Maintenance Direct Materials Used Direct Labor Delivery Vehicle Depreciation Administrative Salaries $10,600 10,000 500,000 230,000 60,500 1200 8000 13,000 920 27,500 36,000 1550 22,000 How much were Myer's product costs? A) $604,650 B) $252,000 C) $510,600 D) $86,620arrow_forward

- Swifty Accounting performs two types of services, Audit and Tax. Swifty's estimated overhead costs consist of computer support, $306000; and legal support, $153000. Information on the two services and their estimated use of cost drivers is as follows: Direct labor cost CPU minutes Legal hours used Audit O $306000. O $153000. O $275400. O $183600. Tax $50000 $100000 40000 10000 200 800 Overhead assigned to tax services using activity-based costing isarrow_forwardActivity-Based Costing for a Service Company Safety First Insurance Company carries three major lines of insurance: auto, workers' compensation, and homeowners. The company has prepared the following report:arrow_forwardCompton Information Services, Inc., has two service departments: human resources and billing. Compton's operating departmen organized according to the special industry each department serves, are health care, retail, and legal services. The billing depart supports only the three operating departments, but the human resources department supports all operating departments and th billing department. Other relevant information follows. Number of employees Annual cost* Annual revenue Req A1 Department Billing Human Resources 10 $720,000 $1,428,000 $6,000,000 Billing Health Care Retail Complete this question by entering your answers in the tabs below. Req A2 Legal Services Total *This is the operating cost before allocating service department costs. Required a. Allocate service department costs to operating departments, assuming that Compton adopts the step method. The company the number of employees as the base for allocating human resources department costs and department annual revenue as…arrow_forward

- Technology and Personnel, and two operating departments, Prepress and Printing. Service Department Operating Department Information Technology $ 27,412 Printing $ 530,110 Personnel Prepress Departmental costs $ 27,008 $ 376,940 Computer workstations 28 19 51 38 Employees 27 14 98 30 Information Technology Department costs are allocated on the basis of computer workstations and Personnel Department costs are allocated on the basis of employees. The total Prepress Department cost after service department allocations is closest to: Multiple Choice $406,961 $413,326 $402,881 $410,563arrow_forwardLily Accounting performs two types of services, Audit and Tax. Lily's estimated overhead costs consist of computer support, $312000; and legal support, $153000. Information on the two services and their estimated use of cost drivers is as follows: Direct labor cost CPU minutes Legal hours used Audit Tax $50000 $100000 O $3744 O $5097 O $5544 O $3897 40000 200 10000 800 Lily Accounting performs tax services for Cathy Lane. Direct labor cost is $1200, 600 CPU minutes were used; and 1 legal hour was used. What is the total cost of the Lane job using ABC?arrow_forwardThe managing director of a consulting group has the accompanying monthly data on total overhead costs and professional labor hours to bill to clients. Complete parts a through c. Click the icon to view the monthly data. a. Develop a sim Overhead Costs (Round the const Monthly Overhead Costs and Billable Hours Data Overhead Costs Billable Hours $385,000 2,000 $425,000 3,000 $445,000 4,000 $496,000 5,000 $560,000 6,000 $580,000 7,000 - clude the $ symbol in your answers.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education