FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

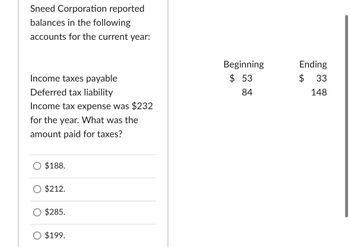

Transcribed Image Text:Sneed Corporation reported

balances in the following

accounts for the current year:

Income taxes payable

Deferred tax liability

Income tax expense was $232

for the year. What was the

amount paid for taxes?

Beginning

$ 53

84

$188.

$212.

$285.

○ $199.

Ending

$ 33

148

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sneed Corporation reported balances in the following accounts for the current year: Income taxes payable $ 50 $ 30 Deferred tax liability 80 140 Income tax expense was $230 for the year. What was the amount paid for taxes? $220. $280. $190. $210.arrow_forwardThe statements of financial position of Nedburg include the following extracts: Statements of financial position as at 30 September 20X2 20X1 $m $m Non-current liabilities Deferred tax 310 140 Current liabilities Taxation 130 160 The tax charge in the statement of profit or loss for the year ended 30 September 20X2 is $270 million. What amount of tax was paid during the year to 30 September 20X2?arrow_forwardDuring 20X1, a company reported an increase in the deferred tax liability account of $47,790, a decrease in the deferred tax asset account of $17,225, and an income tax liability as per the 20X1 income tax return of $198,375. What is the income tax expense to be reported on the income statement for the year ending December 31, 20X1? Multiple Choice $228,940 $263,390 $167,810 $198,375arrow_forward

- Given the following information, compute Peach Company’s income taxes paid Decrease in income taxes payable …… $ 600 Income tax expense …………. 4,400 Please provide explantionarrow_forwardA bhaliyaarrow_forwardNalad Corp. provided the following data related to accounting and taxable income: Pre-tax accounting income (financial statements) Taxable income (tax return) Income tax rate 20X8 $530,000 20X9 $505,000 305,000 730,000 38% 38% There are no existing temporary differences other than those reflected in these data. There are no permanent differences. Required: 1-a. How much tax expense would be reported in each year if the taxes payable method was used? Tax Expense 20X8 20X9 1-b. What is the implied tax rate? (Round your answers to 1 decimal place.) 20X8 20X9 Implied tax rate 96 % 2-a. How much tax expense would be reported using comprehensive tax allocation (liability method). Tax Expense 20X8 20X9 2-b. How much deferred income tax would be reported using comprehensive tax allocation (liability method).arrow_forward

- 1. What is the total deferred tax liability at December 31, 20x6?2. What is the total deferred tax asset at December 31, 20x6?3. What is the current income tax expense for the year ended December 31, 4. What is the total income tax expense for 20x6?arrow_forward1. What is the total deferred tax liability at December 31, 20x6? 2. What is the total deferred tax asset at December 31, 20x6? 3. What is the current income tax expense for the year ended December 31, 20x6? 4. What is the total income tax expense for 20x6?arrow_forwardWhat is the adjusted balance of income tax payable to be reflected in the 2021 statement of financial position?arrow_forward

- *see attached What amount of income tax payable should be reported?a. P 385,000b. P 498,000c. P 425,000d. P 305,000arrow_forwardhfgarrow_forwardA company reported in the income statement for the current year P900,000 income before provision for income tax. Please consider the following information: Rent income received in advance 150,000Interest income on time deposit 200,000Depreciation deducted for income tax purposes in excess of financial depreciation 100,000Income tax rate 30% Required: 1. How much is the taxable income?2. How much is the accounting income subject to tax?3. How much is the permanent difference?4. How much is the net temporary differences?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education