FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

*see attached

What amount of income tax payable should be reported?

a. P 385,000

b. P 498,000

c. P 425,000

d. P 305,000

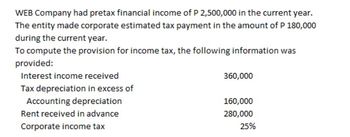

Transcribed Image Text:WEB Company had pretax financial income of P 2,500,000 in the current year.

The entity made corporate estimated tax payment in the amount of P 180,000

during the current year.

To compute the provision for income tax, the following information was

provided:

Interest income received

360,000

160,000

Tax depreciation in excess of

Accounting depreciation

Rent received in advance

Corporate income tax

280,000

25%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exercise 3-23 (Algorithmic) (LO. 6) Compute the 2023 tax liability and the marginal and average tax rates for the following taxpayers. Click here to access the 2023 tax rate schedule. If required, round the tax liability to the nearest dollar. When required, round the average rates to four decimal places before converting to a percentage (l.e., .67073 would be rounded to .6707 and entered as 67.07%). a. Chandler, who files as a single taxpayer, has taxable income of $157,600. Tax liability: Marginal rate: Average rate: 14,934 X 19.78 X % % b. Lazare, who files as a head of household, has taxable income of $72,000. Tax liability: Marginal rate: Average rate: % %arrow_forwardA9arrow_forwardin utilities in both cities? 7. Use the tax table on questions 7 and 8. Jenna is a part-time receptionist at the dentist's office. Her income last year was $9,125. Her tax status is single, she claims one exemption for herself, and she plans on taking the standard deduction. What is her taxable income? If line 43 And you are - (taxable income) is- At But Single least less than Your tax is- 83,000 83,000 83,050 16,967 13,131 17,379 83,050 83,100 16,981 13,144 17.393 83,100 83,150 16,995 13,156 17,407 83,150 83,200 17,009 13,169 17,421 13,181 17,435 13,194 17.449 83,200 83,250 17,023 83,250 83,300 17,037 83,300 83,350 17,081 83,350 83,400 17,065 13,206 17,463 13,219 17,477 13,231 17,491 13,244 17,505 13,256 17,519 13,269 17,533 13,281 17,547 13,294 17,561 83,400 83,450 17,079 83,450 83,550 17,093 83,500 83,550 17,107 83,550 83,600 17,121 83,600 83,650 17,135 83,650 83,700 17,149 83,700 83,750 17,163 83,750 83,800 17,177 83,800 83,850 17,191 83,850 83,900 17,205 83,900 83,950 17,219…arrow_forward

- Question 8: Collectively, Social Security tax and Medicare tax are referred to as FICA taxes. Answer: A. O True В. O Falsearrow_forwardFind the amounts that are missing from this summary of an income tax return: a. Gross income $42,685 b. Adjustments to income $3,670 c. Adjusted gross income d. Deductions $8,978 e. Adjusted gross income less deductions f. Exemptions (4 $3,100) $12,400 g. Taxable income Vince Bottolito's adjusted gross income on his federal tax return was $53.748. He claimed the standard deduction of $4,850, and one exemption at $3,100. What was Vince's taxable income? The Valek's gross income last vear was $64.890. They had adjustments to income totaling S3.829. Their deductions totaled $12.502. and they had four exemptions at S3.100 each. Find their taxable income.arrow_forwardChapter 3 Activity – Taxes Individual Income Tax Brackets (2021) Marginal Tax Rate Single, taxable income over: Joint, taxable income over: Head of Household, taxable income over: 10% $0 $0 $0 12% $9,950 $19,900 $14,200 22% $40,525 $81,050 $54,200 24% $86,375 $172,750 $86,350 32% $164,925 $329,850 $164,900 35% $209,425 $418,850 $209,400 37% $523,600 $628,300 $523,600 Standard Deduction Amounts (2021) Filing Status Deduction Amount Single $12,550 Married Filing Jointly $25,100 Head of Household $18,800 Long-term Capital Gains & Qualified Dividends (2021) Tax Rate Single Joint Head of Household 0% Under $40,000 Under $80,800 Under $54,100 15% $40,400 $80,800 $54,100 20% $445,850 $501,600 $473,750 Additional 3.8% Net Investment Income Tax for MAGI over $200,000 / $250,000 / $200,000 Calculate the federal income…arrow_forward

- How do I calculate the before-tax total amount if the tax is 40% and after-tax amount is 1255162.00? (I do not have any other information like revenue or expenses)arrow_forwardExercise 16-10 (Algo) Calculate income tax amounts under various circumstances; financial statement effects [LO16-2, 16-3] Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: ($ in thousands) Taxable income Future deductible amounts Future taxable amounts. Balance(s) at beginning of the year: Deferred tax asset Deferred tax liability The enacted tax rate is 25%. Required: Situation 1 2 3 4 $ 112 $ 244 $ 252 $ 344 16 20 20 16 16 56 2 16 8 2 For each situation, determine the following: Note: Enter your answers in thousands rounded to one decimal place (i.e. 1,200 should be entered as 1.2). Negative amounts should be indicated by a minus sign. Leave no cell blank, enter "O" wherever applicable. a. Income tax payable currently. b. Deferred tax asset-ending balance. c. Deferred tax asset-change. d. Deferred tax liability-ending balance. e. Deferred tax liability change. f. Income tax…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education