Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please solve this. Make sure you don't use Chathpt please.

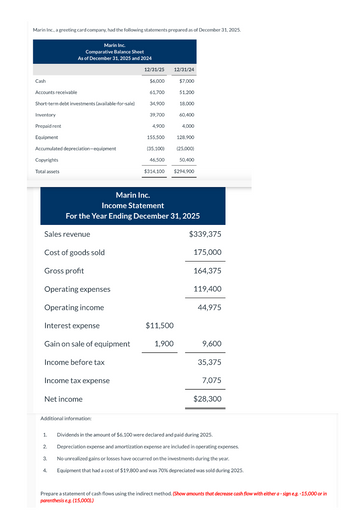

Transcribed Image Text:Marin Inc., a greeting card company, had the following statements prepared as of December 31, 2025.

Marin Inc.

Comparative Balance Sheet

As of December 31, 2025 and 2024

12/31/25

12/31/24

Cash

$6,000

$7,000

Accounts receivable

61,700

51,200

Short-term debt investments (available-for-sale)

34,900

18,000

Inventory

39,700

60,400

Prepaid rent

4,900

4,000

Equipment

155,500

128,900

Accumulated depreciation-equipment

(35,100) (25,000)

Copyrights

46,500

50,400

Total assets

$314,100 $294,900

Marin Inc.

Income Statement

For the Year Ending December 31, 2025

Sales revenue

Cost of goods sold

Gross profit

$339,375

175,000

164,375

Operating expenses

119,400

Operating income

44,975

Interest expense

$11,500

Gain on sale of equipment

1,900

9,600

Income before tax

35,375

Income tax expense

7,075

Net income

$28,300

Additional information:

1. Dividends in the amount of $6,100 were declared and paid during 2025.

2.

Depreciation expense and amortization expense are included in operating expenses.

3.

No unrealized gains or losses have occurred on the investments during the year.

4.

Equipment that had a cost of $19,800 and was 70% depreciated was sold during 2025.

Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in

parenthesis e.g. (15,000).)

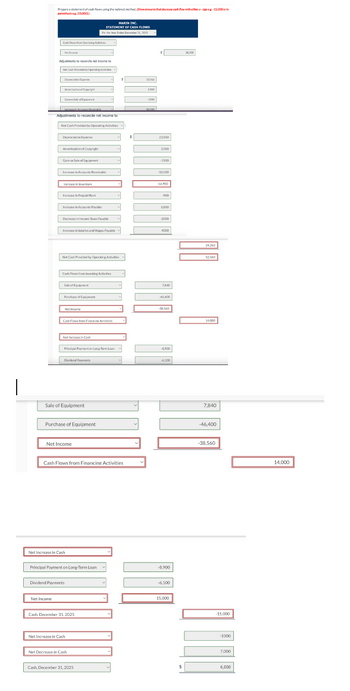

Transcribed Image Text:Prepare a statement of cash flows using the indirect method. Show amounts that decrease cash flow with either a-sign-15,000

(15,000)

Cash Flows from Operating Act

MARIN INC.

STATEMENT OF CASH FLOWS

For the Year Ended December 31, 2005

Adjustments to reconcile net income to

Net Cash Provided by

Depreciation Exper

Amortization of Copert

Sk

Increase in Accounts Receivable

Adjustments to reconcile net income to

Net Cash Provided by Operating Activities

23,940

8,900

-1900

Depreciation Expense

$

23,960

Amortization of Copyright

3,500

Gain on Sale of Equipment

-1900

Increase in Accounts Receivable

-10,500

Increase in Inventory

Increase in Prepaid Rent

Increase in Accounts Payable

-16,900

-500

5,800

Decrease in Income Taxes Payable

-2000

Increase in Salaries and Wages Payable

4000

Net Cash Provided by Operating Activities

Cash Flows from Investing Activities

Sale of Equipment

Purchase of Equipment

Net Income

Cash Flows from Financing Activities

7,840

38.560

Net Increase in Cash

Principal Payment on Long-Term Loan

-8,900

Dividend Payments

-6.100

Sale of Equipment

Purchase of Equipment

Net Income

Cash Flows from Financing Activities

Net Increase in Cash

Principal Payment on Long-Term Loan

-8,900

Dividend Payments

Net Income

Cash. December 31.2025

Net Increase in Cash

Net Decrease in Cash

Cash, December 31, 2025

-6,100

15,000

24,250

52,560

14,000

7,840

-46,400

-38,560

-15,000

-1000

7,000

6,000

14,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Flint Inc., a greetlng card company, had the following statements prepared as of December 31, 2020. FLINT INC. COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,100 $7,100 Accounts recelvable 62,400 51,000 Short-term debt Investments (avallable-for-sale) 34,700 18,100 Inventory 40,400 60,300 Prepald rent 4,900 4,000 Equipment 154,100 130,600 Accumulated depreclatlon-equlpment (34,900 ) (24,800 ) Copyrights 46,400 49,800 Total assets $314,100 $296,100 Accounts payable $46,500 $40,200 Income taxes payable 4,000 6,000 Salarles and wages payable 8,100 4,100 Short-term loans payable 7,900 10,100 Long-term loans payable 59,600 68,400 Common stock, $10 par 100,000 100,000 Contributed capital, common stock 30,000 30,000 Retalned earnings 58,000 37,300 Total labiles &. stockholders' equlty $314,100 $296,100 FLINT INC. INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2020 Sales revenue $339,800 Cost of goods sold 176,500 Gross profit 163,300 Operating expenses…arrow_forward25. Windsor Inc., a greeting card company, had the following statements prepared as of December 31, 2020. WINDSOR INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,100 $7,100 Accounts receivable 62,400 51,000 Short-term debt investments (available-for-sale) 34,700 18,100 Inventory 40,400 60,300 Prepaid rent 4,900 4,000 Equipment 154,100 130,600 Accumulated depreciation—equipment (34,900 ) (24,800 ) Copyrights 46,400 49,800 Total assets $314,100 $296,100 Accounts payable $46,500 $40,200 Income taxes payable 4,000 6,000 Salaries and wages payable 8,100 4,100 Short-term loans payable 7,900 10,100 Long-term loans payable 59,600 68,400 Common stock, $10 par 100,000 100,000…arrow_forward26. Coronado Inc., a greeting card company, had the following statements prepared as of December 31, 2020. CORONADO INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $5,900 $7,000 Accounts receivable 61,400 51,500 Short-term debt investments (available-for-sale) 35,000 18,200 Inventory 40,000 60,500 Prepaid rent 5,000 4,100 Equipment 152,900 131,100 Accumulated depreciation—equipment (35,200 ) (25,100 ) Copyrights 45,800 50,000 Total assets $310,800 $297,300 Accounts payable $46,100 $40,100 Income taxes payable 3,900 5,900 Salaries and wages payable 8,000 4,000 Short-term loans payable 8,100 10,000 Long-term loans payable 60,400 69,300 Common stock, $10 par 100,000 100,000…arrow_forward

- The comparative balance sheets for Metlock Corporation show the following information. December 312020 2019Cash $33,500 $12,900Accounts receivable 12,400 10,000Inventory 12,100 9,000Available-for-sale debt investments –0– 3,000Buildings –0– 29,800Equipment 44,800 19,900Patents 5,000 6,300 $107,800 $90,900Allowance for doubtful accounts $3,100 $4,500Accumulated depreciation—equipment 2,000 4,500Accumulated depreciation—building –0– 6,000Accounts payable 5,000 3,000Dividends payable –0– 4,900Notes payable, short-term (nontrade) 3,000 4,100Long-term notes payable 31,000 25,000Common stock 43,000 33,000Retained earnings 20,700 5,900 $107,800 $90,900 Additional data related to 2020 are as follows. 1. Equipment that had cost $11,000 and was 40% depreciated at time of disposal was sold for $2,500.2. $10,000 of the long-term note payable was paid by issuing common stock.3. Cash dividends paid were $4,900.4. On January…arrow_forwardPlease solve this :)arrow_forwardSolve this please :)arrow_forward

- Carla Vista Co. has these comparative balance sheet data: CARLA VISTA CO.Balance SheetsDecember 31 2022 2021 Cash $ 16,140 $ 32,280 Accounts receivable (net) 75,320 64,560 Inventory 64,560 53,800 Plant assets (net) 215,200 193,680 $371,220 $344,320 Accounts payable $ 53,800 $ 64,560 Mortgage payable (15%) 107,600 107,600 Common stock, $10 par 150,640 129,120 Retained earnings 59,180 43,040 $371,220 $344,320 Additional information for 2022: 1. Net income was $32,500. 2. Sales on account were $392,900. Sales returns and allowances amounted to $27,300. 3. Cost of goods sold was $217,300. 4. Net cash provided by operating activities was $57,200. 5. Capital expenditures were $30,000, and cash dividends were $19,000. Compute the following ratios at December 31, 2022. (Round current ratio and inventory turnover to 2 decimal…arrow_forwardSuppose the Crane Ltd's 2020 financial statements contain the following selected data (in millions). Current assets Total assets Current liabilities Total liabilities NT$3,536.0 31,408.0 3,016.0 16,640.0 Compute the following values. Interest expense Income taxes Net income NT$520.0 (a) Debt to assets ratio. (Round to O decimal places, e.g. 62%.) 1,976.0 4,590.0 (b) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) % timesarrow_forwardCrane Company has these comparative balance sheet data: CRANE COMPANYBalance SheetsDecember 31 2022 2021 Cash $ 27,105 $ 54,210 Accounts receivable (net) 126,490 108,420 Inventory 108,420 90,350 Plant assets (net) 361,400 325,260 $623,415 $578,240 Accounts payable $ 90,350 $ 108,420 Mortgage payable (15%) 180,700 180,700 Common stock, $10 par 252,980 216,840 Retained earnings 99,385 72,280 $623,415 $578,240 Additional information for 2022: 1. Net income was $27,900. 2. Sales on account were $382,300. Sales returns and allowances amounted to $29,000. 3. Cost of goods sold was $207,500. 4. Net cash provided by operating activities was $57,000. 5. Capital expenditures were $28,900, and cash dividends were $17,900. Compute the following ratios at December 31, 2022. (Round current ratio and inventory turnover to 2 decimal…arrow_forward

- Calculate the Debt to Equity ratio for Urban Outfitters for both 2018 and 2019. Be sure to round your answer to 2 decimal place.arrow_forwardThe following investment account was taken from the general ledger of One Dream Investment Company: Debt Investments - Fulfilled Dream 6% bonds (2,000,000 face value, due December 31, 2027) Date PR Debit Credit Balance January 2, 2022 VR P1,812,300 P1,812,300 June 30, 2022 CRJ 60,000 1,752,300 Dec. 31, 2022 CRJ 60,000 1,692,300 Dec. 31, 2022 195,000 1,497,300 In the course of your examination, you obtained the following information: Interest checks were received on June 30 and December 31 and were credited to the investment account. One dream sold P200,000 of its investment on December 31, 2022 for P195,000. Effective interest rate on this investment, as computed by your audit staff, is 8%. One Dream included this investment in a portfolio that is held to collect and for sale. The fair value at December 31, 2022 and 2023 is 97.5 and 105, respectively. Question 1: The entry to correct the interest income for 2022…arrow_forwardAn extract from a computer company's 2021 financial statements follows: Balance sheet As of December 31, 2021 As of December 31, 2020 Total assets 57,699 54,013 Total liabilities 37,682 37,919 Total stockholders' equity 20,017 16,096 What was the company's debt-to- equity ratio for 2021? OA. 2.5 OB. 1.6 O C. 0.9 O D. 1.9arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning