FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

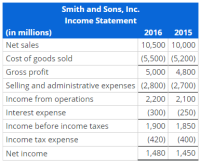

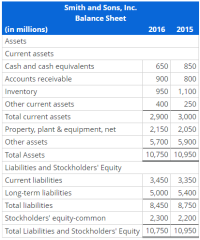

Calculate the times-interest-earned ratio for Smith & Sons, Inc., for 2015 and 2016. Round answers to two decimal places.

Transcribed Image Text:Smith and Sons, Inc.

Income Statement

(in millions)

2016 2015

Net sales

10,500 10,000

Cost of goods sold

(5,500) (5,200)

Gross profit

5,000 4,800

Selling and administrative expenses (2,800) (2,700)

Income from operations

2,200 2,100

Interest expense

(300) (250)

Income before income taxes

1,900 1,850

Income tax expense

(420)

(400)

Net income

1,480 1,450

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Find in the Selected Financial Data or calculate, the following data: Dividends per share declared in 2017. Capital expenditures in 2016. Year total equity grew by the greatest amount over the previous year. Change in total debt from 2013 to 2017.arrow_forwardThe following schedule of assets and liabilities relates to Kona Enterprises. Their year-end is 28 February. Income received in advance Input VAT Output VAT Prepaid expenses Accumulated depreciation: Equipment Equipment Fixed deposit (maturing on 31 May 2023) Savings account Bank overdraft Accrued expenses Accrued income Trade receivables Trading inventory Land and Buildings Mortgage loan: Vida Bank Trade payables 2022 2 000 3 000 6 500 7500 30 000 90 000 40 000 13 500 0 16 000 9 500 34 000 105 000 950 000 450 000 150 000 2023 Calculate the level of working capital (total current assets) as at the financial years ended 28 February 2022 and 28 February 2023. Calculate the total for current liabilities as at the financial year ending 28 February 2022 and 2023. 1000 3 500 11 500 5 000 35 000 100 000 40 000 18 500 4 500 10 500 12 000 41 500 115 000 950 000 380 000 170 000arrow_forwardse the following selected financial statement information from Black Water Industries. BLACK WATER INDUSTRIES Year Net Credit Sales Ending Accounts Receivable 2017 $687,430 $332,250 2018 705,290 362,450 2019 769,500 403,650 A. Compute the number of days’ sales in receivables ratios for 2018 and 2019. Round your answers to two decimal places. 2018 fill in the blank 1 days 2019 fill in the blank 2 days B. Using the sales in accounts receivable, choose the statement that most closely describes the company's management of its receivables. a. The company collects its accounts slowly, and the days are increasing. b. This may be leave the company unable to pay current debt owed to a lender. c. The company may need to be more aggressive with its receivable collection procedures. d. All of the above statements may be correct.arrow_forward

- How to calculate the total outstanding receivables?? For example if at the Dec 31 2013, total sales on account and invoiced during the year, the account receivable balance outstanding at the year end, the date when the invoice was issued and the date when the invoice was paid off was given!arrow_forwardWhat was H&R Block's Current Ratio for year ending APR. 30, 20118? Carry your answer to two decimal points.arrow_forwardUse the following financial statement information from Black Water Industries. BLACK WATER INDUSTRIES Ending Accounts Receivable Year Net Credit Sales 2017 $690,430 $335,250 2018 705,290 364,450 2019 770,500 406,650 A. Compute the accounts receivable turnover ratios for 2018 and 2019. Round your answers to two decimal places. 2018 times 2019 times B. Using the accounts receivable turnover, choose the statement that most closely describes the company's management of its receivables. a. The company's lending policies may be too strict. b. Collection efforts are not aggressive enough. There may be uncollectable receivables affecting the beginning and ending C. balances. d. All of the above statements may be correct. a b darrow_forward

- Please answers parts 4,5, and 6. I have the first three alreadyarrow_forwardAccounting Questionarrow_forwardGuinea C. Company is preparing trend percentages for its service fees earned for the period 2013 through 2017. The base year is 2013. The 2016 trend percentage is computed as: Question 23 options: A) 2016 service fees earned divided by 2012 service fees earned B) 2015 service fees earned divided by 2016 service fees earned C) 2016 service fees earned divided by 2013 service fees earned D) 2013 service fees earned divided by 2016 service fees earnedarrow_forward

- Suppose the 2022 financial statements of 3M Company report net sales of $23.1 billion. Accounts receivable (net) are $3.2 billion at the beginning of the year and $3.25 billion at the end of the year. Compute 3M’s accounts receivable turnover. - Accounts Recievable turnover ratio=? (times) Compute 3M’s average collection period for accounts receivable in days - Average collection period =? (days)arrow_forwardF. Based on Baker’s account balances, the amount of Net Income that would be shown on Baker’s Income Statement for December 2017 would be:arrow_forwardWinterwear Clothiers reported the following selected items at April 30, 2025 (last year's-2024-amounts also given as needed): View the financial data. Compute Winterwear Clothiers' (a) acid-test ratio, (b) accounts receivable turnover ratio, and (c) days' sales in receivables for the year ending April 30, 2025. Evaluate each ratio value as strong or weak. Winterwear Clothiers sells on terms of net 30. (Round days' sales in receivables to a whole number.) (Ignore leap-years, using a 365-day where needed.) (a) Compute Winterwear Clothiers' acid-test ratio. (Round your final answer to two decimal places. Abbreviation used: Avg. = Average; Invest. = Investment; Liab. = Liabilities; Merch. = Merchandise; Receiv. = Receivable; Rev. = Revenue.) + + + + Financial Data = Acid-test ratio = Accounts Payable 320,000 Accounts Receivable, net: Cash 260,000 April 30, 2025 $ 270,000 Merchandise Inventory: April 30, 2024 170,000 April 30, 2025 290,000 Cost of Goods Sold 1,150,000 April 30, 2024 200,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education