Concept explainers

Pleaes see attachment to answer questions

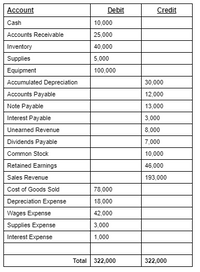

The following is Baker Co.'s Pre-Closing

Use the information in Baker’s Trial balance to answer D through H.

(D.) In the General Journal below record the

(E.) In the General Journal below record the journal entry that should be made to close the Expense accounts.

(F.) Based on Baker’s account balances, the amount of Net Income that would be shown on Baker’s Income Statement for December 2017 would be:

Blank 1

(G.) Based on Baker’s account balances, the amount of Total Assets that would be shown on Baker’s

Blank 1

(H.) Based on Baker’s account balances, the amount of Total Equity that would be shown on Baker’s Balance Sheet as of December 31, 2017 would be:

Blank 1

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

F. Based on Baker’s account balances, the amount of Net Income that would be shown on Baker’s Income Statement for December 2017 would be:

F. Based on Baker’s account balances, the amount of Net Income that would be shown on Baker’s Income Statement for December 2017 would be:

- Pharoah Corporation issued $420,000 of 5-year bonds on April 1, 2023. Interest is paid semi-annually on April 1 and October 1. Below is a partial amortization schedule for the first few years of the bond issue. Semi-Annual Interest Period Apr 1, 2023 Oct. 1, 2023 Apr. 1.2024 Oct 1, 2024 Apr. 1.2025 Oct. 1, 2025 Apr. 1, 2026 Interest Payment $8,400 $6,591 8,400 6,563 6,536 6,508 6,479 6,451 8,400 Interest Expense 8,400 8,400 8,400 Amortization. $1,809 1,837 1,864 1,892 1,921 1,949 Carrying Amount of Bonds $439,367 437,558 435,721 433,857 431.965 430,044 428,095arrow_forwardFrom the partial worksheet, journalize the closing entries for December 31 for A. Slow Co. Start by journalizing the closing entry for revenues. (See attached images for clearer info) Journal Entry Date Accounts PR Dr. Cr. Dec. 31 Journalize the closing entry for the expense and contra-revenue accounts. Journal Entry Date Accounts PR Dr. Cr. Dec. 31 Journalize the closing entry for the Income Summary account. Journal Entry Date Accounts PR…arrow_forwardOn November 1, 2021, Aviation Training Corp. borrows $44,000 cash from Community Savings and Loan. Aviation Training signs a three-month, 6% note payable. Interest is payable at maturity. Aviation’s year-end is December 31. Required: 1.-3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Record the adjusting entry for interest. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2021arrow_forward

- On January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a six-year period with an option to extend the lease for three years. • Rick's had no significant economic incentive as of the beginning of the lease to exercise the three-year extension option. Annual lease payments are $12,000 due on December 31 of each year, calculated by the lessor using a 7% discount rate. . The expected useful life of the asset is nine years, and its fair value is $90,000. . Assume that at the beginning of the third year, January 1, 2026, Rick's had made significant improvements to the truck whose cost could be recovered only if it exercises the extension option, creating an expectation that extension of the lease was "reasonably certain." The relevant interest rate at that time was 8%. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) Required: 1. Prepare the journal entry, if any, on January 1 and on December 31 of…arrow_forwardComplete this questions by entering your answers in the tabs below. Required 1 Required 2 Prepare the December 31 closing entries. The account number for Income Summary is 901. View transaction list Journal entry worksheet View general Journalarrow_forwardPrepare journal entries for the following transactions of Danica Company. Dec. 13 Accepted a $9,500, 45-day, 8% note in granting Miranda Lee a time extension on her past-due account receivable. 31 Prepared an adjusting entry to record the accrued interest on the Lee note.arrow_forward

- Sweet Acacia Metro sold 7,920 annual subscriptions on October 1, 2017 for $19 each. Prepare Sweet Acacia's October 1, 2017 journal entry and the December 31, 2017 annual adjusting entry, assuming the magazines are published and delivered monthly. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Te diarrow_forwardPrepare the entries for transaction below and indicate what journal it is 21 august issued a $600 credit memo to ultracity co. For an allowance on good sold on august 19, 2020arrow_forwardGuardian Carpets Incorporated provided the following accounts related to beginning balances in its accounts receivable and allowance accounts for the current year: Accounts Receivable Beginning Balance 6,000,000 Allowance for Uncollectible Accounts 2,000,000 Beginning Balance Question content area top right Part 1 Requirement Prepare the journal entries to record the following transactions that occurred during the current year. Prepare a schedule for both accounts receivable and the allowance for uncollectible accounts that shows the beginning balances, the various items that change the beginning balance, and the ending balance. Question content area bottom Part 1 Prepare the journal entries to record the following transactions that occurred during the current year. (Record debits first, then credits. Exclude explanations from any journal…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education