FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

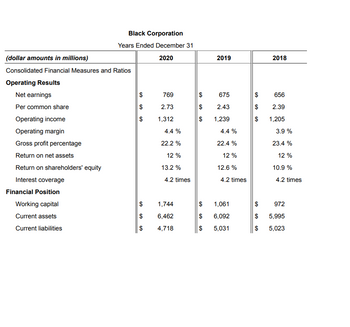

Transcribed Image Text:(dollar amounts in millions)

Consolidated Financial Measures and Ratios

Operating Results

Net earnings

Per common share

Operating income

Operating margin

Gross profit percentage

Return on net assets

Return on shareholders' equity

Interest coverage

Financial Position

Black Corporation

Years Ended December 31

2020

Working capital

Current assets

Current liabilities

$

$

$

$

$

$

769

2.73

1,312

4.4 %

22.2 %

12 %

13.2 %

4.2 times

1,744

6,462

4,718

GA

GA

2019

GA

675

2.43

1,239

1,061

6,092

$ 5,031

4.4 %

22.4 %

12%

12.6%

4.2 times

2018

656

$ 2.39

$

1,205

3.9%

23.4 %

12 %

10.9 %

4.2 times

$

972

$ 5,995

$ 5,023

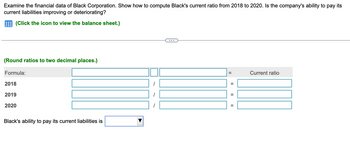

Transcribed Image Text:Examine the financial data of Black Corporation. Show how to compute Black's current ratio from 2018 to 2020. Is the company's ability to pay its

current liabilities improving or deteriorating?

(Click the icon to view the balance sheet.)

(Round ratios to two decimal places.)

Formula:

2018

2019

2020

Black's ability to pay its current liabilities is

II

11

Current ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Income Statement and Earnings per Share for Discontinued Operations Apex Inc. reports the following for a recent year: Income from continuing operations before income tax expense $1,000,000 Loss from discontinued operations $240,000* Weighted average number of shares outstanding 20,000 Applicable tax rate 40% *Net of any tax effect. Question Content Area a. Prepare a partial income statement for Apex Inc., beginning with income from continuing operations before income tax expense.arrow_forwardFollowing are some data from the financial records of Enteng Corporation: How much is the retained earnings balance as of the end of 200B?arrow_forwardHelparrow_forward

- Financial statement data for the current year for Hanz Corp. are as follows: Line Item Description Amount Net income $5,700,000 Preferred dividends $70,000 Average number of common shares outstanding 200,000 The earnings per share for the current year are? a.$28.15 b.$28.50 c.$28.85 d.$0.35arrow_forwardWeighted Average Cost of Capital The December 31, 2018, partial financial statements taken from the annual report for AT&T Inc. (T ) follow. Consolidated Statements of Income Dollars in millions except per share amounts 2018 2017 Operating revenues Service $152,345 $145,597 Equipment 18,411 14,949 Total operating revenues 170,756 160,546 Operating expenses Equipment 19,786 18,709 Broadcast, programming and operations 26,727 21,159 Other cost of services (exclusive of depreciation and amortization show separately below) 32,906 37,942 Selling, general and administrative 36,765 35,465 Abandonment of network assets 46 2,914 Depreciation and amortization 28,430 24,387 Total operating expenses 144,660 140,576 Operating income 26,096 19,970 Other income (expense): Interest expense (7,957) (6,300) Equity in net income of affiliates (48) (128)…arrow_forwardThe balance sheet for Fanning Corporation follows: $ 246,000 764,000 Current assets Long-term assets (net) Total assets $1,010,000 $ 149,000 452,000 601,000 409,000 Current liabilities Long-term liabilities Total liabilities Common stock and retained earnings Total liabilities and stockholders' equity $1,010,000 Required Compute the following. (Round "Ratios" to 1 decimal place.) Working capital Current ratio Debt-to-assets ratio % Debt-to-equity ratio < Prev 5 of 6 MacEarrow_forward

- Balance Sheet Jack and Jill Corporation's year-end 2009 balance sheet lists current assets of $257,000, fixed assets of $807,000, current liabilities of $188,000, and long-term debt of $293,000. What is Jack and Jill's total stockholders' equity? Multple Cholce $583.000 $1,064,000 $481,000 There Is not enough Information to calculate total stockholder's equity. Prev 1 of 8 Score answer> 9:43 AM 42°F Mostly sunny ype here to search 11/5/2021 21 DELLarrow_forwardwhat is the the quick ratio for both yearsarrow_forwardConsider the following income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATIONIncome Statement Sales $ 42,900 Costs 33,900 Taxable income $ 9,000 Taxes (21%) 1,890 Net income $ 7,110 Dividends $ 2,509 Addition to retained earnings 4,601 The balance sheet for the Heir Jordan Corporation follows. HEIR JORDAN CORPORATIONBalance Sheet Assets Liabilities and Owners’ Equity Current assets Current liabilities Cash $ 2,250 Accounts payable $ 4,000 Accounts receivable 5,100 Notes payable 8,000 Inventory 8,000 Total $ 12,000 Total $ 15,350 Long-term debt $ 22,000 Owners’ equity Fixed assets Common stock and…arrow_forward

- Debt to Assets ratio? Current assets $22400 Net income $44500 Stockholders' Current liabilities 13400 66400 equity Average assets 132000 Total liabilities 28600 Total assets 87000 Average common shares outstanding was 17000. 21.7 percent 43.8 percent 32.9 percent 33.7 percentarrow_forwardView Policies Current Attempt in Progress Using the following balance sheet and income statement data, what is the debt to assets ratio? Current assets $31500 Net income $41100 Stockholders' Current liabilities 15400 79400 equity Average assets 162500 Total liabilities 42300 Total assets 114000 Average common shares outstanding was 15500. 37 percent O 70 percent O 15 percent O 28 percent Attempts: 0 of 1 used Save for Laterarrow_forwardIncome statement and earnings per share for discontinued operations Apex Inc. reports the following for a recent year: Income from continuing operations before income tax $817,500 Loss from discontinued operations $146,250 * Weighted average number of shares outstanding 45,000 Applicable tax rate 40% *Net of any tax effect. a. Prepare a partial income statement for Apex Inc., beginning with income from continuing operations before income tax. Apex Inc.Partial Income StatementFor the Year Ended December 31 $- Select - - Select - $- Select - - Select - $- Select - b. Determine the earnings per common share for Apex Inc., including per-share amounts for unusual items. Enter answers in dollars and cents, rounding to the nearest whole cent. Apex Inc.Partial Income StatementFor the Year Ended December 31 Earnings per common share: $- Select - - Select - $- Select -arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education