FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

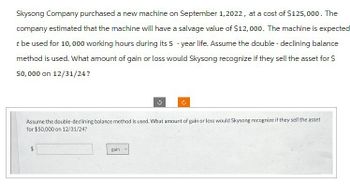

Transcribed Image Text:Skysong Company purchased a new machine on September 1, 2022, at a cost of $125,000. The

company estimated that the machine will have a salvage value of $12,000. The machine is expected

t be used for 10,000 working hours during its 5-year life. Assume the double - declining balance

method is used. What amount of gain or loss would Skysong recognize if they sell the asset for $

50,000 on 12/31/24?

Assume the double-declining balance method is used. What amount of gain or loss would Skysong recognize if they sell the asset

for $50,000 on 12/31/24?

gain

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dewey Corporation purchased a machine for $340,000 on January 1, 2012. The machine had an estimated useful life of 12 years and an estimated residual value of $40,000. The machine was depreciated using the straight-line method. On April 1, 2021, the company no longer needed the machine and sold it for $80,000. Dewey takes a half-year depreciation for the year an asset is disposed. a. What is the book value of the machine at the end of 2020? b. Calculate and record the depreciation for 2021 in the journal provided. c. Calculate the book value of the machine at the time of sale. d. Record the sale of the machine on April 1 in the journal provided.arrow_forwardWildhorse Company purchaseda hot tub for $ 11,790 on January 1, 2016. Straight-line depreciation is used, based on a 6-year life and a $ 1,890 salvage value. In 2018, the estimates are revised. Wildhorse now feels the hot tub will be used until December 31, 2020, when it can be sold for $ 885. Compute the 2018 depreciation. Depreciation expense, 2018 %24arrow_forwardOn January 2, 2023, Lotus Spa purchased fixtures for $57,600 cash, expecting the fixtures to remain in service for nine years. Lotus Spa has depreciated the fixtures on a straight-line basis, with $9,000 residual value. On April 30, 2025, Lotus Spa sold the fixtures for $39,500 cash. Record both depreciation expense for 2025 and sale of the fixtures on April 30, 2025. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Apr. 30 Accounts and Explanation Debit Credit Before recording the sale of the fixtures, let's calculate any gain or loss on the sale of the fixtures. (Enter a loss with a minus sign or parentheses.) Fair value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss) Now, record the sale of the fixtures on April 30, 2025. Date Apr. 30 Accounts and Explanation Debit Creditarrow_forward

- On January 2, 2022, Pet Haven purchased fixtures for $39,600 cash, expecting the fixtures to remain in service for seven years. Pet Haven has depreciated the fixtures on a straight-line basis, with $6,000 residual value. On June 30, 2024, Pet Haven sold the fixtures for $23,600 cash. Record both depreciation expense for 2024 and sale of the fixtures on June 30, 2024. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by recording the depreciation expense as of Jun. 30, 2024. Date Accounts and Explanation Jun. 30 C Debit #I Creditarrow_forwardWinia Corporation purchased farm equipment on January 1, 2019, for $280,000. In 2019 and 2020, Winia depreciated the asset on a straight-line basis with an estimated useful life of five years and a $90,000 residual value. In 2021, due to changes in technology, Winia revised the residual value to $30,000 but still plans to use the equipment for the full five years. What depreciation would Winia record for the year 2021 on this equipment? $8,000arrow_forwardOn August 1, 2015, Toy Inc. purchased a new piece of equipment that cost $25000. The estimated useful life is five years and the estimated residual value is $2,500. During the five years of useful life the equipment is expected to produce 10,000 units. If Toy Inc. uses the straight line method of depreciation and sells the equipment for $11,500 on August 1st, 2018. What will be the realized gain (loss)? Multiple Choice $0 $4,500 $13,500 None of the other alternatives are correct ($9,000) Xarrow_forward

- Concord Corporation bought a machine on January 1, 2011 for $807000. The machine had an expected life of 20 years and was expected to have a salvage value of $77000. On July 1, 2021, the company reviewed the potential of the machine and determined that its future net cash flows totaled $403000 and its fair value was $298000. If the company does not plan to dispose of it, what should Concord record as an impairment loss on July 1, 2021? a. $20750 b. $0 c. $28000 d. $125750arrow_forwardPopeye Company purchased a machine for $350,000 on January 1, 2020. Popeye depreciates machines of this type by the straight-line method over a five-year period using no salvage value. Due to an error, no depreciation was taken on this machine in 2020. Popeye discovered the error in 2021. What amount should Popeye record as depreciation expense for 2021? The tax rate is 25%. O O O O $105,000. $52,500. $70,000. $140,000.arrow_forwardOn January 1, 2021, Slim Inc. purchased machinery for $350,000. The machinery had an estimated useful life of 10 years and a salvage value of $35,000. The company elected to use sum-of-years digits depreciation. At the beginning of 2025, Slim decided to switch to the straight-line method of depreciation and reassessed the remaining useful life of the machinery to be 4 years with no change in the salvage value. A change in depreciation methods together with a change in the useful life of the asset is Question 26Answer a. a change in accounting principle. b. an error correction. c. a change in accounting principle effected as a change in accounting estimate. d. a change in accounting estimate.arrow_forward

- Haystack company purchased a machine on January 1, 2015 for $48,000. The company estimates that the machine will have a $4,000 salvage value at the end of its 10 year useful life. On September 30, 2019 the machine was sold for a gain of $3,500. What must have been the selling price of the machine?arrow_forwardOman Cables Co. Purchased a machine for OR45,000 on January 1, 2020. The machine is expected to have a four - year life, with a residual value of OR5,000 at the end of four years. Using the sum - of - the years' - digits method, depreciation for 2021 would be Select one: a. 16,000 b. 12,000 C. 13,500 O d. none of the above is correctarrow_forwardGetaway Inc. bought a machine on January 1, 2021 for $50,000. Getaway plans to keep the machine for 10 years. What is the machine's carrying value on June 30, 2023 assuming Gateway uses straight-line depreciation?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education