FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

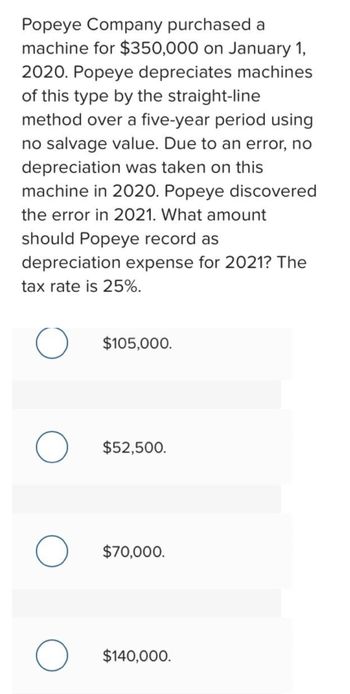

Transcribed Image Text:Popeye Company purchased a

machine for $350,000 on January 1,

2020. Popeye depreciates machines

of this type by the straight-line

method over a five-year period using

no salvage value. Due to an error, no

depreciation was taken on this

machine in 2020. Popeye discovered

the error in 2021. What amount

should Popeye record as

depreciation expense for 2021? The

tax rate is 25%.

O

O

O

O

$105,000.

$52,500.

$70,000.

$140,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 2, 2023, Lotus Spa purchased fixtures for $57,600 cash, expecting the fixtures to remain in service for nine years. Lotus Spa has depreciated the fixtures on a straight-line basis, with $9,000 residual value. On April 30, 2025, Lotus Spa sold the fixtures for $39,500 cash. Record both depreciation expense for 2025 and sale of the fixtures on April 30, 2025. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Apr. 30 Accounts and Explanation Debit Credit Before recording the sale of the fixtures, let's calculate any gain or loss on the sale of the fixtures. (Enter a loss with a minus sign or parentheses.) Fair value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss) Now, record the sale of the fixtures on April 30, 2025. Date Apr. 30 Accounts and Explanation Debit Creditarrow_forwardOn January 2, 2018, Lapar Corporation purchased a machine for $50,000. Lapar paid shipping expenses of $500, as well as installation costs of $1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of $3,000. On January 1, 2019, Lapar made additions costing $3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2019? 2. Assume Lapar determines the machine has three significant components as shown below. Component Amount Service Life Salvage Value $25,000 10 years $3,000 15,000 5 years 11,700 3 years If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded? A B с 0 0arrow_forwardHowarth Manufacturing Company purchased equipment on June 30, 2017, at a cost of $155,000. The residual value of the equipment was estimated to be $14,000 at the end of a five-year life. The equipment was sold on March 31, 2021, for $48,000. Howarth uses the straight-line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in service. Required:1. Prepare the journal entry to record the sale.2. Assuming that Howarth had instead used the double-declining-balance method, prepare the journal entry to record the sale.arrow_forward

- UMPI Corporation purchased a new machine for production on 1/1/18. The cost of the machine was $175,000. The salvage value was estimated to be $25,000. Its useful life was estimated to be 5 years and its working hours was estimated at 25,000 hours. The hours used 2018 thru 2023 were 5,750, 5,000, 4,250, 5,500, 4,500, respectively. Year-end is December 31st. Fully depreciate the equipment through the full 5 years. Instructions: Compute the depreciation expense under each of the following methods below. Record the journal entry for each year to record the depreciation expense. 5.1 Straight-Line method 5.2 Activity method 5.3 Double-Declining Balance methodarrow_forwardssarrow_forwardOn January 1, 2018, Wasson Company purchased a delivery vehicle costing $40,000. The vehicle has an estimated 3-year life and a $4,000 residual value. Wasson estimates that the vehicle will be driven 72,000 miles. What is the vehicle's depreciation expense for the year ended December 31, 2020 assuming Wasson uses the units-of-production depreciation method and the vehicle was driven 35,000 miles during 2018, 25,000 miles during 2019 and 14,000 miles in 2020? Group of answer choices A)$7,000 b)$12,000 C)$7,778 D)$6,667 e)None of the abovearrow_forward

- On January 2, 2022, Pet Haven purchased fixtures for $39,600 cash, expecting the fixtures to remain in service for seven years. Pet Haven has depreciated the fixtures on a straight-line basis, with $6,000 residual value. On June 30, 2024, Pet Haven sold the fixtures for $23,600 cash. Record both depreciation expense for 2024 and sale of the fixtures on June 30, 2024. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by recording the depreciation expense as of Jun. 30, 2024. Date Accounts and Explanation Jun. 30 C Debit #I Creditarrow_forwardWinia Corporation purchased farm equipment on January 1, 2019, for $280,000. In 2019 and 2020, Winia depreciated the asset on a straight-line basis with an estimated useful life of five years and a $90,000 residual value. In 2021, due to changes in technology, Winia revised the residual value to $30,000 but still plans to use the equipment for the full five years. What depreciation would Winia record for the year 2021 on this equipment? $8,000arrow_forwardOn September 30, 2017, Foley Distribution Service purchased a copy machine for $36,800. Foley Distribution Service expects the machine to last for four years and to have a residual value of $2,000. Compute depreciation expense on the machine for the year ended December 31, 2017, using the straight-line method.arrow_forward

- devratarrow_forwardOn January 1, 2019, Woodstock, Inc. purchased a machine costing $42.400. Woodstock also paid $2,200 for transportation and installation. The expected useful life of the machine is 6 years and the residual value is $6.200. If Woodstock uses the straight-line depreciation method, which of the following statements is incorrect? Multiple Cholce The December 31, 2020 book value Is$25.600. The annual depreclation expense Is $6.400. The December 31, 2019 book value Is $38.200. The December 31, 2021 accumulated depreclation balance is $19.200,arrow_forwardbhavesharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education