FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

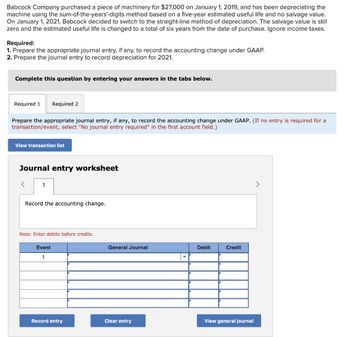

Transcribed Image Text:Babcock Company purchased a piece of machinery for $27,000 on January 1, 2019, and has been depreciating the

machine using the sum-of-the-years'-digits method based on a five-year estimated useful life and no salvage value.

On January 1, 2021, Babcock decided to switch to the straight-line method of depreciation. The salvage value is still

zero and the estimated useful life is changed to a total of six years from the date of purchase. Ignore income taxes.

Required:

1. Prepare the appropriate journal entry, if any, to record the accounting change under GAAP.

2. Prepare the journal entry to record depreciation for 2021.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare the appropriate journal entry, if any, to record the accounting change under GAAP. (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

<

1

Record the accounting change.

Note: Enter debits before credits.

Event

1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2017, Windsor Company purchased a building and equipment that have the following useful lives, salvage values, and costs. Building, 40-year estimated useful life, $53,,600 salvage value, $768,000 cost Equipment, 12-year estimated useful life, $10,000 salvage value, $91,000 cost The building has been depreciated under the double-declining balance method through 2020. In 2021, the company decided to switch to the straight-line method of depreciation. Windsor also decided to change the total useful life of the equipment to 9 years, with a salvage value of $5,200 at the end of that time. The equipment is depreciated using the straight-line method. (a) Prepare the journal entry necessary to record the depreciation expense on the building in 2021. (Round answers to 0 decimal places, e.g. 125. Credit account titles are automatically Indented when amount Is entered. Do not indent manually, If no entry is required, select "No Entry" Por the account titles and enter 0 for the…arrow_forwardOn Jan 1, 2021, ABC Company acquired a machinery at a cost of P250,000. It was estimated to have a useful life of 10 years and no residual value. The company uses the cost model to account for the machinery and the straight-line method is used in depreciating the machinery. On Dec 31, 2022, the company tested the machinery for possible impairment and determined that the recoverable value of the said machinery amounted to P150,000. On Dec 31, 2023, it was revealed that the recoverable value of the machinery had increased to P187,500. Q-29. 8.How much is the impairment loss reported in 2022? 9.What is the carrying amount of the machinery on Dec 31, 2023 before reversal of impairment? 10.What is the carrying amount of the machinery on Dec 31, 2023 on the basis that it was not impaired? 11.What amount of gain on reversal of impairment should be reported in profit or loss for 2023?arrow_forwardSIMCO Company purchases a machine on 1/1/2020, at a cost of $24,000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 5 years with a $4,000 salvage value. On 1/1/2022, management decides to change the useful life to 7 years, instead of 5 years, and keep salvage value the same.arrow_forward

- Dewey Corporation purchased a machine for $340,000 on January 1, 2012. The machine had an estimated useful life of 12 years and an estimated residual value of $40,000. The machine was depreciated using the straight-line method. On April 1, 2021, the company no longer needed the machine and sold it for $80,000. Dewey takes a half-year depreciation for the year an asset is disposed. a. What is the book value of the machine at the end of 2020? b. Calculate and record the depreciation for 2021 in the journal provided. c. Calculate the book value of the machine at the time of sale. d. Record the sale of the machine on April 1 in the journal provided.arrow_forwardOn January 1, 2020, ABC Corp acquired a piece of machinery for $500,000. The machinery has an estimated useful life of 10 years and a residual value of $50,000. ABC Corp decided to use the double-declining balance method for depreciation. Additionally, the company incurred $15,000 in transportation costs and $5,000 in installation costs to get the machinery ready for use. Furthermore, on December 31, 2021, the company conducted an impairment test and determined that the machinery's recoverable amount is $450,000, and its fair value is $420,000. The company expects to use the machinery for the remaining estimated useful life. Prepare the necessary journal entries for ABC Corp related to the machinery for the year 2020 and 2021, including depreciation, impairment, and any adjusting entries needed at the end of each yeararrow_forwardCullumber Company purchased a machine on January 1, 2019, for $1008000. At the date of acquisition, the machine had an estimated useful life of 6 years with no salvage. The machine is being depreciated on a straight-line basis. On January 1, 2022, Cullumber determined, as a result of additional information, that the machine had an estimated useful life of 8 years from the date of acquisition with no salvage. An accounting change was made in 2022 to reflect this additional information. Assume that the direct effects of this change are limited to the effect on depreciation and the related tax provision, and that the income tax rate was 30% in 2019, 2020, 2021, and 2022. What should be reported in Cullumber's income statement for the year ended December 31, 2022, as the cumulative effect on prior years of changing the estimated useful life of the machine? $0 $100800 $67200 $504000arrow_forward

- On January 2, 2017, Union Co. purchased a machine for P264,000 and depreciated it by the straight-line method using an estimated useful life of eight years with no salvage value. On January 2, 2020, Union determined that the machine had a useful life of six years from the date of acquisition and will have a salvage value of P24,000. An accounting change was made in 2020 to reflect the additional data. The accumulated depreciation for this machine should have a balance at December 31, 2020, of O 146,000 O 154,000 O 176,000 O 160,000arrow_forwardHowarth Manufacturing Company purchased equipment on June 30, 2017, at a cost of $155,000. The residual value of the equipment was estimated to be $14,000 at the end of a five-year life. The equipment was sold on March 31, 2021, for $48,000. Howarth uses the straight-line depreciation method for all of its plant and equipment. Partial-year depreciation is calculated based on the number of months the asset is in service. Required:1. Prepare the journal entry to record the sale.2. Assuming that Howarth had instead used the double-declining-balance method, prepare the journal entry to record the sale.arrow_forwardOriole Company purchased a machine on January 1, 2019, for $927000. At the date of acquisition, the machine had an estimated useful life of 6 years with no salvage. The machine is being depreciated on a straight-line basis. On January 1, 2022, Oriole determined, as a result of additional information, that the machine had an estimated useful life of 8 years from the date of acquisition with no salvage. An accounting change was made in 2022 to reflect this additional information.Assume that the direct effects of this change are limited to the effect on depreciation and the related tax provision, and that the income tax rate was 40% in 2019, 2020, 2021, and 2022. What should be reported in Oriole's income statement for the year ended December 31, 2022, as the cumulative effect on prior years of changing the estimated useful life of the machine? $463500 $61800 $0 $92700arrow_forward

- devratarrow_forwardOn January 1, 2017, Buffalo Company purchased a building and equipment that have the following useful lives, salvage values, and costs. Building, 40-year estimated useful life, $53,200 salvage value, $746,800 cost Equipment, 12-year estimated useful life, $10,800 salvage value, $103,500 cost The building has been depreciated under the double-declining-balance method through 2020. In 2021, the company decided to switch to the straight-line method of depreciation. Buffalo also decided to change the total useful life of the equipment to 9 years, with a salvage value of $5,200 at the end of that time. The equipment is depreciated using the straight-line method.(a) Prepare the journal entry necessary to record the depreciation expense on the building in 2021. (Round answers to 0 decimal places, e.g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for…arrow_forwardBabcock Company purchased a piece of machinery for $40,500 on January 1, 2019, and has been depreciating the machine using the sum-of-the-years'-digits method based on a five-year estimated useful life and no salvage value. On January 1, 2021, Babcock decided to switch to the straight-line method of depreciation. The salvage value is still zero and the estimated useful life is changed to a total of six years from the date of purchase. Ignore income taxes. Required: 1. Prepare the appropriate journal entry, if any, to record the accounting change under GAAP. 2. Prepare the journal entry to record depreciation for 2021.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education