FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

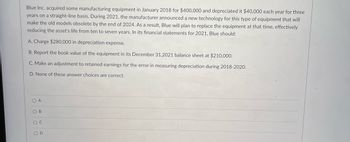

Transcribed Image Text:Blue Inc. acquired some manufacturing equipment in January 2018 for $400,000 and depreciated it $40,000 each year for three

years on a straight-line basis. During 2021, the manufacturer announced a new technology for this type of equipment that will

make the old models obsolete by the end of 2024. As a result, Blue will plan to replace the equipment at that time, effectively

reducing the asset's life from ten to seven years. In its financial statements for 2021, Blue should:

A. Charge $280,000 in depreciation expense.

B. Report the book value of the equipment in its December 31,2021 balance sheet at $210,000.

C. Make an adjustment to retained earnings for the error in measuring depreciation during 2018-2020.

D. None of these answer choices are correct.

O B

O D

O o o0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Myron Corp has the following information available related to the equipment it uses in its business. Description Information Purchase Date January 1, 2020 Original Capitalized Cost $800,000 Original Useful Life 5 years Original Residual Value $40,000 On January 1, 2022, Myron made $100,000 worth of extraordinary repairs on this equipment. It financed these repairs by taking out a two-year, 12% note. These repairs are expected to extend the useful life of the equipment by an additional three (3) years past its original five (5) year life (to a new total life of 8 years). There is no change expected to the asset’s residual value. Myron uses the straight-line depreciation method for all its depreciable assets. Part A: Record the journal entry Myron should make on 1/1/22 for the cost of the extraordinary repair.arrow_forwardOriole Company purchases an oil tanker depot on January 1, 2025, at a cost of $657,400. Oriole expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. The company estimates the dismantle and removal will cost $73,610 at the end of the depot's useful life. (a) Prepare the journal entries to record the depot and asset retirement obligation for the depot on January 1, 2025. Based on an effective-interest rate of 6%, the present value of the asset retirement obligation on January 1, 2025, is $41,103. Use the Plant Assets account for the tanker depot. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) (b) Account Titles and Explanation (To record the depot) (To record the asset retirement obligation) eTextbook and…arrow_forwardVan Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the $19.80 million cost of the patent on a straight-line basis since it was acquired at the beginning of 2020. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the end of 2024 (before adjusting and closing entries). What is the appropriate adjusting entry for patent amortization in 2024 to reflect the revised estimate? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50). View transaction list Journal entry worksheet < 1 Record the adjusting entry for patent amortization in 2024. Note: Enter debits…arrow_forward

- Vincent Limited paid $100,000 to purchase equipment at the beginning of 2020. Vincent Limited estimated the useful life of the equipment to be 5 years or 200,000 units. The equipment will be considered fully amortized a when the balance in the Accumulated Depreciation account reaches $100,000. The equipment produced 50,000 units in 2020. Required:a. Determine the estimated residual value of the equipment.b. What is the amortizable cost of the equipment?c. Calculate depreciation expense for 2020 under each of the following methods:i. straight-lineii. units-of-productioniii. double-declining-balanced. If you were a new accountant in a company and you were asked to determine how best to depreciate a new machine they just bought; how would you determine the best method? What is the difference between your method and other method? How does your method affect the income statement?arrow_forwardHardevarrow_forwardVan Frank Telecommunications has a patent on a cellular transmission process. The company has amortized the $22.50 million cost of the patent on a straight-line basis since it was acquired at the beginning of 2017. Due to rapid technological advances in the industry, management decided that the patent would benefit the company over a total of six years rather than the nine-year life being used to amortize its cost. The decision was made at the end of 2021 (before adjusting and closing entries). What is the appropriate adjusting entry for patent amortization in 2021 to reflect the revised estimate?arrow_forward

- Munabhaiarrow_forwardWaterway Company purchased Machine #201 on May 1, 2020. The following information relating to Machine # 201 was gathered at the end of May. Price Credit terms Freight-in Preparation and installation costs Labor costs during regular production operations (a) It is expected that the machine could be used for 10 years, after which the salvage value would be zero. Waterway intends to use the machine for only 8 years, however, after which it expects to be able to sell it for $2,070. The invoice for Machine #201 was paid May 5, 2020. Waterway uses the calendar year as the basis for the preparation of financial statements. (1) (2) Compute the depreciation expense for the years indicated using the following methods. (3) Straight-line method for 2020 $117,300 Sum-of-the-years'-digits method for 2021 2/10, n/30 Double-declining-balance method for 2020 $1,104 $5,244 $14,490 $ LA $ $ Depreciation Expensearrow_forwardFor financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2018 for $2,816,000. Its useful life was estimated to be six years with a $224,000 residual value. At the beginning of 2021, Clinton decides to change to the straight-line method. The effect of this change on depreciation for each year is as follows: ($ in thousands) Year Straight-Line Declining Balance Difference 2018 $ 432 $ 938 $ 506 2019 432 626 194 2020 432 417 (15 ) $ 1,296 $ 1,981 $ 685 Required:2. Prepare any 2021 journal entry related to the change. (Enter your answers in dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

- Van Frank Telecommunications has a patent on a cellular transmission process. The company has amortized thepatent on a straight-line basis since 2014, when it was acquired at a cost of $9 million at the beginning of thatyear. Due to rapid technological advances in the industry, management decided that the patent would benefit thecompany over a total of six years rather than the nine-year life being used to amortize its cost. The decision wasmade at the beginning of 2018.Required:Prepare the year-end journal entry for patent amortization in 2018. No amortization was recorded during the year.arrow_forwardBlossom Company purchased a large piece of equipment on October 1, 2023. The following information relating to the equipment was gathered at the end of October: Price Credit terms $40,000 2/10, n/30 Engineering costs $3,000 Maintenance costs during regular production operations $6,000 It is expected that the equipment could be used for 12 years, after which the salvage value would be zero. Blossom intends to use the equipment for only 10 years, however, after which it expects to be able to sell it for $2,600. The equipment was delivered on October 1 and the invoice for the equipment was paid on October 9, 2023. Blossom uses the calendar year to prepare financial statements. Blossom follows IFRS for financial statement purposes. (a) Calculate the depreciation expense for the years indicated using the following methods. (Do not round intermediate calculations. Round final answers to 0 decimal places, e.g. 5,275.) 1. Straight-line method for 2023 $ 2. Sum-of-the-years'-digits method for…arrow_forwardRoland Company uses special strapping equipment in its packaging business. The equipment was purchased in January 2019 for $10,000,000 and had an estimated useful life of 8 years with no salvage value. At December 31, 2020, new technology was introduced that would accelerate the obsolescence of Roland’s equipment. Roland’s controller estimates that expected future net cash flows on the equipment will be $6,300,000 and that the fair value of the equipment is $5,600,000. Roland intends to continue using the equipment, but it is estimated that the remaining useful life is 4 years. Roland uses straight-line depreciation. Instructions a. Prepare the journal entry (if any) to record the impairment at December 31, 2020. b. Prepare any journal entries for the equipment at December 31, 2021. The fair value of the equipment at December 31, 2021, is estimated to be $5,900,000. c. Repeat the requirements for (a) and (b), assuming that Roland intends to dispose of the equipment and that it…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education