FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

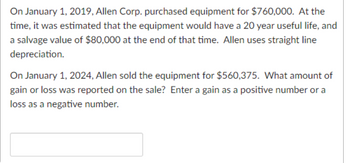

Transcribed Image Text:On January 1, 2019, Allen Corp. purchased equipment for $760,000. At the

time, it was estimated that the equipment would have a 20 year useful life, and

a salvage value of $80,000 at the end of that time. Allen uses straight line

depreciation.

On January 1, 2024, Allen sold the equipment for $560,375. What amount of

gain or loss was reported on the sale? Enter a gain as a positive number or a

loss as a negative number.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On August 1, 2015, Toy Inc. purchased a new piece of equipment that cost $25000. The estimated useful life is five years and the estimated residual value is $2,500. During the five years of useful life the equipment is expected to produce 10,000 units. If Toy Inc. uses the straight line method of depreciation and sells the equipment for $11,500 on August 1st, 2018. What will be the realized gain (loss)? Multiple Choice $0 $4,500 $13,500 None of the other alternatives are correct ($9,000) Xarrow_forwardFrancis Corporation purchased an asset at a cost of $50,000 on March 1, 2020. The asset has a useful life of 8 years and a salvage value of $4,000. For tax purposes, the MACRS class life is 5 years. Compute tax depreciation for each year 2020–2025.arrow_forwardAt the beginning of 2022, Metatec Incorporated acquired Ellison Technology Corporation for $630 million. In addition to cash, receivables, and inventory, the following assets and their fair values were also acquired: Plant and equipment (depreciable assets) Patent Goodwill The plant and equipment are depreciated over a 10-year useful life on a straight-line basis. There is no estimated residual value. The patent is estimated to have a five-year useful life, no residual value, and is amortized using the straight-line method. $ 153 million 43 million 100 million At the end of 2024, a change in business climate indicated to management that the assets of Ellison might be impaired. The following amounts have been determined: Plant and equipment: Undiscounted sun of future cash flows Fair value Patent: Undiscounted sum of future cash flows Fair value $ 83 million 63 million $ 20 million 13 million Goodwill: Fair value of Ellison Technology Corporation Book value of Ellison's net assets…arrow_forward

- On 1/1/2018, ABC company purchased equipment costing $35, 000 where its useful life was 5 years and the salvage value was 55,000. ABC decided to use the straight-line method in calculating depreciation. In 2020, ABC found out that the accountant recorded wrongly $600 and 5900 for 2018 and 2019 respectively, instead of S6, 000 for each year, for depreciation. Equipment is depreciated for tax purposes using a straight-line method, with a tax rate of 40% The accounting entries in 31/12/2020 for the corrections are: Select one: a. All answers are false b. Accumulated depreciation $10,500 Cumulative effect of corrections of prior period errors $6, 300 Deferred tax Liabilities S4, 200 c. Cumulative effect of corrections of prior period errors $8, 400 Deferred tax Assets $2, 100 Accumulated depreciation $10, 500 Retained earnings S8, 400 Cumulative effect of correction of prior period error S8, 400 d. Cumulative effect of corrections of prior period errors S6, 300 Deferred tax Assets S4, 200…arrow_forwardIn 2023, BayKing Company sold used equipment for $20,000. The equipment had an original cost of $90,000 and accumulated depreciation as of the date of sale was $69,000. BayKing also purchased held-to-maturity securities for $7,000. What is the gain or loss on the sale of the equipment? Group of answer choices $21,000 gain $1000 loss $14,000 loss $34,000 gainarrow_forwardWildhorse Corporation purchased a machine on January 2, 2020, for $4900000. The machine has an estimated 5-year life with no salvage value. The straight-line method of depreciation is being used for financial statement purposes and the following MACRS amounts will be deducted for tax purposes: 2020 2021 2022 $980000 1568000 940800 O $83300 O $7840 2023 O SO O $117600 2024 2025 Assuming an income tax rate of 20% for all years, the net deferred tax liability that should be reflected on Wildhorse's balance sheet at December 31, 2021 be $563500 563500 284200arrow_forward

- Oriole Corporation purchased a machine on January 2, 2020, for $4300000. The machine has an estimated 5-year life with no salvage value. The straight-line method of depreciation is being used for financial statement purposes and the following MACRS amounts will be deducted for tax purposes: 2020 $860000 2023 $494500 2021 1376000 2024 494500 2022 825600 2025 249400 Assuming an income tax rate of 20% for all years, the net deferred tax liability that should be reflected on Oriole's balance sheet at December 31, 2021 be $103200 $73100 $0 $6880arrow_forward1. On November 4, 2020, GT Corporation sells a piece of its equipment. GT Corporation had initially purchased the equipment for $350,000. The company had recorded $230,000 in depreciation for this piece of equipment as of the date of sale. If GT Corporation receive $150,000 cash when they sell the equipment, they will report a November 2020 Income Statement; if they instead receive $100,000 cash when they sell the equipment, they will on their report a a. $150,000 gain; $100,000 gain. b. $80,000 gain; $130,000 loss. c. $30,000 loss; $20,000 gain. d. $30,000 gain; $20,000 loss.arrow_forwardABC Ltd acquired an item of machinery on 1 July 2021 for a cost of $120 000 When the asset was acquired it was considered that the asset would have a useful life to the entity of five years, after which time it would have no residual value It was considered that the pattern of economic benefits would best be reflected by applying the sum-of-digits method Contrary to expectations, on 1 July 2023 the asset was sold for $80 000 Required 1. What was the profit on disposal on 1 July 2023 and what are the journal entries to record the disposal? (Use sum of digit depreciation method) 2. Prepare Depreciation Schedule for the period.arrow_forward

- Swifty Company purchased machinery for $939000 on January 1, 2019. Accumulated Depreciation was $846000 on December 31, 2025. The machinery was sold on January 1, 2026 for $70000. What gain or loss did Swifty record from the sale of the machinery? O $70000 loss O $23000 gain O $70000 gain O $23000 lossarrow_forwardKA. In 2020, Lawrence Landscaping, Inc., (an IFS reporter) acquired equipment at a cost of $620,000. The current balance of accumulated depreciation is $340,000. The sum of the discounted future cash flows expected from the use of this asset is $290,000 and the asset's current fair value is $250,000 before considering costs of disposal of $5,000. What is the loss on impairment that should be recognized for the current year?arrow_forwardExercise 3-27 Balance Sheet Preparation From the following list of accounts, prepare a balance sheet showing all balance sheet items prope sified. (No monetary amounts are to be recognized.) Accounts Payable Accounts Receivable Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Advertising Expense Allowance for Bad Debts Bad Debt Expense Bonds Payable Buildings Cash Common Stock Cost of Goods Sold Deferred Income Tax Liability Depreciation Expense-Buildings Dividends Equipment Estimated Warranty Expense Payable (current) Gain on Sale of Investment Securities Gain on Sale of Land Goodwill Income Tax Expense Income Taxes Payable Interest Receivable Interest Revenue Inventory Investment in Subsidiary Investment Securities (Trading) Land Loss on Purchase Commitments Miscellaneous General Expense Net Pension Asset Notes Payable (current) Paid-In Capital from Sale of Treasury Stock Paid-In Capital in Excess of Stated Value Patents Premium on Bonds Payable Prepaid Insurance…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education