Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve this problem

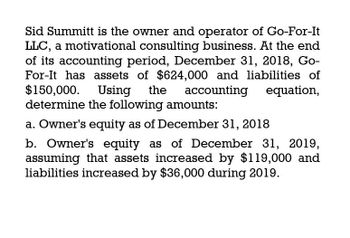

Transcribed Image Text:Sid Summitt is the owner and operator of Go-For-It

LLC, a motivational consulting business. At the end

of its accounting period, December 31, 2018, Go-

For-It has assets of $624,000 and liabilities of

$150,000. Using the accounting

determine the following amounts:

a. Owner's equity as of December 31, 2018

equation,

b. Owner's equity as of December 31, 2019,

assuming that assets increased by $119,000 and

liabilities increased by $36,000 during 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Shane Sunland began a business, Sunland Company, on January 1, 2021, with an investment of $105,000. The company had the following assets and liabilities on the dates indicated: December 31 Total Assets Total Liabilities 2021 $355,000 $200,000 2022 440,000 285,000 2023 535,000 310,000 Use the accounting equation and the change in owner's equity during the year to calculate the profit (or loss) for: a) 2021, assuming Shane Sunland's drawings were $50,000 for the year. b) 2022, assuming Shane Sunland's made an additional investment of $51,000 and had no drawings in 2022. c) 2023, assuming Shane Sunland's made an additional investment of $10,000 and his drawings were $40,000 for the year. Please explain for all questions, thank you.arrow_forwardhe following items are included in the financial statement of ABC BHD for 2019: Instruction: 1. Compute the net profit for the year. 2. What is the retained earnings figure that would appear on the balance sheet at December 31, 2019? 3. Prepare a classified balance sheet for ABC BHD at December 31, 2019,assuming the note payable is a long-term debtarrow_forwardThe owner's capital account has a credit balance of P624,000 on January 1, 2019. The owner's withdrawal account has a debit balance of P360,000 on December 31, 2019. The income summary account contains debit posting of P830,500 and a credit posting of P1,210,500. What would be the balance of the owner's capital account on December 31, 2019.arrow_forward

- 7) Evergreen traders had the gross profit of RO 78,200, advertising of RO 1,700, salesperson salary of RO 1,500, office rent of RO 7,400, office insurance of RO 1,200, interest expense of RO 500, loss on sale of machinery RO 700, dividend revenue RO 2,500 and repairs and maintenance of RO 450 for the year 2019. Calculate and show the Net income of the business transferred to the balance sheet for the year ended 2019? a. RO 68,650 b. RO 78,200 c. RO 69,550 d. RO 67,250arrow_forwardTala Isabel is the sole owner and operator of Star Service Company. As of the end of its accounting penod, December 31, 2019, Star Company has assets of P925.000 and liabilities of P285.000. During the year 2020, Tala Isabel invested an additional P50.000 and withdrew P30,000 from the business. What is the amount of net income during 2020, assuming that as of December 31, 2021, assets were P980.000 and liabilities were P255.0007 Kors Flower Shop reported total revenues of P184 000 for 2021 as well as Total Liabilities as of December 31, 2021-P240.000//2021 Net loss-P38.000// 2021 Total cash payments-P104.000 The company's total expenses must have beenarrow_forwardYou are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company’s interest expense for the year ended December 31, 2021. Your accounting group provided you the following information on the company's debt: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) On July 1, 2021, Moonlight Bay issued bonds with a face amount of $2,000,000. The bonds mature in 20 years and interest of 9% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield investors 10%. Moonlight Bay records interest at the effective rate. At December 31, 2020, Moonlight Bay had a 10% installment note payable to Third Mercantile Bank with a balance of $500,000. The annual payment is $60,000, payable each June 30. On January 1, 2021, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $40,000 beginning January 1, 2021.…arrow_forward

- You are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company’s interest expense for the year ended December 31, 2021. Your accounting group provided you the following information on the company's debt: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) On July 1, 2021, Moonlight Bay issued bonds with a face amount of $1,600,000. The bonds mature in 10 years and interest of 11% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield investors 12%. Moonlight Bay records interest at the effective rate. At December 31, 2020, Moonlight Bay had a 10% installment note payable to Third Mercantile Bank with a balance of $630,000. The annual payment is $125,000, payable each June 30. On January 1, 2021, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $50,000 beginning January 1, 2021.…arrow_forwardYou are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company’s interest expense for the year ended December 31, 2021. Your accounting group provided you the following information on the company's debt: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) On July 1, 2021, Moonlight Bay issued bonds with a face amount of $2,000,000. The bonds mature in 20 years and interest of 11% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield investors 12%. Moonlight Bay records interest at the effective rate. At December 31, 2020, Moonlight Bay had a 10% installment note payable to Third Mercantile Bank with a balance of $530,000. The annual payment is $75,000, payable each June 30. On January 1, 2021, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $40,000 beginning January 1, 2021.…arrow_forwardCullumber Company earned net income of $59,360 during 2020. The company had owner drawings totalling $37,100 during the period.arrow_forward

- Sheridan Company earned net income of $63,840 during 2020. The company had owner drawings totalling $39,900 during the period. Prepare the entries to close Income Summary and the Owner's Drawings account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation (To close net income to Owner's Capital.) (To close Owner's Drawings to Owner's Capital.) Debit Credit 19:3arrow_forwardYou are the new controller for Moonlight Bay Resorts. The company CFO has asked you to determine the company's interest expense for the year ended December 31, 2021. Your accounting group provided you the following information on the company's debt. (EV of $1. PV of 51. EVA of S1. PVA ofS1 EVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. On July 1, 2021, Moonlight Bay issued bonds with a face amount of $2.300,000. The bonds mature in 15 years and interest of 11% is payable semiannually on June 30 and December 31. The bonds were issued at a price to yield investors 12%. Moonlight Bay records interest at the effective rate 2 At December 31, 2020, Moonlight Bay had a 10% installment note payable to Third Mercantile Bank with a balance of $670,000. The annual payment is $145,000, payable each June 30 3, On January 1, 2021, Moonlight Bay leased a building under a finance lease calling for four annual lease payments of $70,000 beginning January 1, 2021.…arrow_forwardAhmad Jiwa is an entrepreneur who manages the "One Soul" mini market. At the end accounting period December 31, 2021, Satu Jiwa has assets of IDR 250,000,000 and liabilities 150.000.000. Required: Using the accounting equation, calculate the amount: 1. Owner's equity, as of December 31, 2021? 2. Owner's equity, on December 31, 2022, assuming assets decrease by Rp. 20,000,000 and liabilities increase by IDR 25,000,000 during 2022?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning