FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

General Accounting

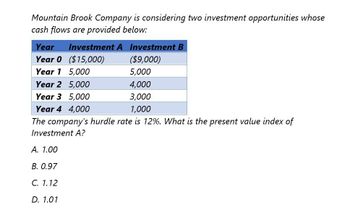

Transcribed Image Text:Mountain Brook Company is considering two investment opportunities whose

cash flows are provided below:

Year

Investment A Investment B

Year 0 ($15,000)

($9,000)

Year 1 5,000

5,000

Year 2 5,000

4,000

Year 3 5,000

3,000

Year 4 4,000

1,000

The company's hurdle rate is 12%. What is the present value index of

Investment A?

A. 1.00

B. 0.97

C. 1.12

D. 1.01

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Please Need Correct Answer with Explanation with calculationarrow_forwardMountain Brook Company is considering two investment opportunities whose cash flows are provided below: Investment A Investment B Year Year 0 ($15,000) ($9,000) Year 1 5,000 5,000 Year 2 5,000 4,000 Year 3 5,000 3,000 Year 4 4,000 1,000 The company's hurdle rate is 12%. What is the present value index of Investment A? A. 0.97 B. 1.00 C. 1.01 D. 1.12arrow_forwardABC Enterprise would like to evaluate/analyze an investment proposal. Given the following:Investment amount - 450,000 (2022)Dividends / Revenue stream - 100,000 for the first year and an interval of 5,000 for the succeeding years Discount rate - 14%a. NPV for the period 2023 through 2029;b. Total NPV using manual computation;c. Total NPV using the Excel function; andd. IRR rate.EXCEL COMPUTATION AND FORMULAarrow_forward

- Provide answer for this questionarrow_forwardFoster Manufacturing is analyzing a capital investment project that is forecasted to produce the following cash flows and net income: After-Tax Cash Flows $(20,000) Net Income Year 1 6,000 2,000 6,000 8,000 2,000 3 2,000 8,000 2,000 Using the present value tables provided in Appendix A, the internal rate of return (rounded to the nearest whole percentage) is: а. 5%. b. 12%. C 14%. d. 40%.arrow_forwardA company is thinking of investing in one of two potential new products for sale. The projections are as follows: Year Revenue/cost £ (Product A) Revenue/cost £ (Product B)0 (150,000) outlay (150,000) outlay 1 24,000 12,0002 24,000 25,3333 44,000 52,0004 84,000 63,333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%. Which product should be chosen and why?arrow_forward

- Given the initial investment in a factory processing equipment as Ghc500,037. Let the opportunity cost of capital for the industry be 10% p.a. Assuming that the equipment is capable of generating an after-tax returns of Ghc115,000 for the first 5 years and Ghc65000 for the 6th year and Ghc53400 for the 7th year. Find the Net Present Value (NPV) Determine the Internal Rate of Return Identify three ways in which the Net Present value is superior to the Internal Rate of return as investment criteriaarrow_forwardNeeded helparrow_forwardYou are evaluating a prospective LBO investment and determine that the Year 5 free cash flow (FCF) estimate is $850 million. Additionally, based on related work you estimate that the appropriate discount rate is 8.5% and the long term growth rate is 3.5%. Based on the perpetuity growth method, the Terminal Value of the company is _________ in Year Group of answer choices a. $17.6 bn, year 5 b. $17.0 bn, year 6 c. $10.0 bn, year 5 d. $17.6 bn, year 6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education