Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Provide solution for this general accounting question

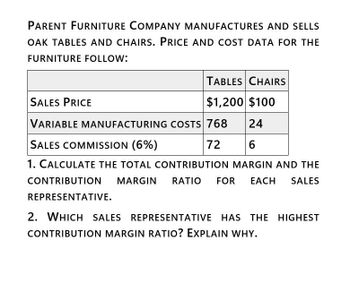

Transcribed Image Text:PARENT FURNITURE COMPANY MANUFACTURES AND SELLS

OAK TABLES AND CHAIRS. PRICE AND COST DATA FOR THE

FURNITURE FOLLOW:

SALES PRICE

TABLES CHAIRS

$1,200 $100

24

72

6

VARIABLE MANUFACTURING COSTS 768

SALES COMMISSION (6%)

1. CALCULATE THE TOTAL CONTRIBUTION MARGIN AND THE

CONTRIBUTION

REPRESENTATIVE.

MARGIN RATIO FOR EACH SALES

2. WHICH SALES REPRESENTATIVE HAS THE HIGHEST

CONTRIBUTION MARGIN RATIO? EXPLAIN WHY.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me. Thankyou.arrow_forwardPlease helparrow_forwardProduct Profitability Analysis PowerTrain Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVS), the Mountain Monster and Desert Dragon, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Mountain Monster Desert Dragon Sales price $6,000 $4,000 Variable cost of goods sold 3,780 2,680 Manufacturing margin $2,220 $1,320 Variable selling expenses 1,260 480 Contribution margin $960 $840 Fixed expenses 450 340 Income from operations $510 $500 In addition, the following sales unit volume information for the period is as follows: Mountain Monster Desert Dragon Sales unit volume 3,000 2,300 a. Prepare a contribution margin by product report. Calculate the contribution margin ratio for each product as a whole percent.arrow_forward

- A. Manufacturing margin? b. Contribution margin? C. Operating income for PhiladelPho's company ?arrow_forwardProduct Profitability Analysis Galaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVS), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Conquistador Hurricane Sales price $4,800 $3,200 Variable cost of goods sold (3,020) (2,140) Manufacturing margin $1,780 $1,060 Variable selling expenses (964) (548) Contribution margin $816 $512 Fixed expenses (380) (200) Operating income $436 $312 In addition, the following sales unit volume information for the period is as follows: Conquistador 2,800 Hurricane 2,000 Sales unit volume a. Prepare a contribution margin by product report. Compute the contribution margin ratjo for each product as a whole percent. Galaxy Sports Inc. Contribution Margin by Productarrow_forwardProvide all 8 solutionsarrow_forward

- How to calculate profitability analysis?arrow_forwardPlease do not give solution in image format thankuarrow_forwardProduct Profitability Analysis Galaxy Sports Inc. manufactures and sells two styles of All Terrain Vehicles (ATVS), the Conquistador and Hurricane, from a single manufacturing facility. The manufacturing facility operates at 100% of capacity. The following per-unit information is available for the two products: Conquistador Hurricane Sales price $4,800 $3,200 Variable cost of goods sold (3,020) (2,140) Manufacturing margin $1,780 $1,060 Variable selling expenses (916) (516) Contribution margin $864 $544 Fixed expenses (410) (220) Operating income $454 $324 In addition, the following sales unit volume information for the period is as follows: Conquistador Hurricane Sales unit volume 2,800 2,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College