CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting Question please answer

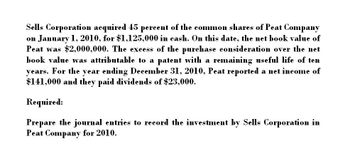

Transcribed Image Text:Sells Corporation acquired 45 percent of the common shares of Peat Company

on January 1, 2010, for $1,125,000 in cash. On this date, the net book value of

Peat was $2,000,000. The excess of the purchase consideration over the net

book value was attributable to a patent with a remaining useful life of ten

years. For the year ending December 31, 2010, Peat reported a net income of

$141,000 and they paid dividends of $23,000.

Required:

Prepare the journal entries to record the investment by Sells Corporation in

Peat Company for 2010.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2018, Pine Company owns 40 percent (40,000 shares) of Seacrest, Inc., which it purchased several years ago for $182,000. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment account as of January 1, 2018, is $293,600. Excess patent cost amortization of $12,000 is still being recognized each year. During 2018, Seacrest reports net income of $342,000 and a $120,000 other comprehensive loss, both incurred uniformly throughout the year. No dividends were declared during the year. Pine sold 8,000 shares of Seacrest on August 1, 2018, for $93,000 in cash. However, Pine retains the ability to significantly influence the investee.During the last quarter of 2017, Pine sold $50,000 in inventory (which it had originally purchased for only $30,000) to Seacrest. At the end of that fiscal year, Seacrest’s inventory retained $10,000 (at sales price) of this merchandise, which was subsequently sold in the first quarter of…arrow_forwardOn January 1, 2018, Pine Company owns 40 percent (40,000 shares) of Seacrest, Inc., which it purchased several years ago for $182,000. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment account as of January 1, 2018, is $293,600. Excess patent cost amortization of $12,000 is still being recognized each year. During 2018, Seacrest reports net income of $342,000 and a $120,000 other comprehensive loss, both incurred uniformly throughout the year. No dividends were declared during the year. Pine sold 8,000 shares of Seacrest on August 1, 2018, for $93,000 in cash. However, Pine retains the ability to significantly influence the investee. During the last quarter of 2017, Pine sold $50,000 in inventory (which it had originally purchased for only $30,000) to Seacrest. At the end of that fiscal year, Seacrest’s inventory retained $10,000 (at sales price) of this merchandise, which was subsequently sold in the first quarter of…arrow_forwardOn January 1, 2017, Alison, Inc., paid $60,000 for a 40 percent interest in Holister Corporation’s common stock. This investee had assets with a book value of $200,000 and liabilities of $75,000. A patent held by Holister having a $5,000 book value was actually worth $20,000. This patent had a six-year remaining life. Any further excess cost associated with this acquisition was attributed to goodwill. During 2017, Holister earned income of $30,000 and declared and paid dividends of $10,000. In 2018, it had income of $50,000 and dividends of $15,000. During 2018, the fair value of Allison’s investment in Holister had risen from $68,000 to $75,000.a. Assuming Alison uses the equity method, what balance should appear in the Investment in Holister account as of December 31, 2018?b. Assuming Alison uses fair-value accounting, what income from the investment in Holister should be reported for 2018?arrow_forward

- On January 1, 2018, Pine Company owns 40 percent (124,000 shares) of Seacrest, Inc., which it purchased several years ago for $700,600. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment account as of January 1, 2018, is $905,200. Excess patent cost amortization of $37,200 is still being recognized each year. During 2018, Seacrest reports net income of $846,000 and a $372,000 other comprehensive loss, both incurred uniformly throughout the year. No dividends were declared during the year. Pine sold 24,800 shares of Seacrest on August 1, 2018, for $236,528 in cash. However, Pine retains the ability to significantly influence the investee. During the last quarter of 2017, Pine sold $71,000 in inventory (which it had originally purchased for only $42,600) to Seacrest. At the end of that fiscal year, Seacrest's inventory retained $12,800 (at sales price) of this merchandise, which was subsequently sold in the first…arrow_forwardOn January 1, 2017, Palka, Inc., acquired 70 percent of the outstanding shares of Sellinger Company for $1,666,000 in cash. The price paid was proportionate to Sellinger’s total fair value, although at the acquisition date, Sellinger had a total book value of $2,070,000. All assets acquired and liabilities assumed had fair values equal to book values except for a patent (six-year remaining life) that was undervalued on Sellinger’s accounting records by $300,000. On January 1, 2018, Palka acquired an additional 25 percent common stock equity interest in Sellinger Company for $656,250 in cash. On its internal records, Palka uses the equity method to account for its shares of Sellinger. During the two years following the acquisition, Sellinger reported the following net income and dividends: 2017 2018 $525,000 $701,000 Net…arrow_forwardDunker Company purchases an 80% interest in the common stock of Fennig Company for $850,000 on January 1, 2017. The fair value of the NCI is $212,500. At the time of the purchase, the total stockholders’ equity of Fennig is $968,750. The price paid is $75,000 in excess of the book value of the controlling portion of Fennig equity. The excess is attributed to a patent with a 10-year life.During 2019, Dunker Company and Fennig Company report the following internally generated income before taxes: Dunker Company Fennig CompanySales . . . . . . . . . . . . . . . . . . . . . . . . . . $ 300,000 $120,000Cost of goods sold . . . . . . . . .. . . . . (200,000) (90,000)Gain on machine. . . . . . . . . . . . . . . . . . 5,000Expenses . . . . . . . . . . . . . . . . . . . . . . . . (40,000) (20,000)Income before taxes . . . . . .. . . . . . . $ 65,000 $ 10,000Fennig…arrow_forward

- At the start of the current year, SBC Corp. purchased 30% of Sky Tech Inc. for $45 million. At the time of purchase, the carrying value of Sky Tech's net assets was $75 million. The fair value of Sky Tech's depreciable assets was $15 million in excess of their book value. For this year, Sky Tech reported a net income of $75 million and declared and paid $15 million in dividends.The total amount of additional depreciation to be recognized by SBC over the remaining life of the assets is:arrow_forwardOn January 1, 2017, Palka, Inc., acquired 70 percent of the outstanding shares of Sellinger Company for $1,141,000 in cash. The price paid was proportionate to Sellinger’s total fair value, although at the acquisition date, Sellinger had a total book value of $1,380,000. All assets acquired and liabilities assumed had fair values equal to book values except for a patent (six-year remaining life) that was undervalued on Sellinger’s accounting records by $240,000. On January 1, 2018, Palka acquired an additional 25 percent common stock equity interest in Sellinger Company for $415,000 in cash. On its internal records, Palka uses the equity method to account for its shares of Sellinger.During the two years following the acquisition, Sellinger reported the following net income and dividends:Show Palka’s journal entry to record its January 1, 2018, acquisition of an additional 25 percent ownership of Sellinger Company shares.Prepare a schedule showing Palka’s December 31, 2018, equity…arrow_forwardAt the start of the current year, SBC Corp. purchased 30% of Sky Tech Inc. for $51 million. At the time of purchase, the carrying value of Sky Tech's net assets was $80 million. The fair value of Sky Tech's depreciable assets was $20 million in excess of their book value. For this year, Sky Tech reported a net income of $80 million and declared and paid $20 million in dividends. The total amount of additional depreciation to be recognized by SBC over the remaining life of the assets is: Multiple Choice O $6.0 million. $20 million. $30 million. None of these answer choices are correct.arrow_forward

- Planer Co. purchased 100% of Schedule Co's common stock on January 2022, for $380,000. On that date, Schedule reported assets with a historical cost of $350,000 and a fair value of 380,000The difference was to the increased value of patent which had a remaining useful life of 10 years. During 2022 & 2023, Schedule reported net income of $60,000 and $100,000, and paid dividends of $25,000 and $45,000, respectivelyWhat is the balance of the Investment in Schedule account on Planner's balance sheet at December 31, 2023, after all required equity method entries have been recordedHint: Use the Taccount to help you in your calculations $434,000 . $440,000 $464,000 d. $ 470,000arrow_forwardOn January 1, 2021, Pine Company owns 40 percent (140,000 shares) of Seacrest, Inc., which it purchased several years ago for $644,000. Since the date of acquisition, the equity method has been properly applied, and the carrying amount of the investment account as of January 1, 2021, is $875,000. Excess patent cost amortization of $42,000 is still being recognized each year. During 2021, Seacrest reports net income of $942,000 and a $420,000 other comprehensive loss, both incurred uniformly throughout the year. No dividends were declared during the year. Pine sold 28,000 shares of Seacrest on August 1, 2021, for $223,454 in cash. However, Pine retains the ability to significantly influence the investee. During the last quarter of 2020, Pine sold $75,000 in inventory (which it had originally purchased for only $45,000) to Seacrest. At the end of that fiscal year, Seacrest's inventory retained $12,300 (at sales price) of this merchandise, which was subsequently sold in the first quarter…arrow_forwardOn January 1, 2016, Uncle Company purchased 80 percent of Nephew Company's capital stock for $688,000 in cash and other assets. Nephew had a book value of $842,000 and the 20 percent noncontrolling interest fair value was $172,000 on that date. On January 1, 2015, Nephew had acquired 30 percent of Uncle for $394,100. Uncle's appropriately adjusted book value as of that date was $1,247,000. Separate operating income figures (not including investment income) for these two companies follow. In addition, Uncle declares and pays $25,000 in dividends to shareholders each year and Nephew distributes $6,000 annually. Any excess fair-value allocations are amortized over a 10-year period. Year UncleCompany NephewCompany 2016 $ 175,000 $ 32,000 2017 202,000 40,800 2018 210,000 57,200 Assume that Uncle applies the equity method to account for this investment in Nephew. What is the subsidiary's income recognized by Uncle in 2018? What is the net income…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning