SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Problem related to Accounting

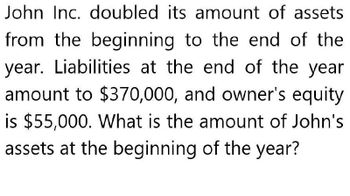

Transcribed Image Text:John Inc. doubled its amount of assets

from the beginning to the end of the

year. Liabilities at the end of the year

amount to $370,000, and owner's equity

is $55,000. What is the amount of John's

assets at the beginning of the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Huron has provided the following year-end balances:· Cash, $25,000· Long-term Investments, $7,900· Accounts receivable, $9,300· Property, plant, and equipment, $98,700· Prepaid insurance, $3,600· Accumulated depreciation, $10,000· Inventory, $37,000· Retained earnings, $12,600How much are Huron's current assets? Group of answer choices a)$74,900. B)$163,600. c)$87,500.D)$95,400arrow_forwardIn a recent year, Crane Corporation reported net income of $205800, interest expense of $47000, and income tax expense of $95000. What was Crane's times interest earned for the year? 6.4 O 5.4 O 7.4 O 4.4arrow_forwardXYZ Co. has current assets of OR 75000 and total assets of OR 210000. It has current liabilities of OR 45000 and total liabilities of OR 110000. If during the year he had drawings OR 7500, retained earnings OR 34000 & Net Profit for the year OR 12500. What will be the amount of XYZ's Opening Capital?arrow_forward

- From the following information for BlueInks Corporation, compute the rate of return on assets. Hint: The numerator is income before interest expense and taxes. Net income $40,878 Total assets at beginning of year $250,100 Total assets at end of year $158,680 a. 15% b. 25% c. 16% d. 20%arrow_forwardJones Corp. had a total asset turnover of 4.0 in 2019 and had sales of $10.0 million. If the corresponding statement of financial position or balance sheet reported shareholders’ equity of $1.4 million, what were the total liabilities for Jones Corp.?arrow_forwardplease help mearrow_forward

- In the past year, Blossom Corporation reported assets of $230229000. Liabilities reported on the balance sheet on the same date were reported at $69091655. Blossom issued a new note payable for cash during the year. The 8%, 5-year note was issued at a face value of $5008000. What is the company's debt to asset ratio after the refinance? O 29.37% 31.50% 32.18% O 30.01%arrow_forwardPlease show your work and explain how you got your answers.arrow_forwardSubject : Accounting On January 1, Boston Company completed the following transactions (use a 7% annual interest rate for all transactions): (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.) Borrowed $117,200 for nine years. Will pay $7,100 interest at the end of each year and repay the $117,200 at the end of the 9th year. Established a plant remodeling fund of $491,650 to be available at the end of Year 10. A single sum that will grow to $491,650 will be deposited on January 1 of this year. Agreed to pay a severance package to a discharged employee. The company will pay $76,100 at the end of the first year, $113,600 at the end of the second year, and $151,100 at the end of the third year. Purchased a $175,500 machine on January 1 of this year for $35,100 cash. A five-year note is signed for the balance. The note will be paid in five equal year-end payments starting on December 31 of this year. Required: 1. In transaction (a),…arrow_forward

- Hanna Company reported warranty expense of P1,900,000 for the current year. The warranty liability account increased by P200,000 during the year. What amount was incurred for warranty expenditures during the year?arrow_forwardWhat was the interest revenue that techprime earned in this period?? General accountingarrow_forwardMMT Corporation reports the following income statement items ($ in millions) for the year ended December 31, 2024: sales revenue, $2,195; cost of goods sold, $1,430; selling expense, $210; general and administrative expense, $200; interest expense, $35; and gain on sale of investments, $100. Income tax expense has not yet been recorded. The income tax rate is 25%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College