Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

1. Direct Materials 96,000 2. Direct Labor 150,000 3. Variable factory

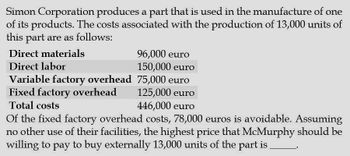

Transcribed Image Text:Simon Corporation produces a part that is used in the manufacture of one

of its products. The costs associated with the production of 13,000 units of

this part are as follows:

Direct materials

Direct labor

96,000 euro

150,000 euro

Variable factory overhead

75,000 euro

125,000 euro

446,000 euro

Fixed factory overhead

Total costs

Of the fixed factory overhead costs, 78,000 euros is avoidable. Assuming

no other use of their facilities, the highest price that McMurphy should be

willing to pay to buy externally 13,000 units of the part is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Piels Corporation produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows: Direct materials $87,000 Direct labor: $126,000 Variable factory overhead: $58,000 Fixed factory overhead: $136,000 Total costs: $407,000 Of the fixed factory overhead costs, $55,000 is avoidable Assuming no other use of their facilities, the highest price that Piels should be willing to pay for 10,000 units of the part is ?arrow_forwardJensen Corporation produces a part for use in the production of one of its products. The per-unit costs associated with the annual production of 1,000 units of this part are as follows: Direct materials Direct labor Variable factory overhead Fixed factory overhead Total costs $5.25 $12.00 $2.75 $6.00 $26.00 $2,500 of the fixed factory overhead costs associated with the production of this product are common fixed costs. Wells Company has offered to sell 1,000 units of the same part to Jensen Corporation for $21 per unit. Jensen should: Select one: O a. Buy the part, because this would save the company $5.00 per unit. O b. Make the part, because this would save the company $1.00 per unit. O c. Make the part, because this would save the company $2,500 annually. O d. Buy the part, because this would save the company $2,500 annually.arrow_forwardScott Corporation produces a part for use in the production of one of its products. The per-unit costs associated with the annual production of 1,000 units of this part are as follows: Direct Materials $10.50 $24.00 Direct labor Variable factory overhead $5.50 Fixed factory overhead $12.00 Total Costs $52.00 $5,000 of the fixed factory overhead costs associated with the production of this product are common fixed costs. Larson Company has offered to sell 1,000 units of the same part to Scott Corporation for $42 per unit. Scott should: Select one: a. buy the part, because this would save $10.00 per unit. X b. buy the part, because this would save the company $5,000 annually. c. make the part, because this would save the company $5,000 annually. d. make the part, because this would save $2.00 per unit.arrow_forward

- Crane Company produces 5000 units of part A12E. The following costs were incurred at that level of production: Direct materials Direct labor Variable overhead Fixed overhead $51000 150000 O $(39000). O $(98000). O $74000. O $129000. 76000 187000 If Crane buys the part from an outside supplier, $59000 of the fixed overhead is avoidable. If the outside supplier offers a unit price of $75, net income will increase (decrease) byarrow_forwardWhat are the fixed overhead costs of making the component?arrow_forwardCrane Company has decided to introduce a new product that can be manufactured by either a capital-intensive method or a labour-intensive method. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs under the two methods are as follows: Direct materials Direct labour Variable overhead Fixed manufacturing costs Capital-Intensive $10.00 per unit $12.00 per unit $6.00 per unit $2,624,960 Labour-Intensive $11.00 per unit $16.00 per unit $9.00 per unit $1,612,000 Crane's market research department has recommended an introductory unit sales price of $64. The incremental selling expenses are estimated to be $522,080 annually, plus $4 for each unit sold, regardless of the manufacturing method.arrow_forward

- Lincoln Company produces a part that is used in the manufacture of one of its productsThe unit manufacturing costs of this part, assuming a production level of 5,000 units, are as follows Direct materials $3 Direct labor (variable cost) 5 Variable manufacturing overhead 4 Fixed manufacturing overhead 2 Total cost $14 Erickson Company has offered to sell 5,000 units of the same part to Lincoln Company for $13 per unit. Assuming the company has no other use for its facilities and that the fixed manufacturing costs are unavoidable , what should Lincoln Company do make it or buy it? **Show your work to support your answerarrow_forwardDelta produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows: Direct materials $ 90,000 Direct labor 130,000 Variable factory overhead Fixed factory overhead 140,000 Total costs $420,000 60,000 Of the fixed factory overhead costs, $60,000 is avoidable. 20) Conners has offered to sell 10,000 units of the same part to Delta for $36 per unit. Assuming there is no other use for the facilities, what is the effect on operating income if Delta buys from Conners? 21) Assuming no other use of their facilities, at what buying price per unit for Delta would Delta's operating income be the same whether they made the part or bought it from Conners?arrow_forwardMakina Company manufactures engines on a cost-plus basis. The cost of a particular machine follows: Direct materials, P400,000; Direct Labor, P300,000; Supervisor's salary, P40,000; Fringe benefits on direct labor, P30,000; Depreciation, P24,000; Rent, P22,000. If the production of the engine were discontinued, the production capacity would be idle and the supervisor will be laid off. Should there be a next contract for this engine, the company should bid a minimum price of: P816,000 O P700,000 O P730,000 O P770,000arrow_forward

- Supler Corporation produces a part used in the manufacture of one of its products. The unit product cost is $19, computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost $7 5 2 5 $ 19 An outside supplier has offered to provide the annual requirement of 6,600 of the parts for only $15 each. The company estimates that 80% of the fixed manufacturing overhead cost above could be eliminated if the parts are purchased from the outside supplier. Assume that direct labor is an avoidable cost in this decision. Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:arrow_forwardThe Grouper Company manufactures 1,478 units of a part that could be purchased from an outside supplier for $14 each. Grouper’s costs to manufacture each part are as follows: Direct materials $2 Direct labor 4 Variable manufacturing overhead 3 Fixed manufacturing overhead 8 Total $17 All fixed overhead is unavoidable and is allocated based on direct labor. The facilities that are used to manufacture the part have no alternative uses. (a) Calculate relevant cost to make. Relevent cost to make $ ___ per unit (c) Calculate net cost to buy if Grouper leases the manufacturing facilities to another company for $9,260 per year. Net cost to buy $ ______arrow_forwardTalent Industries manufactures 30,000 components per year. The manufacturing cost of the components was determined to be as follows: Direct materials $ 300,000 Direct labor 480,000 Variable manufacturing overhead 180,000 Fixed manufacturing overhead 240,000 Total $ 1,200,000 Required:a. Assume that the fixed manufacturing overhead reflects the cost of Talent's manufacturing facility. This facility cannot be used for any other purpose. An outside supplier has offered to sell the component to Talent for $34. If Talent Industries purchases the component from the outside supplier, the effect on income would be a:b. Assume Talent Industries could avoid $80,000 of fixed manufacturing overhead if it purchases the component from an outside supplier. An outside supplier has offered to sell the component for $34. If Talent purchases the component from the supplier instead of manufacturing it, the effect on income would be a:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning