On January 1, 2017, Palka, Inc., acquired 70 percent of the outstanding shares of Sellinger Company for $1,141,000 in cash. The price paid was proportionate to Sellinger’s total fair value, although at the acquisition date, Sellinger had a total book value of $1,380,000. All assets acquired and liabilities assumed had fair values equal to book values except for a patent (six-year remaining life) that was undervalued on Sellinger’s accounting records by $240,000. On January 1, 2018, Palka acquired an additional 25 percent common stock equity interest in Sellinger Company for $415,000 in cash. On its internal records, Palka uses the equity method to account for its shares of Sellinger.

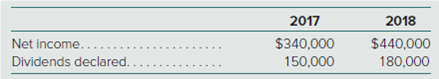

During the two years following the acquisition, Sellinger reported the following net income and dividends:

Show Palka’s

Prepare a schedule showing Palka’s December 31, 2018, equity method balance for its Investment in Sellinger account.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

- On January 1, 2018, Cameron Inc. bought 20% of the outstanding common stock of Lake Construction Companyfor $300 million cash. At the date of acquisition of the stock, Lake’s net assets had a fair value of $900 million.Their book value was $800 million. The difference was attributable to the fair value of Lake’s buildings and itsland exceeding book value, each accounting for one-half of the difference. Lake’s net income for the year endedDecember 31, 2018, was $150 million. During 2018, Lake declared and paid cash dividends of $30 million. Thebuildings have a remaining life of 10 years.Required:1. Prepare all appropriate journal entries related to the investment during 2018, assuming Cameron accounts forthis investment by the equity method.2. Determine the amounts to be reported by Cameron:a. As an investment in Cameron’s 2018 balance sheetarrow_forwardOn January 3, 2021, Matteson Corporation acquired 30 percent of the outstanding common stock of O'Toole Company for $1,462, 000. This acquisition gave Matteson the ability to exercise significant influence over the investee. The book value of the acquired shares was $859, 000. Any excess cost over the underlying book value was assigned to a copyright that was undervalued on its balance sheet. This copyright has a remaining useful life of 10 years. For the year ended December 31, 2021, O'Toole reported net income of $350, 000 and declared cash dividends of $45, 000. On December 31, 2021, what should Matteson report as its investment in O'Toole under the equity method?arrow_forwardOn January 1, 2017, Corgan Company acquired 70 percent of the outstanding voting stock of Smashing, Inc., for a total of $1,120,000 in cash and other consideration. At the acquisition date, Smashing had common stock of $830,000, retained earnings of $380,000, and a noncontrolling interest fair value of $480,000. Corgan attributed the excess of fair value over Smashing's book value to various covenants with a 20-year remaining life. Corgan uses the equity method to account for its investment in Smashing. During the next two years, Smashing reported the following: Net Income 2017 S 2018 Inventory Purchases Dividends Declared from 280,000 260,000 Corgan $ 48,000 58,000 $ 230,000 250,000 Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of 2017 and 2018, 30 percent of the current year purchases remain in Smashing's inventory. 1. Compute the equity method balance in Corgan's Investment in Smashing, Inc., account as of December 31, 2018. 2. Prepare the…arrow_forward

- On March 31, 2018, Elf Hotels purchased Reindeers and Riders Company for $6,000,000. Reindeers reported the following balance sheet on the date of the acquisition:arrow_forwardOn January 1, 2017, Harrison, Inc., acquired 90 percent of Starr Company in exchange for$1,125,000 fair-value consideration. The total fair value of Starr Company was assessed at $1,200,000. Harrison computed annual excess fair-value amortization of $8,000 based on the difference between Starr’s total fair value and its underlying book value. The subsidiary reported net income of $70,000 in 2017 and $90,000 in 2018 with dividend declarations of $30,000 each year. Apart from its investment in Starr, Harrison had net income of $220,000 in 2017 and $260,000 in 2018. What is the balance of the non controlling interest in Starr at December 31, 2018?arrow_forwardGiant acquired all of Small’s common stock on January 1, 2017, in exchange for cash of $770,000. On that day, Small reported common stock of $170,000 and retained earnings of $400,000. At the acquisition date, $32,500 of the fair-value price was attributed to undervalued land while $95,500 was assigned to undervalued equipment having a 10-year remaining life. The $72,000 unallocated portion of the acquisition-date excess fair value over book value was viewed as goodwill. Over the next few years, Giant applied the equity method to the recording of this investment. The following are individual financial statements for the year ending December 31, 2021. On that date, Small owes Giant $11,900. Small declared and paid dividends in the same period. Credits are indicated by parentheses. Giant Small Revenues $ (1,183,550 ) $ (462,500 ) Cost of goods sold 583,000 98,500 Depreciation expense 187,000 148,000 Equity in income of Small (206,450 ) 0…arrow_forward

- In January 1, 2011, Cullmon Company acquired an 80% interest in Toner Company for a purchase price that was $550,000 over the book value of Toner’s Stockholders’ Equity on the acquisition date. The Cullmon allocated the excess to the following [A] assets: [A] Asset Initial Fair Value Useful Life (years) Patent 300,000 10 Goodwill 250,000 Indefinite $550,000 Toner sells inventory to the Cullmon (upstream) which includes that inventory in products that it (Cullmon), ultimately, sells to customers outside of the controlled group. You have compiled the following data as of 2016 and 2017: 2016 2017 Transfer price for inventory sale $ 671,000 $ 733,000 Cost of goods sold (615,000) (653,000) Gross profit $ 56,000 $ 80,000 % inventory remaining 25% 35% Gross profit deferred $ 14,000 $ 28,000 EOY Receivable/Payable $ 90,000 $ 100,000 The inventory not…arrow_forwardPerke Corporation purchased 80% of the stock of Superstition Company for $1,970,000 on January 1, 2012. On this date, the fair value of the assets and liabilities of Superstition Company was equal to their book value except for the inventory and equipment accounts. The inventory had a fair value of $725,000 and a book value of $600,000. Sixty percent of Superstition Company's inventory was sold in 2012; the remainder was sold in 2013. The equipment had a book value of $900,000 and a fair value of $1,075,000. The remaining useful life of the equipment is seven years. The balances in Superstition Company's capital stock and retained earnings accounts on the date of acquisition were $1,200,000 and $600,000, respectively. Perke uses the complete equity method to account for its investment in Superstition. The following financial data are from Superstition Company's records. Net income: (2012) $750,000; (2013) $900,000 Dividends declared: (2012) $150,000; (2013) $225,000 Required: c.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education