FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

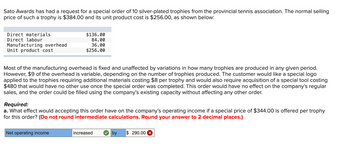

Transcribed Image Text:Sato Awards has had a request for a special order of 10 silver-plated trophies from the provincial tennis association. The normal selling

price of such a trophy is $384.00 and its unit product cost is $256.00, as shown below:

Direct materials

Direct labour

Manufacturing overhead

Unit product cost

$136.00

84.00

36.00

$256.00

Most of the manufacturing overhead is fixed and unaffected by variations in how many trophies are produced in any given period.

However, $9 of the overhead is variable, depending on the number of trophies produced. The customer would like a special logo

applied to the trophies requiring additional materials costing $8 per trophy and would also require acquisition of a special tool costing

$480 that would have no other use once the special order was completed. This order would have no effect on the company's regular

sales, and the order could be filled using the company's existing capacity without affecting any other order.

Required:

a. What effect would accepting this order have on the company's operating income if a special price of $344.00 is offered per trophy

for this order? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Net operating income

increased

by $ 290.00 ×

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cotton Corp. currently makes 12,500 subcomponents a year in one of its factories. The unit costs to produce are: Per unit Direct materials $ 24.00 Direct labor 20.00 Variable manufacturing overhead 19.00 Fixed manufacturing overhead 9.00 Total unit cost $ 72.00 An outside supplier has offered to provide Cotton Corp. with the 12,500 subcomponents at an $76.00 per unit price. Fixed overhead is not avoidable. If Cotton Corp. accepts the outside offer, what will be the effect on short-term profits? Multiple Choice no change $78,750 increase $112,500 increase $162,500 decreasearrow_forwardDelta produces a part that is used in the manufacture of one of its products. The costs associated with the production of 10,000 units of this part are as follows: Direct materials $ 90,000 Direct labor 130,000 Variable factory overhead Fixed factory overhead 140,000 Total costs $420,000 60,000 Of the fixed factory overhead costs, $60,000 is avoidable. 20) Conners has offered to sell 10,000 units of the same part to Delta for $36 per unit. Assuming there is no other use for the facilities, what is the effect on operating income if Delta buys from Conners? 21) Assuming no other use of their facilities, at what buying price per unit for Delta would Delta's operating income be the same whether they made the part or bought it from Conners?arrow_forwardRahularrow_forward

- Garrow_forwardGallerani Corporation has received a request for a special order of 5,600 units of product A90 for $27.50 each. Product A90's unit product cost is $27.25, determined as follows: $ 2.85 8.15 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead 7.25 9.00 Unit product cost $27.25 Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $3.90 per unit and that would require an investment of $28,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be: Multiple Cholce ($48,440) $1.960 $1.400 ($85.960)arrow_forwardrrarrow_forward

- Hawkins Audio Video, Inc. manufactures digital cameras. Hawkins is considering whether it should outsource production of a part used in the manufacturing of its cameras. 60,000 units of the part were made by Hawkins last year. At this production level, the company incurred the following direct product costs: Direct Materials $250,000 Direct Labor $104,000 Manufacturing Overhead incurred during the same period for production of the part is represented by the following cost behavior equation: y = $0.10x + $50,000. If the part were purchased from an outside supplier, 80% of the total fixed manufacturing overhead cost would continue, and the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional income from this other product would be $12,600 per year. A supplier has been identified who can sell the part to Hawkins at a price of $7.80 per unit. Which of…arrow_forwardZion Manufacturing had always made its components in-house. However, Bryce Component Works had recently offered to supply one component, K2, at a price of $13 each. Zion uses 4,400 units of Component K2 each year. The cost per unit of this component is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total $7.84 2.84 1.67 4.00 $16.35 The fixed overhead is an allocated expense; none of it would be eliminated if production of Component K2 stopped. Required: 1. What are the alternatives facing Zion Manufacturing with respect to production of Component K2? 2. List the relevant costs for each alternative. If required, round your answers to the nearest cent. Total Relevant Cost Make per unit Buy per unit Differential Cost to Make per unitarrow_forwardPlease help me with this questionarrow_forward

- TechSystems manufactures an optical switch that it uses in its final product. TechSystems incurred the following manufacturing costs when it produced 66,000 units last year: A B 1 Direct materials $528,000 2 Direct labor 132,000 3 Variable MOH 198,000 4 Fixed MOH 462,000 5 Total manufacturing cost for 66,000 units $1,320,000 Another company has offered to sell TechSystems the switch for $11.00 per unit. If TechSystems buys the switch from the outside supplier, none of the fixed costs are avoidable. The company prepared an outsourcing decision analysis to show the cost per unit of making the switches versus the cost per unit of buying (outsourcing) the switches. TechSystems Incremental Analysis for Outsourcing Decision Make Buy Unit Unit Difference Variable cost per unit: Direct materials $8.00 $0.00 $8.00 Direct labor 2.00 0.00 2.00…arrow_forwardWehrs Corporation has received a request for a special order of 9,800 units of product K19 for $47.50 each. The normal selling price of this product is $52.60 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product K19 is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product.cost $ 18.30 7.60 4.80 7.70 $ 38.40 Direct labor is a varlable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $7.20 per unit and that would require a one-time investment of $47,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. Required: Determine the effect on the company's total net…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education