FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

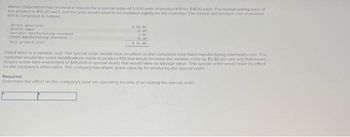

Transcribed Image Text:Wehes Corporation has received a request for a special order of 9.200 units of product K19 for $4610 each. The normal selling price of

this product is $51.20 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product

K19 is computed as follows

Direct materials

Direct Jabor

Variable manufacturing overhead

Fixed Manufacturing overhead

5 16.90

6.20

3.40

6.30

$32.00

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs The

customer would like some modifications made to product K19 that would increase the variable costs by $5 80 per unit and that would

require a one-time investment of $45,600 in special molds that would have no salvage value. This special order would have no effect

on the company's other sales. The company has ample spare capacity for producing the special order

Required:

Determine the effect on the company's total net operating income of accepting the special order.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Costner produces two product lines. Prices/costs per unit follow. "W" "H" Selling price $60 $45 Direct material $16 $12 Direct labor ($20/hour) $15 $10 Variable overhead $13 $8 Demand for "W" is 216 units and "H" is 342 units If Costner has only 177 labor hours available, how many units of "W" should be manufactured? Round your final answer to the nearest whole unit.arrow_forwardA customer has requested a special order of ABC Co's primary product and has offered to pay $30 per unit. While the product would be modified slightly for the special order, the product's normal information is provided below Sales price per unit Direct materials per unit Direct labor per unit $25.50 Total Fixed Costs $6.20 $2 Variable manufacturing overhead per unit $ 4.40 $1,150,000 The customer would like modifications made to each product that would increase the variable costs by $2.20 per unit and that would require an investment of $24,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. How large would the special order have to be in units in order for ABC Co to break even on the special order?arrow_forwardFrannie Fans currently manufactures ceiling fans that include remotes to operate them. The current cost to manufacture 10,020 remotes is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total Frannie is approached by Lincoln Company, which offers to make the remotes for $18 per unit. Required: Cost 10 $ 65,130 $ 55,110 $ 30,060 $ 50,100 $ 200,400 1. Compute the difference in cost per unit between making and buying the remotes if none of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 2. Compute the difference in cost per unit between making and buying the remotes if $20,040 of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 3. What is the change in net income if fixed cost of $20,040 can be avoided and Frannie could rent out the factory space no longer in use for $20,040? Complete this question by entering your answers in the tabs below. Required 1 Required…arrow_forward

- Dinesh Bhaiarrow_forwardGadubhaiarrow_forwardEpsilon Company can produce a unit of product for the following costs: Direct material $ 8.10 Direct labor 24.10 Overhead 40.50 Total product costs per unit $ 72.70 An outside supplier offers to provide Epsilon with all the units it needs at $64.55 per unit. If Epsilon buys from the supplier, the company will still incur 30% of its overhead. Epsilon should choose to:arrow_forward

- Bridgeport Company manufactures and sells two products. Relevant per-unit data concerning each product follow: Selling price Variable costs Machine hours Product Basic $43.00 $19.00 0.50 Show Transcribed Text Calculate the contribution margin per machine hour for each product. Question Part Score Contribution margin per machine hour $ Basic eTextbook and Media Deluxe Deluxe $52.00 $23.30 Bridgeport should manufacture the Basic 0.70 If 1,800 additional machine hours are available, which product should Bridgeport manufacture? - Show Transcribed Text Total contribution margin $ Basic Prepare an analysis showing the total contribution margin if 1,800 additional hours are: (1) Divided equally between the products. product. $ Deluxe Total contribution margin $ (2) Allocated entirely to the product identified in part (b).arrow_forwardPlease help me with show all calculation thankuarrow_forwardSheffield Corp. incurs the following costs to produce 10500 units of a subcomponent: Direct materials Direct labor Variable overhead Fixed overhead $(3600). $9200 Ⓒ$8150. $950. $(950). 11750 13000 An outside supplier has offered to sell Sheffield the subcomponent for $2.80 a unit. No fixed costs are avoidable. If Sheffield accepts the offer, it could use the production capacity to produce another product that would generate additional income of $3600. The increase (decrease) in net income from accepting the offer would be 20800arrow_forward

- Vikramarrow_forwardZesta Company produces a part used in the manufacture of one of its products. The unit product cost is $18, computed as follows: Direct materials $ 8 Direct labor 4 Variable manufacturing overhead Fixed manufacturing overhead Unit product cost 1 $ 18 An outside supplier has offered to provide the annual requirement of 4,000 of the parts for only $14 each. The company estimates that 60% of the fixed manufacturing overhead cost above could be eliminated if the parts are purchased from the outside supplier. Based on these data, whether the company accept or reject the supplier offer? And Why?arrow_forwardCherokee Manufacturing Company established the following standard price and cost data: Sales price $ 12.00 per unit Variable manufacturing cost $ 7.20 per unit Fixed manufacturing cost $ 3,600 total Fixed selling and administrative cost $ 1,200 total Cherokee planned to produce and sell 2,000 units. Actual production and sales amounted to 2,200 units. Assume that the actual sales price is $11.76 per unit and that the actual variable cost is $6.90 per unit. The actual fixed manufacturing cost is $3,000, and the actual selling and administrative costs are $1,230. Required a.&b. Determine the flexible budget variances and classify the variances by selecting favorable (F) or unfavorable (U). (Select "None" if there is no effect (i.e., zero variance).)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education