Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

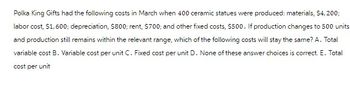

Transcribed Image Text:Polka King Gifts had the following costs in March when 400 ceramic statues were produced: materials, $4,200;

labor cost, $1,600; depreciation, $800; rent, $700; and other fixed costs, $500. If production changes to 500 units

and production still remains within the relevant range, which of the following costs will stay the same? A. Total

variable cost B. Variable cost per unit C. Fixed cost per unit D. None of these answer choices is correct. E. Total

cost per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bethany Company has just completed the first month of producing a new product but has not yet shipped any of this product. The product incurred variable manufacturing costs of 5,000,000, fixed manufacturing costs of 2,000,000, variable marketing costs of 1,000,000, and fixed marketing costs of 3,000,000. Under the variable costing concept, the inventory value of the new product would be: a. 5,000,000. b. 6,000,000. c. 8,000,000. d. 11,000,000.arrow_forwardThornton Industries has 2,700 defective units of product that already cost $28 each to produce. A salvage company will purchase the defective units as is for $12 each. Thornton's production manager reports that the defects can be corrected for $20 per unit, enabling them to be sold at their regular market price of $28. The $28 per unit is a: Multiple Choice Sunk cost. Opportunity cost. Out-of-pocket cost. Period cost. Incremental cost.arrow_forwardWhat are the fixed overhead costs of making the component?arrow_forward

- Chang Industries has 1,500 defective units of product that already cost $44 each to produce. A salvage company will purchase the defective units as is for $20 each. Chang's production manager reports that the defects can be corrected for $36 per unit, enabling them to be sold at their regular market price of $36. The $44 per unit is a: Multiple Choice 15 Period cost. Sunk cost. Opportunity cost. Out-of-pocket cost. Incremental cost.arrow_forwardRundle Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,300 containers follows. Unit-level materials. Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Rundle for $2.60 each. Required a. Calculate the total relevant cost. Should Rundle continue to make the containers? b. Rundle could lease the space it currently uses in the manufacturing process. If leasing would produce $11,600 per month, calculate the total avoidable costs. Should Rundle continue to make the containers? Answer is complete but not entirely correct. $ a. Total relevant cost a. Should Rundle continue to make the containers? b. Total avoidable cost b. Should Rundle continue to make the containers? 190.650,000 Yes $24,180,000 $ 5,200 6,100 4,000 7,800…arrow_forwardCrane Company has decided to introduce a new product. The new product can be manufactured by either a capital-intensive method or a labor-intensive method. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows. Direct materials Direct labor Variable overhead Fixed manufacturing costs (a) Crane' market research department has recommended an introductory unit sales price of $40.00. The selling expenses are estimated to be $622,000 annually plus $2.00 for each unit sold, regardless of manufacturing method. (b) Capital-Intensive $6.00 per unit $7.00 per unit $4.00 per unit Your answer is correct. $3,200,000 Calculate the estimated break-even point in annual unit sales of the new product if Crane Company uses the: 1. Capital-intensive manufacturing method. 2. Labor-intensive manufacturing method. Break-even point in units eTextbook and Media Labor-Intensive $7.00 per unit $10.00 per unit $5.50 per unit…arrow_forward

- Campbell Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,200 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $ 6,900 6,400 4,100 9,600 26,600 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Campbell for $2.80 each. Required a. Calculate the total relevant cost. Should Campbell continue to make the containers? b. Campbell could lease the space it currently uses in the manufacturing process. If leasing would produce $12,800 per month, calculate the total avoidable costs. Should Campbell continue to make the containers? a. Total relevant cost Should Campbell continue to make the containers? b. Total avoidable cost Should Campbell continue to make the containers?arrow_forwardBaird Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. $ 6,500 6,400 4,100 9,600 27,900 Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Baird for $2.60 each. Required a. Calculate the total relevant cost. Should Baird continue to make the containers? b. Baird could lease the space it currently uses in the manufacturing process. If leasing would produce $11,200 per month, calculate the total avoidable costs. Should Baird continue to make the containers? a. Total relevant cost Should Baird continue to make the containers? b. Total avoidable cost Should Baird continue to make the containers?arrow_forwardParker Pottery produces a line of vases and a line of ceramic figurines. Each line uses the sameequipment and labor; hence, there are no traceable fixed costs. Common fixed cost equals$30,000. Parker’s accountant has begun to assess the profitability of the two lines and has gathered the following data for last year: Required:1. Compute the number of vases and the number of figurines that must be sold for thecompany to break even.2. Parker Pottery is considering upgrading its factory to improve the quality of its products.The upgrade will add $5,260 per year to total fixed cost. If the upgrade is successful, theprojected sales of vases will be 1,500, and figurine sales will increase to 1,000 units. Whatis the new break-even point in units for each of the products?arrow_forward

- Vernon Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $5,700 6,500 3,200 8,400 27,100 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Vernon for $2.60 each. Required a. Calculate the total relevant cost. Should Vernon continue to make the containers? b. Vernon could lease the space it currently uses in the manufacturing process. If leasing would produce $12,700 per month, calculate the total avoidable costs. Should Vernon continue to make the containers? a. Total relevant cost a. Should Vernon continue to make the containers? b. Total avoidable cost b. Should Vernon continue to make the containers?arrow_forwardPharoah Company has decided to introduce a new product. The new product can be manufactured by either a capital-intensive method or a labor-intensive method. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows. Direct materials Direct labor Variable overhead Fixed manufacturing costs (a) Pharoah' market research department has recommended an introductory unit sales price of $28.00. The selling expenses are estimated to be $432,000 annually plus $2.00 for each unit sold, regardless of manufacturing method. Capital-Intensive $4.00 per unit $5.00 per unit $3.00 per unit $2,284,000 Calculate the estimated break-even point in annual unit sales of the new product if Pharoah Company uses the: 1. Capital-intensive manufacturing method. Labor-intensive manufacturing method. 2. Labor-Intensive $4.50 per unit $7.00 per unit $4.00 per unit $1,437,000 Break-even point in units Capital-Intensive Labor-Intensivearrow_forwardFinch Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,200 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $ 6,400 6,000 4,000 11,400 27,300 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Finch for $2.70 each. Required a. Calculate the total relevant cost. Should Finch continue to make the containers? b. Finch could lease the space it currently uses in the manufacturing process. If leasing would produce $11,000 per month, calculate the total avoidable costs. Should Finch continue to make the containers? a. Total relevant cost Should Finch continue to make the containers? b. Total avoidable cost Should Finch continue to make the containers?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,