Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

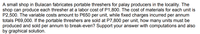

Transcribed Image Text:A small shop in Bulacan fabricates portable threshers for palay producers in the locality. The

shop can produce each thresher at a labor cost of P1,800. The cost of materials for each unit is

P2,500. The variable costs amount to P650 per unit, while fixed charges incurred per annum

totals P69,000. If the portable threshers are sold at P7,800 per unit, how many units must be

produced and sold per annum to break-even? Support your answer with computations and also

by graphical solution.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Swiss Industries imports raw nuts from farmers at a cost of $8.40 per pound. Swiss can resell the nuts without any further processing for $9.00 a pound or it can use the nuts to make energy bars. Each box of energy bars contains eight-tenths (0.80) of a pound of nuts and can be sold for $13.20. Making and selling a box of energy bars requires additional variable costs of $3.30 per box. The traceable fixed costs associated with making energy bars includes the production line supervisor's salary of $5,805 per month, the product line sales manager's salary of $5,670 per month, and the depreciation expense on the specialized production equipment of $2,025 per month. The equipment has no resale value. Swiss is thinking about discontinuing production of energy bars. How many boxes of energy bars does Swiss need to sell each month to break-even on the production and sale of energy bars as opposed to merely reselling the raw nuts without any further processing? Round to the nearest whole…arrow_forwardneed help.arrow_forwardRocky Mountain Bottling Company produces a soft drink that is sold for a dollar. At production and sales of 1,000,000 units, the company pays $600,000 in production costs, half of which are fixed costs. At that volume, general, selling, and administrative costs amount to $250,000, of which $50,000 are fixed costs. What is the amount of contribution margin per unit? (Do not round intermediate calculations.) Multiple Choice $0.10 $0.50 $0.35 None of these is correct.arrow_forward

- Barkov Industries makes an electronic component in two departments, Machining and Assembly. The capacity per month is 60,000 units in the Machining Department and 50,000 units in the Assembly Department. The only variable cost of the product is direct material of $200 per unit. All direct material cost is incurred in the Machining Department. All other costs of operating the two departments are fixed costs. Barkov can sell as many units of this electronic component as it produces at a selling price of $500 per unit. Required: a) Barkov’s Machining managers believe that they could increase the capacity in their department by 10,000 units, if they were able to increase fixed costs by $100,000. Should the money be spent? Explain.b) An outside contractor offers to do assembly for 10,000 units at a cost of $2,000,000. Should Barkov accept the offer from the subcontractor? Show calculations.c) How do your answers in parts (a) and (b) relate to the theory of constraints?…arrow_forwardNorthwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball is manufactured in a small plant that reles heavily on direct labor workers. Thus, varlable expenses are high, totaling $15.00 per ball, of which 60% Is direct labor cost Last year, the company sold 62.000 of these balls, with the following results: Sales (62,809 balls) Variable expenses Contribution margin Fixed expenses $ 1,558, 000 930,e00 620, e00 426,e00 Net operating income $ 194, e00 Required: 1. Compute (a) last year's CM ratio and the break-even polnt In balls, and (b) the degree of operating leverage at last year's sales level. 2 Due to an Increase In labor rates, the company estimates that next year's varlable expenses will increase by $3.00 per ball. If this change takes place and the selling price per ball remalns constant at $25.00, what will be next year's CM ratio and the break-even polnt In balls? 3. Refer to the data in (2) above. If the expected change In…arrow_forwardThe Mighty Music Company produces and sells a desktop speaker for $200. The company has the capacity to produce 60,000 speakers each period. At capacity, the costs assigned to each unit are as follows: Unit-level costs Product-level costs Facility-level costs The company has received a special order for 11,000 speakers. If this order is accepted, the company will have to spend $20,000 on additional costs. Assuming that no sales to regular customers will be lost if the order is accepted, at what selling price will the company be indifferent between accepting and rejecting the special order? Multiple Choice O O $96.82 $146.82 $104.32 $95 $25 $15 $107.32arrow_forward

- The “ABM” Company sells pencil cases for $15 each. Manufacturing cost is $4.60 per pencil case; marketing costs are $1.40 per pencil case; and royalty payments are 20% of the selling price. The fixed cost of preparing the pencil cases is $18 000. Capacity is 15 000 pencil cases. Compute the unit contribution margin and contribution rate. Compute the break-even point in units Determine the break-even point in units if fixed costs are increased by 20%. 4. Determine the break-even point in units if the selling price is increased by 30%, while fixed costs are increased by 20%.arrow_forwardCypress Inc. manufactures wooden canoes. Cypress normally sells the canoes for $2,700 per unit. A major distributor has offered to buy 1,000 units at a reduced price. At its budgeted annual production level of 18,000 units, Cypress' per-unit manufacturing costs are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead $950 $200 $330 $450 Cypress would have to produce the special order on an overtime shift, which would increase the direct labor costs to $300 per unit. The special order would not impact Cypress' fixed costs. However, if Cypress accepts the special order, it will also incur $60,000 in additional, one-time costs in connection with the order. What is the minimum per-unit selling price that Cypress must charge to break even on the special order? Round to the nearest whole dollar and do not enter a dollar sign or a decimal point (e.g., enter 89, not $89.00).arrow_forwardPerry, Inc. manufactures metal stampings for automobiles: stick shifts and trim kits. Fixed costs are $146,000. Each stick shift sells for $10 and has variable costs of $8; each trim kit sells for $9 and has variable costs of $5. What are the contribution margins per unit and contribution ratios for door handles and trim kits? If Perry sells 30,000 stick shifts and 45,000 trim kits, what is operating income? How many stick shifts and trim kits must be sold for Perry to break even?arrow_forward

- Barkov Industries makes an electronic component in two departments, Machining and Assembly. The capacity per month is 60,000 units in the Machining Department and 50,000 units in the Assembly Department. The only variable cost of the product is direct material of $200 per unit. All direct material cost is incurred in the Machining Department. All other costs of operating the two departments are fixed costs. Barkov can sell as many units of this electronic component as it produces at a selling price of $500 per unit. Required: Barkov’s Machining managers believe that they could increase the capacity in their department by 10,000 units, if they were able to increase fixed costs by $100,000. Should the money be spent? Explain. An outside contractor offers to do assembly for 10,000 units at a cost of $2,000,000. Should Barkov accept the offer from the subcontractor? Show calculations. How do your answers in parts (a) and (b) relate to the theory of constraints? Explain.arrow_forwardNative Wood Products Ltd sells hand-made coffee tables. The shop owner has divided sales into two categories according to the type of wood used in the tables, as follows: Product type Kahikatea Rimu Sales price $2,000 $1,200 Costs $1,200 $520 Sales commission $100 $60 Seventy percent (70%) of the shop's sales are rimu tables. The shop's annual fixed costs are $161,000. Calculate the weighted average contribution margin, assuming the sales mix stays the same.arrow_forwardDiamond Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $83 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 40% of direct labor cost. The fully absorbed unit costs to produce comparable carrying cases are expected to be as follows:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education