FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:Sandra Willis is the advertising manager for Bargain Shoe Store. She is currently working on a major promotional campaign. Her ideas

include the installation of a new lighting system and increased display space that will add $39,000 in fixed costs to the

$423,000 currently spent. In addition, Sandra is proposing that a 5% price decrease ($60 to $57) will produce a 20% increase in sales

volume (20,000 to 24,000). Variable costs will remain at $36 per pair of shoes. Management is impressed with Sandra's ideas but

concerned about the effects that these changes will have on the break-even point and the margin of safety.

(a)

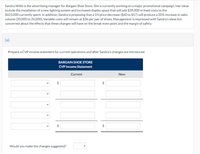

Prepare a CVP income statement for current operations and after Sandra's changes are introduced.

BARGAIN SHOE STORE

CVP Income Statement

Current

New

2$

$

$

Would you make the changes suggested?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tommy’s Tile Service is planning on purchasing new tile cleaning equipment that will improve their ability to remove tough stains from ceramic tiles. The company’s contribution margin is 25% and its current break-even point is $409,200 in sales revenue. Purchasing the new equipment will increase fixed costs by $9,500. Required: 1. Determine the company’s current fixed costs. 2. Determine the company’s new break-even point in sales. 3. After the purchase of the equipment, how much revenue does the company need to generate a profit of $120,000?arrow_forwardWendell's Donut Shoppe is investigating the purchase of a new $34,600 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $6,500 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,500 dozen more donuts each year. The company realizes a contribution margin of $1.60 per dozen donuts sold. The new machine would have a six-year useful life.arrow_forwardJ. Smythe, Incorporated, manufactures fine furniture. The company is deciding whether to introduce a new mahogany dining room table set. The set will sell for $6,130, including a set of eight chairs. The company feels that sales will be 2,600, 2,750, 3,300, 3,150, and 2,900 sets per year for the next five years, respectively. Variable costs will amount to 48 percent of sales and fixed costs are $1,880,000 per year. The new tables will require inventory amounting to 13 percent of sales, produced and stockpiled in the year prior to sales. It is believed that the addition of the new table will cause a loss of 550 tables per year of the oak tables the company produces. These tables sell for $4,200 and have variable costs of 43 percent of sales. The inventory for this oak table is also 13 percent of sales. The sales of the oak table will continue indefinitely. J. Smythe currently has excess production capacity. If the company buys the necessary equipment today, it will cost $16,000,000.…arrow_forward

- Big Blue Granite (BBC) needs to purchase a new saw for creating their top quality countertops. Saw A costs $300, 000 with S6, 000 of annual maintenance costs for the first year that will increase by 7.5% each year for the 9 - year life of the saw. Saw B costs $150, 000 with SII, 000 of annual maintenance costs for the first year that will increase by 11.0% each year for the 4 - year life of the saw. Which saw should BBG choose? What is the annualized cost of this choice? Assume a discount rate of 14.0 % , and ignore all taxesarrow_forwardThe ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.5 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $303,500, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.5 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $5.2 million, of which $900,000 of the purchase price would represent land value, and $4.3 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $555,000 per year for a term of…arrow_forwardMilliken uses a digitally controlled dyer for placing intricate patterns on manufactured carpet squares for home and commercial use. It is purchased for $400,000. Its market value will be $310,000 at the end of the 1st year and drop by $48,000 per year thereafter to a minimum of $30,000. Operating costs are $20,000 the 1st year, increasing by 10% per year. Maintenance costs are only $8,000 the 1st year but will increase by 37% each year thereafter. Milliken's MARR is 18%. Determine the optimum replacement interval for the dyer. Year(s)arrow_forward

- The ABC Corporation is considering opening an office in a new market area that would allow it to increase its annual sales by $2.6 million. The cost of goods sold is estimated to be 40 percent of sales, and corporate overhead would increase by $304,000, not including the cost of either acquiring or leasing office space. The corporation will have to invest $2.6 million in office furniture, office equipment, and other up-front costs associated with opening the new office before considering the costs of owning or leasing the office space. A small office building could be purchased for sole use by the corporation at a total price of $5.3 million, of which $900,000 of the purchase price would represent land value, and $4.4 million would represent building value. The cost of the building would be depreciated over 39 years. The corporation is in a 21 percent tax bracket. An investor is willing to purchase the same building and lease it to the corporation for $570,000 per year for a term of…arrow_forwardThe Fleming Company, a food distributor, is considering replacing a filling line at its Oklahoma City warehouse. The existing line was purchased several years ago for $3,600,000. The line’s book value is $445,000, and Fleming's management feels it could be sold at this time for $350,000. A new, increased capacity line can be purchased for $2,575,000 and will require and increase in NWC of $55,000. Delivery and installation of the new line are expected to cost $50,000 and 215,000 respectively. Assuming Fleming’s marginal tax rate is 35%, calculate the net investment for the new line.arrow_forwardEmmons Lawn Maintenance (ELM) provides lawn and garden care for residential properties. In the current year, ELM maintains 76 properties and earns an average of $5,200 annually for each property. The owner of ELM is planning for the coming year. New building in the area is expected to increase volume by 21 percent. In addition, the owner estimates that the number of homeowners that will want ELM's service will increase by 11 percent. ELM plans to increase the price of service by 13.0 percent to cover expected increased wage and equipment costs. Required: Estimate revenues for Emmons Lawn Maintenance for the coming year. Note: Enter your answer rounded to the nearest whole dollar.arrow_forward

- White Oaks Properties builds strip shopping centers and small malls. The company plans to replace its refrigeration, cooking, and HVAC equipment with newer models in one entire center built 10 years ago. 10 years ago, the original purchase price of the equipment was $700,000 and the operating cost has averaged $220,000 per year. Determine the equivalent annual cost of the equipment if the company can now sell it for $224,000. The company's MARR is 17% per year. The equivalent annual cost of the equipment is determined to be $arrow_forwardNytre Limited sells executive office chairs for a price of $195 each. The contribution margin ratio of the chairs is 60% and the company’s fixed costs for this year are expected to be $80,000. The company has a profit target this year of $85,000 and is considering an improved design which is expected to increase sales. Question 13: How many chairs must the company sell to reach its profit target?arrow_forwardWendell’s Donut Shoppe is investigating the purchase of a new $40,000 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $5,200 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,000 dozen more donuts each year. The company realizes a contribution margin of $2.40 per dozen donuts sold. The new machine would have a six-year useful life. Required: 4. In addition to the data given previously, assume that the machine will have a $10,515 salvage value at the end of six years. Under these conditions, what is the internal rate of return? (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero.) (Round your final answer to the nearest whole percentage.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education