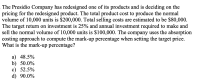

(Original question included in the attached image)

The Presidio Company has redesigned one of its products and is deciding on the pricing for the redesigned product. The total product cost to produce the normal volume of 10,000 units is $200,000. Total selling costs are estimated to be $80,000. The target

_____________________

-

a) 48.5%

-

b) 50.0%

-

c) 52.5%

-

d) 90.0%

_____________________

I got "C" as my final answer for this question, but just want to make sure it is correct.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Sonora, Inc. is launching a new product that it estimates will sell for $95 per unit. Annual demand is estimated to be 98,000 units. Sonora estimates that using its current manufacturing technology, it can manufacture the units for $37 per unit, but if it purchases a new machine, the units can be manufactured for $36 per unit. Sonora has a target profit of 20% return on sales. Under target costing, what is the target cost for the new product?arrow_forwardX-Cee-Ski Company recently expanded its manufacturing capacity, which will allow it to produce up to 21,000 pairs of cross-country skis of the mountaineering model or the touring model. The Sales Department assures management that it can sell between 9,000 and 14,000 pairs of either product this year. Because the models are very similar, X-Cee-Ski will produce only one of the two models. Fixed costs will total $320,000 if the mountaineering model is produced but will be only$220,000 if the touring model is produced. X-Cee-Ski is subject to a 40 percent income tax rate.Required: 1. If X-Cee-Ski Company desires an after-tax net income of $48,000, how many pairs of tour-ing model skis will the company have to sell? 2. Suppose that X-Cee-Ski Company decided to produce only one model of skis. What is the total sales revenue at which X-Cee-Ski Company would make the same profit or loss regard less of the ski model it decided to produce? 3. If the Sales Department could guarantee the annual…arrow_forwardJupiter Game Company manufactures pocket electronic games. Last year Jupiter sold 25,000 games at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. In an attempt to improve its product, the company is considering replacing a component part that has a cost of $2.50 with a new and better part costing $4.50 per unit in the coming year. A new machine also would be needed to increase plant capacity. The machine would cost $18,000 with a useful life of six years and no salvage value. The company uses straight-line depreciation on all plant assets. (Ignore income taxes.) Jupiter Game Company manufactures pocket electronic games. Last year Jupiter sold 25,000 games at $25 each. Total costs amounted to $525,000, of which $150,000 were considered fixed. In an attempt to improve its product, the company is considering replacing a component part that has a cost of $2.50 with a new and better part costing $4.50 per unit in the coming year. A new machine also would…arrow_forward

- Shue Music Company is considering the sale of a new sound board used in recording studios. The new board would sell for $24,100, and the company expects to sell 1,580 per year. The company currently sells 1,930 units of its existing model per year. If the new model is introduced, sales of the existing model will fall to 1,600 units per year. The old board retails for $22,500. Variable costs are 53 percent of sales, depreciation on the equipment to produce the new board will be $1,395,000 per year, and fixed costs are $3,100,000 per year. If the tax rate is 23 percent, what is the annual OCF for the project? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. OCFarrow_forwardSupersonic Tire Company makes a special kind of racing tire. Variable costs are $210 per unit, and fixed costs are $42,000 per month. Supersonic sells 400 units per month at a sales price of $320. If the quality of the tire is upgraded, the company believes it can increase the price to $350. If so, the variable cost will increase to $220 per unit, and the fixed costs will rise by 20%. If Supersonic decides to upgrade, how will operating income be affected? A. Operating income will increase by $20. B. Operating income will decrease by $400. C. Operating income will decrease by $12,000. D. Operating income will increase by $12,000.arrow_forwardA component of the direct materials cost requires the nectar of a specific plant in South America. If the company could eliminate this special ingredient, the materials cost would decrease by 25%. However, this would require design changes of $300,000 to engineer a chemical equivalent of the ingredient. Will this design change allow the product to meet its target cost?arrow_forward

- Praveen Co. manufactures and markets a number of rope products. Management is considering the future of Product XT, a special rope for hang gliding that has not been as profitable as planned. Because Product XT is manufactured and marketed independently of the other products, its total costs can be precisely measured. Next year's plans call for a $200 selling price per unit. Its fixed costs for the year are expected to be $270,000. Variable costs for the year are expected to be $140 per unit. Required 1. Estimate Product XT's break-even point in terms of (a) sales units and (b) sales dollars. Check (10) Break-even sales, 4,500 units 2. Prepare a contribution margin income statement for Product XT at the break-even point.arrow_forwardPraveen Co. manufactures and markets a number of rope products. Management is considering the future of Product XT, a special rope for hang gliding that has not been as profitable as planned. Because Product XT is manufactured and marketed independently of the other products, its total costs can be precisely measured. Next year's plans call for a $200 selling price per unit. Its fixed costs for the year are expected to be $270,000. Variable costs for the year are expected to be $140 per unit. Required 1. Estimate Product XT's break-even point in terms of (a) sales units and (b) sales dollars. Check (1a) Break-even sales, 4,500 units 2. Prepare a contribution margin income statement for Product XT at the break-even point.arrow_forwardMighty Safe Fire Alarm is currently buying 58,000 motherboards from MotherBoard, Inc., at a price of $63 per board. Mighty Safe is considering making its own boards. The costs to make the board are as follows: direct materials, $31 per unit; direct labor, $10 per unit; and variable factory overhead, $14 per unit. Fixed costs for the plant would increase by $89,000. Which option should be selected and why? Oa. make, $464,000 increase in profits Ob. buy, $89,000 increase in profits Oc. make, $375,260 increase in profits Od. buy, $375,260 increase in profitsarrow_forward

- Mighty Safe Fire Alarm is currently buying 55,000 motherboards from MotherBoard, Inc., at a price of $67 per board. Mighty Safe is considering making its own boards: The costs to make the board are as follows: direct materials, $34 per unit; direct labor, $11 per unit; and variable factory overhead, $16 per unit. Fixed costs for the plant would increase by $86,000. Which option should be selected and why? a. buy, $244,200 increase in profits O b. buy, $86,000 increase in profits Oc. make, $244,200 increase in profits Od. make, $330,000 increase in profitsarrow_forwardMighty Safe Fire Alarm is currently buying 57,000 motherboards from MotherBoard, Inc. at a price of $65 per board. Mighty Safe is considering making its own motherboards. The costs to make the motherboards are as follows: direct materials, $28 per unit; direct labor, $10 per unit; and variable factory overhead, $16 per unit. Fixed costs for the plant would increase by $80,000. Which option should be selected and why?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education