FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

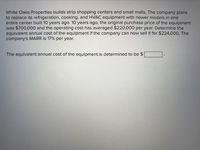

Transcribed Image Text:White Oaks Properties builds strip shopping centers and small malls. The company plans

to replace its refrigeration, cooking, and HVAC equipment with newer models in one

entire center built 10 years ago. 10 years ago, the original purchase price of the equipment

was $700,000 and the operating cost has averaged $220,000 per year. Determine the

equivalent annual cost of the equipment if the company can now sell it for $224,000. The

company's MARR is 17% per year.

The equivalent annual cost of the equipment is determined to be $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hurzdan, Inc., is considering the purchase of a $410,000 computer with an economic life of five years. The computer will be fully depreciated over five years using the straight-line method. The market value of the computer will be $74,000 in five years. The computer will replace five office employees whose combined annual salaries are $119,000. The machine will also immediately lower the firm’s required net working capital by $94,000. This amount of net working capital will need to be replaced once the machine is sold. The corporate tax rate is 24 percent. The appropriate discount rate is 14 percent. Calculate the NPV of this project.arrow_forwardBuiltrite is considering the purchase of a new five-year machine worth $90,000. It will cost another $10,000 to install the machine and Builtrite will need to keep an extra $9,000 in inventory on hand due to the machine's efficiency. The current machine being used is 5 years old and originally cost $60,000 and is being depreciated down to zero over a 10-year period. If the current machine were sold today, it could be sold for $45,000. In five years, the new machine is estimated to have a salvage value of $36,000. Two employees will need to be trained for the new machine at a cost of $4000. The new machine is expected to produce $80,000 in annual savings. Builtrite is in the 34% tax bracket. What is the terminal cash flow for the new machine? O $23.760 O $31,800 O $32,760arrow_forwardThe Ocean City water park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $8,000,000, and it will cost an additional $475,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 7-year class life. Management expects to run about 150 rides per day, with each ride averaging 35 riders. The season will last for 120 days per year. In the first year, the ticket price per rider is expected to be $5.25, and it will be increased by 4% per year. The variable cost per rider will be $1.65, and total fixed costs will be $525,000 per year. After six years, the ride will be dismantled at a cost of $245,000 and the parts will be sold for $600,000. The cost of capital is 8.5%, and its marginal tax rate is 25%. a. Calculate the initial outlay, annual after-tax cash flow for each year, and the terminal cash flow.arrow_forward

- DuPree Coffee Roasters, Inc., wishes to expand and modernize its facilities. The installed cost of a proposed computer-controlled automatic-feed roaster will be $135,000. The firm has a chance to sell its 5-year-old roaster for $34,000. The existing roaster originally cost $60,500 and was being depreciated using MACRS and a 7-year recovery period (see the table attached). DuPree is subject to a 21% tax rate. a. What is the book value of the existing roaster? b. Calculate the after-tax proceeds of the sale of the existing roaster. c. Calculate the change in net working capital using the following figures: Anticipated Changes in Current Assets and Current Liabilities Accruals −$19,500 Inventory +50,000 Accounts payable +40,900 Accounts receivable +70,200 Cash 0 Notes payable +14,400arrow_forwardThe Ocean City water park is considering the purchase of a new log flume ride. The cost to purchase the equipment is $8,000,000, and it will cost an additional $475,000 to have it installed. The equipment has an expected life of 6 years, and it will be depreciated using a MACRS 7-year class life. Management expects to run about 150 rides per day, with each ride averaging 35 riders. The season will last for 120 days per year. In the first year, the ticket price per rider is expected to be $5.25, and it will be increased by 4% per year. The variable cost per rider will be $1.65, and total fixed costs will be $525,000 per year. After six years, the ride will be dismantled at a cost of $245,000 and the parts will be sold for $600,000. The cost of capital is 8.5%, and its marginal tax rate is 25%. Using Goal Seek, calculate the minimum ticket price that must be charged in the first year in order to make the project acceptable.arrow_forwardMedavoy Company is considering a new project that complements its existing business. The machine required for the project costs $4.5 million. The marketing department predicts that sales related to the project will be $2.67 million per year for the next four years, after which the market will cease to exist. The machine will be depreciated to zero over its 4-year economic life using the straight-line method. Cost of goods sold and operating expenses related to the project are predicted to be 30 percent of sales. The company also needs to add net working capital of $190,000 immediately. The additional net working capital will be recovered in full at the end of the project’s life. The corporate tax rate is 23 percent and the required return for the project is 13 percent. What is the value of the NPV for this project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)arrow_forward

- Required: 1. Prepare a comparative income statement covering the next five years, assuming: a. The new machine is not purchased. b. The new machine is purchased. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) Total expenses w Transcribed Text of purchasing the new machine Keep Old Machine S Minimum saving in costs 5 Years Summary Buy New Machine Ĉ Difference 2. Compute the net advantage of purchasing the new machine using only relevant costs in your analysis. (Do not round intermediate calculations.) Check my work 3. What is the minimum saving in annual operating costs that must be achieved in order for the president to consider buying the new machine?arrow_forwardYummy Food is expanding its business and wants to open a new facility to make frozen lasagna, which requires a new automated lasagna maker. A lasagna maker can be purchased for $350,000 or leased under a finance lease over 7 years, with lease payments to be made at the beginning of each year. If the company purchases the lasagna maker, it can be fully depreciated to zero using the straight-line method over seven years. The management expects the scrap/residual value of the lasagna maker to be $60,000 at the end of the lease. After a detailed analysis of the project, Yummy Food determines the appropriate after-tax cost of capital of the project to be 15% per annum. Yummy Food pays a corporate tax rate of 28% and it can borrow funds at a before-tax interest rate of 5% per annum. All cash-flows have been quoted on a before-tax basis. Given this information, what is the lease payment (per annum) that would make Yummy Food indifferent between leasing and borrow-to-buy the machine? (Using…arrow_forwardDobbs Corporation is considering purchasing a new delivery truck. The truck has many advantages over the company's current truck (not the least of which is that it runs). The new truck would cost $55,981. Because of the increased capacity, reduced maintenance costs, and increased fuel economy, the new truck is expected to generate cost savings of $8,900. At the end of eight years, the company will sell the truck for an estimated $28,400. Traditionally, the company has used a general rule that it should not accept a proposal unless it has a payback period that is less than 50% of the asset's estimated useful life. Pavel Chepelev, a new manager, has suggested that the company should not rely only on the payback approach but should also use the net present value method when evaluating new projects. The company's cost of capital is 8%. 1. Calculate the cash payback period and net present value of the proposed investment.arrow_forward

- Martin Enterprises needs someone to supply it with 175,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you've decided to bid on the contract. It will cost $2,300,000 to install the equipment necessary to start production; you'll depreciate this cost straight-line to zero over the project's life. You estimate that, in five years, this equipment can be salvaged for $185,000. Your fixed production costs will be $670,000 per year, and your variable production costs should be $9.23 per carton. You also need an initial investment in net working capital of $340,000. If your tax rate is 25 percent and you require a 11 percent return on your investment, what bid price per carton should you submit? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Bid pricearrow_forwardNeed-Based Accounting Corp. has just purchased 10 photocopiers for a total cost of $500,000. The CCA rate for these photocopiers is 20%. The company plans to use these photocopiers for 10 years. By the end of the 10th year, the company expects to move into new imaging system that will no longer require the photocopiers, and the asset pool will then be closed. If the company can sell the photocopiers for $50,000 in 10 years’ time, what amount of terminal loss/CCA recapture can be claimed after the photocopiers have been sold? Assume that half-year rule applies. Please show all calculation steps:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education