FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

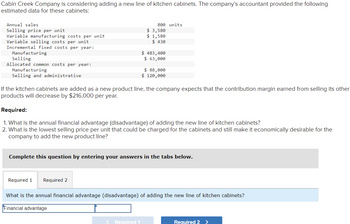

Transcribed Image Text:Cabin Creek Company is considering adding a new line of kitchen cabinets. The company's accountant provided the following

estimated data for these cabinets:

Annual sales

Selling price per unit

Variable manufacturing costs per unit

Variable selling costs per unit

Incremental fixed costs per year:

Manufacturing

Selling

Allocated common costs per year:

Manufacturing

Selling and administrative

800 units

$ 3,580

$ 1,580

$ 430

$ 483,400

$ 63,000

$ 88,000

$ 120,000

If the kitchen cabinets are added as a new product line, the company expects that the contribution margin earned from selling its other

products will decrease by $216,000 per year.

Required:

1. What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets?

2. What is the lowest selling price per unit that could be charged for the cabinets and still make it economically desirable for the

company to add the new product line?

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

What is the annual financial advantage (disadvantage) of adding the new line of kitchen cabinets?

Financial advantage

<Required 1.

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- he production cost information for Blossom's Salsa is as follows: Blossom's Salsa Production Costs April 2020 Production 23,000 Jars of Salsa Ingredient cost (variable) $13, 800 Labor cost (variable ) 9,660 Rent (fixed) 4, 300 Depreciation (fixed) 6,000 Other (fixed) 1,400 Total $35, 160 The company is currently producing and selling 345,000 jars of salsa annually. The jars sell for $7.00 each. The company is considering lowering the price to $6.30. Suppose this action will increase sales to 391, 000 jars. What is the incremental cost associated with producing an extra 46, 000 jars of salsa?arrow_forwardYour Company is considering the addition of a new product to its current product lines. The expected cost and revenue data for the new product are as follows: Annual sales in units 3,000 Selling price per unit $309 Variable costs per unit: Production $130 Selling $50 Traceable annual fixed costs: Production $51,000 Selling $75,000 Allocated annual fixed cost $54,000 If the new product is added to the existing product line, then sales of existing products will decline. As a consequence, the contribution margin of the existing product lines is expected to drop $78,000 per year. What is the increase in net income if the new product is added next year? This is a reverse drop the segment. New CM is positive and new FC and lost CM are negative.arrow_forwardA company wants to expand by offering a new product. Expected cost and revenue data for this product are: Annual sales 5,000 units Unit selling price ? Unit variable costs: Production $ 30.20 Selling 6. Incremental fixed costs per year: 32:16 Production $35,000 Selling $45,000 If the company adds this new product, sales of its other product lines will be impacted, causing the contribution margin of other product lines to drop by $18,500 per year. What is the lowest price the company could charge for its new product without affecting the company's total profits? Multiple Choice $39.90 $52.20arrow_forward

- At the beginning of the year, Paradise Co. had an inventory of $200,000. During the year, the company purchased goods costing $900,000. Paradise Co reported ending inventory of $300,000 at the end of the year. Their cost of goods sold is a. $1,000,000 b. $800,000 c. $1,400,000 d. $400,000arrow_forwardCrane Company manufactures dog food for distribution in Washington, Oregon, and California. A dog food distributor from Florida has approached Crane and offered to purchase 264000 pounds of dog food for $1.40 per pound. Crane can produce 2048000 pounds of dog food per year, and its results for last year are as follows: Sales (1844000 at $1.65) Variable costs Contribution margin Fixed costs Operating income $3042600 O $1392800 O $1336400 O $2084400 O $1270400 1106400 1936200 814000 $1122200 If Crane accepts the offer, it will only be able to sell 1784000 pounds of dog food at the regular price due to its capacity constraints. What will Crane's total operating income be next year if it accepts the offer?arrow_forwardSantana Rey expects sales of Business Solutions’ line of computer workstation furniture to equal 300 workstations (at a sales price of $3,700 each) for 2021. The workstations’ manufacturing costs include the following. Direct materials $ 760 per unit Direct labor $ 300 per unit Variable overhead $ 60 per unit Fixed overhead $ 14,400 per year Selling and administrative expenses for these workstations follow. Variable $ 35 per unit Fixed $ 3,500 per year Santana is considering how many workstations to produce in 2021. She is confident that she will be able to sell any workstations in her 2021 ending inventory during 2022. However, Santana does not want to overproduce as she does not have sufficient storage space for many more workstations. Required: 1. Complete the following income statements using absorption costing. 2. Complete the following income statements using variable costing. 3. Which costing method, absorption or variable, yields the higher income when 320 workstations are…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education