FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:●

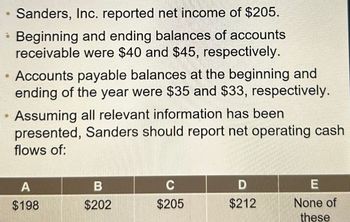

Sanders, Inc. reported net income of $205.

Beginning and ending balances of accounts

receivable were $40 and $45, respectively.

• Accounts payable balances at the beginning and

ending of the year were $35 and $33, respectively.

Assuming all relevant information has been

presented, Sanders should report net operating cash

flows of:

A

$198

$202

с

$205

D

$212

E

None of

these

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Accounts receivable from sales transactions were $45,634 at the beginning of the year and $60,027 at the end of the year. Net income reported on the income statement for the year was $126,710. Exclusive of the effect of other adjustments, the net cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method would be a. $126,710 b. $112,317 c. $14,393 d. $141,103arrow_forwardMunster Company reports the following net cash in its statement of cash flows: net inflow from operating activities: $200; net outflow from investing activities: $300; net outflow from financing activities: $50. The ending balance in cash is $20; the beginning balance must have been Multiple choice question. $190. $210. $150. $170.arrow_forwardSheridan Company completed its first year of operations on December 31. 2022. It initial income statement showed that Sheridan had sales revenue of $190,900 and operating expenses of $73,200. Accounts receivable and accounts payable at year-end were $63,900 and $31,600 respectively. Assume that accounts payable related to operating expenses. Inore income taxes. Compute net cash provided by operating activities using the direct method. (Show amo wnts that decrease cosh fow with either a sign eg 1s oog orinparenthesises (15,000) Net cash provided by operating activitiesarrow_forward

- Macrosoft Company reports net income of $62,000. The accounting records reveal depreciation expense of $77,000 as well as increases in prepaid rent, accounts payable, and income tax payable of $57,000, $10,000, and $16,500, respectively. Prepare the operating activities section of Macrosoft's statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from operating activities MACROSOFT COMPANY Statement of Cash Flows (partial) Adjustments to reconcile net income to net cash flows from operating activities: Net cash flows from operating activitiesarrow_forwardOn the indirect statement of cash flows, $500,000 relating to notes payable was subtracted from net income to get indirect cash flow from operations. This must mean that:arrow_forwardWolff Company’s income statement and comparative balance sheets follow: Cash dividends of $29,000 were declared and paid during 20X7. Also in 20X7, PPE was purchased for cash, and bonds payable were issued for cash. Bond interest is paid semiannually on June 30 and December 31. Accounts payable relate to merchandise purchases. Compute the change in cash that occurred during 20X7. Prepare and 20X7 statement of cash flows using the indirect method.arrow_forward

- 125. accountigarrow_forwardHolloway Company earned $4,300 of service revenue on account during Year 1. The company collected $3,655 cash from accounts receivable during Year 1. Based on this information alone, determine the following for Holloway Company. The amount of net cash flow from operating activities that would be reported on the Year 1 statement of cash flows. The amount of retained earnings that would be reported on the Year 1 balance sheet.arrow_forwarduse the information in the income statement below to calculate operating cash flow (OCF). sales- $1,280 COGS- $620 Dep Exp- $180 EBIT- $480 Int Exp- $110 EBT- $370 Taxes- $78 NI- $292arrow_forward

- Typedarrow_forwardDillin Inc. reported the following on the company’s statement of cash flows in 20Y2 and 20Y1: Line Item Description 20Y2 20Y1 Net cash flows from operating activities $435,300 $416,000 Net cash flows used for investing activities (429,000) (380,000) Net cash flows used for financing activities (43,000) (60,000) Of the net cash flows used for investing activities, 70% was used for the purchase of property, plant, and equipment. a. Determine Dillin’s free cash flow for both years. Line Item Description 20Y2 20Y1 Free cash flow fill in the blank 1 of 2$ fill in the blank 2 of 2$arrow_forward11-13) Stormer Company reports the following amounts on its statement of cash flow: Net cash provided by operating activities was $37,500; net cash used in investing activities was $13,800 and net cash used in financing activities was $17,700. If the beginning cash balance is $6,900, what is the ending cash balance? Multiple Choice $75,900. $62,100. $40,500.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education