FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

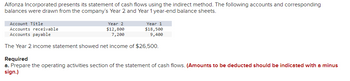

Transcribed Image Text:Alfonza Incorporated presents its statement of cash flows using the indirect method. The following accounts and corresponding

balances were drawn from the company's Year 2 and Year 1 year-end balance sheets.

Year 2

$12,800

7,200

Account Title

Accounts receivable

Accounts payable

The Year 2 income statement showed net income of $26,500.

Year 1

$18,500

9,400

Required

a. Prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with a minus

sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Accounts payable pertain to operating expenses. Prepare the operating activities section of the statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000).) SHERIDAN COMPANY Partial Statement of Cash Flows Adjustments to reconcile net income to $ $arrow_forwardMunster Company reports the following net cash in its statement of cash flows: net inflow from operating activities: $200; net outflow from investing activities: $300; net outflow from financing activities: $50. The ending balance in cash is $20; the beginning balance must have been Multiple choice question. $190. $210. $150. $170.arrow_forwardThe following information is available from the current period financial statements: Net income $116,986 Depreciation expense 23,264 Increase in accounts receivable 14,950 Decrease in accounts payable 15,020 The net cash flow from operating activities using the indirect method isarrow_forward

- I need some assistance in Preparing the operating activities section of the statement of cash flows using the direct method. See attached images for the inputs. I have been getting "bounced" on the yellow sections for incorrect valuesarrow_forward125. accountigarrow_forwardDemers Inc. reported the following data: Net income $409,500 Depreciation expense 46,460 Gain on disposal of equipment 37,860 Decrease in accounts receivable 25,340 Decrease in accounts payable 5,930 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Refer to the Amount Descriptions list provided for the exact wording of the answer choices for text entries. Use the minus sign to indicate cash outflows, cash payments, decreases in cash and for any adjustments, if required.arrow_forward

- Hamburger Heaven's income statement for the current year and selected balance sheet data for the current and prior years ended December 31 are presented below. Income Statement $2,280 Sales Revenue Expenses: Cost of Goods Sold 950 Depreciation Expense Salaries and Wages Expense 250 550 Rent Expense 300 Insurance Expense 85 Interest Expense Utilities Expense 65 55 Net Income 25 Selected Balance Sheet Accounts Prior Year Current Year Inventory 92 65 405 500 Accounts Receivable Accounts Payable Salaries/Wages Payable Utilities Payable Prepaid Rent Prepaid Insurance 225 260 39 25 25 70 4 11 13 TIP: Prepaid Rent decreased because the amount taken out of Prepaid Rent (and subtracted from net income as Rent Expense) was more than the amount paid for rent in cash during the current year. Required: Prepare the cash flows from operating activities section of the statement of cash flows using the direct method. TIP: Convert the cost of goods sold to cash paid to suppliers by adding the increase…arrow_forwardThe income statement for Rhino Company for the current year ended June 30 and balances of selected accounts at the beginning and the end of the year are as follows: Please see the attachment for details: Prepare the Cash flows from operating activities section of the statement of cash flows, using the direct method.arrow_forwardShim Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Shim's Year 2 and Year 1 year-end balance sheets. Account Title Year 2 Year 1 $31,297 1,496 249 Accounts receivable $37,556 Prepaid rent 1,309 Interest receivable Accounts payable Salaries payable 199 10,537 2,930 3,215 12,644 3,348 Unearned revenue 4,287 The income statement reported a $1,170 gain on the sale of equipment, an $750 loss on the sale of land, and $3,700 of depreciation expense. Net income for the period was $53,353. Required Prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from operating activities: Plus: Less: Net cash flow from operating activitiesarrow_forward

- Use the following information of VPI Company to prepare a statement of cash flows for the year ended December 31 using the indirect method. (Amounts to be deducted should be indicated by a minus sign.) Cash balance at prior year-end Increase in inventory Depreciation expense Cash received from issuing stock Cash paid for dividends Cash flows from operating activities VPI COMPANY Statement of Cash Flows (Indirect Method) For Current Year Ended December 31 Changes in current operating assets and liabilities $43,600 8,600 7,600 11,600 4,600 Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Cash flows from investing activities Gain on sale of machinery Cash received from sale of machinery Increase in accounts payable Net income Decrease in accounts receivable Cash flows from financing activities $ 2,900 11,300 3,300 59,000 6,600arrow_forwardOo.25. Subject :- Accountarrow_forwardSelected data derived from the income statement and balance sheet of National Beverage Co. for a recent year are as follows: Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method for National Beverage Co. Interpret your results in part (a).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education